Insights

The state of FinServ communications: Controlling complexity and connecting with customers

Digital communication for financial services can quickly get complex, especially in 2025. People used to visit brick-and-mortar banks to talk with tellers. They’d pick up the phone to call an advisor and set up a meeting. Monthly statements showed up in the mailbox.

While those kinds of interactions still happen, there are many other options in modern FinServ communication. Financial institutions and FinTech brands must reach clients and customers on preferred channels, and different situations require different methods of communicating.

A fraud alert comes through on SMS. An email newsletter delivers personalized financial advice. A client portal shares information securely with in-app messages. Voice and video calls make room for in-depth financial conversations. The list goes on, and we haven’t even mentioned artificial intelligence yet. Does your company have it all covered?

Exploring the state of financial services communication

In early 2025, Sinch surveyed 2,800 consumers and more than 400 business leaders in financial services to find out what people expect from these communications and how FinServ brands can connect with them. We detailed many of the findings in our report, The state of customer communications.

However, there were too many insights for just one report. That’s why we’re taking a deep dive into results that relate to communication strategies in financial services.

Our new report examines consumer expectations around topics such as personalization and privacy as well as trust in using artificial intelligence (AI) for communications. Plus, we also hear from business leaders about the challenges they face and the opportunities they’re investing in to improve customer communication efforts.

We’ll review some key findings from The state of financial communications in this article. You can download the full report to get even more information.

Challenges and opportunities in FinServ communication

Sinch’s research found consumers have a range of channels they prefer when receiving messages about their personal finances. While 32% chose email as the best channel, making it the most popular choice, customer portals (23%) and the voice channel (13%) were the next most popular options.

Respondents from the financial services industry are clearly investing in multiple channels to meet the needs and expectations of different consumers:

use email for customer communication.

use SMS for customer communication.

use voice (call centers, interactive voice response, etc.) for customer communication.

use chatbots for customers communication.

use in-app messages through customer or client portals.

use RCS for Business messages for customer communication.

There’s a definite need for a multi-channel approach. The right channels for FinServ communication depend on the type of message being delivered. For example, fraud alerts benefit from the speed and reliability of SMS, while chatbots enable basic customer service, and more complex conversations take place on the voice channel.

Security concerns in FinServ communication

Top of mind for both consumers and business leaders is the issue of security and privacy. The state of financial communications report found that 83% of industry respondents are at least somewhat concerned with regulations such as GDPR, FINRA, and PCI compliance when choosing channels.

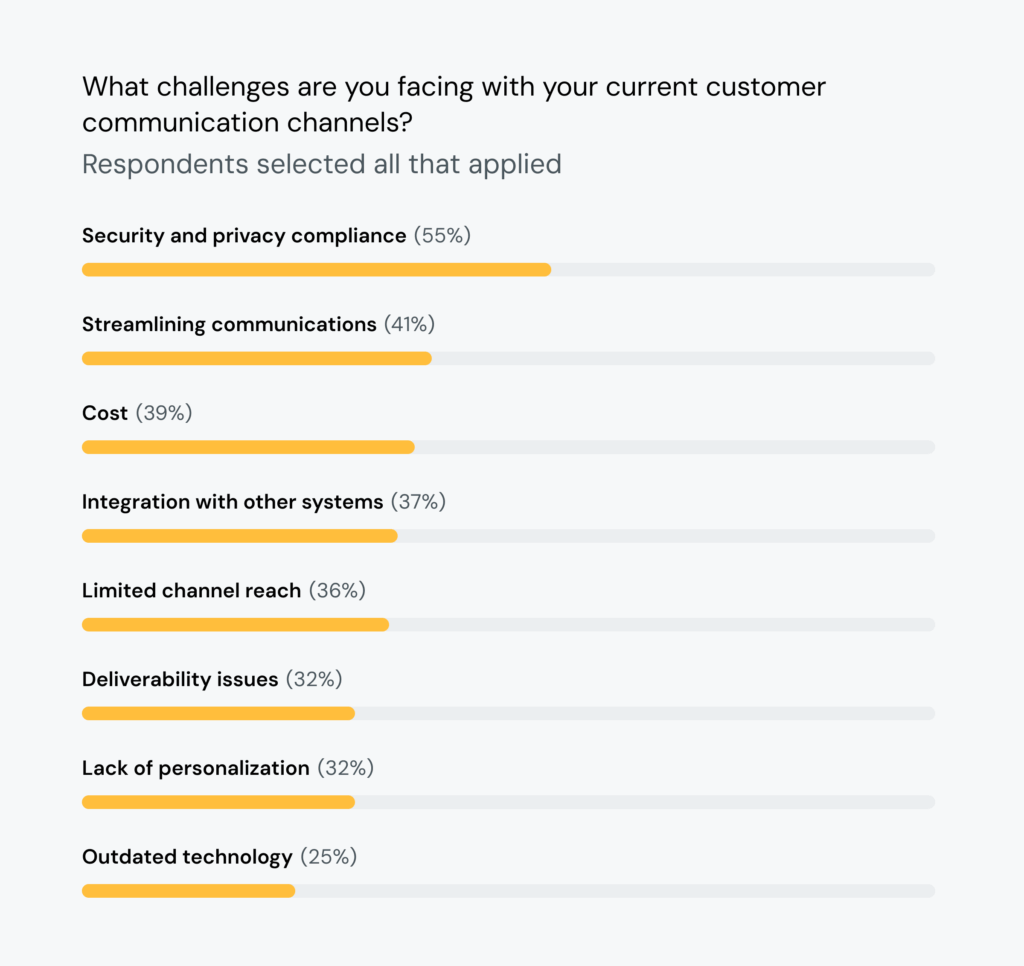

Security and privacy concerns are also the biggest communication challenge in financial services. 55% of FinServ business leaders cited security issues and privacy compliance challenges. Obviously, when you’re dealing with something as sensitive as people’s finances, this makes perfect sense.

Many FinServ respondents also noted challenges with streamlining communication (41%), the cost of customer communication (39%), and integrating communications with other systems (37%). Cost, security, and integration were consistently among the top challenges for other industries Sinch surveyed as well, but privacy and security stood out for FinServ.

On average, across retail, healthcare, technology, and financial services, 44% of respondents selected security and privacy as a challenge. The 55% of FinServ leaders challenged by this issue is 11% higher than the average.

AI in customer communication: Concerns and opportunities

An area where both consumers and business leaders have some privacy concerns involves the use of AI in customer communication. AI adoption is moving quickly across every industry – to say the least.

Sinch found that 98% of FinServ respondents say their organizations are planning to or already use AI in customer communications. More than half of those businesses use AI to automate interactions via chatbots or to analyze customer data.

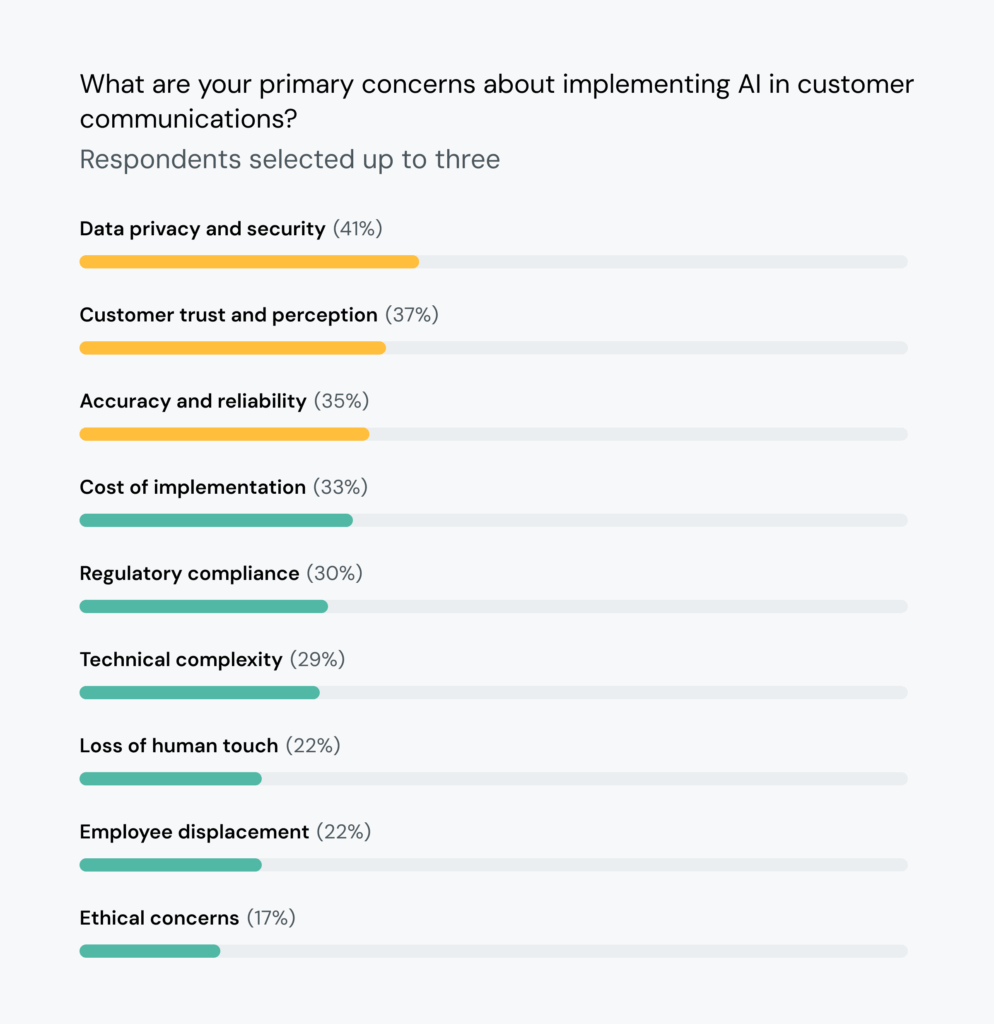

But all this enthusiasm does not mean FinServ respondents expect smooth sailing as they implement AI solutions. Data privacy and security topped the financial service industry’s list of AI concerns at 41%. That’s followed by concerns around customer trust (37%) and AI’s accuracy and reliability (35%).

Despite those hesitations, many FinServ organizations are investing in AI-powered customer communication this year:

of FinServ respondents will adopt AI voice bots in 2025.

of FinServ respondents will adopt AI chatbots in 2025.

Very few question the idea that AI is transforming customer communications. It stands to provide plenty of benefits for both businesses and consumers. However, that doesn’t mean every consumer is ready and willing to start using AI.

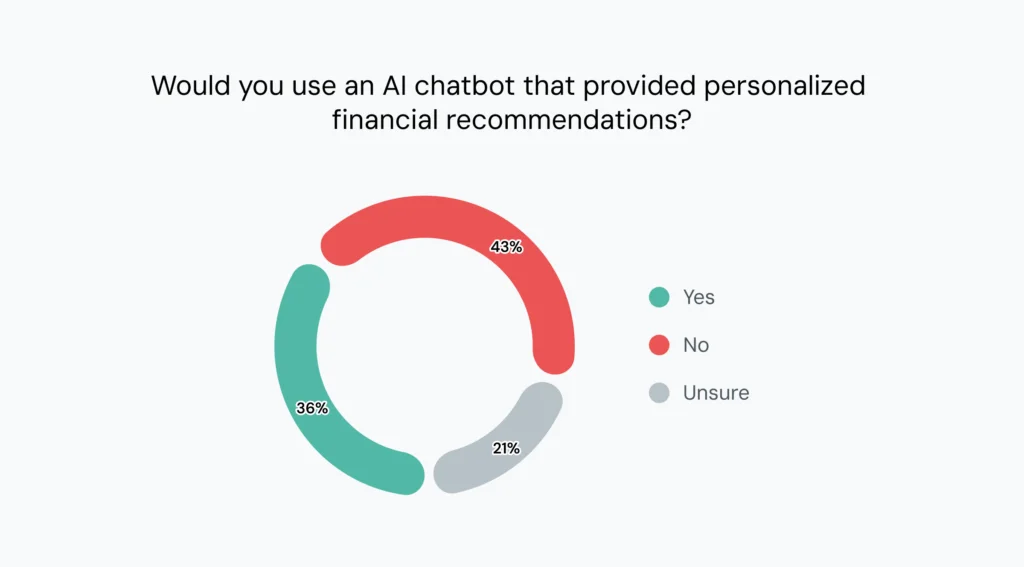

Sinch research found 42% of global consumers feel comfortable engaging with an AI chatbot that’s been trained on a brand’s support documentation. But when we asked about a specific FinServ use case, consumer sentiment shifted slightly.

Just 36% of consumers would feel comfortable receiving personalized financial recommendations from AI. 43% would not use AI for those purposes and 21% were unsure.

Throughout our research, Sinch found there are sharp generational differences when it comes to interacting with AI from brands. Younger consumers are much more likely to feel comfortable using AI chatbots for more advanced purposes.

59% of Gen Z consumers and 53% of millennials would use an AI chatbot that provided personalized financial recommendations. That compares to 36% of Gen X consumers and only 15% of baby boomers.

RCS is helping FinServ brands earn trust

FinServ business leaders are leading the way in adopting a mobile messaging protocol that’s poised to help build trust in customer communications. Rich Communication Services (RCS) lets senders deliver branded, interactive, multimedia campaigns directly to the native messaging app on smartphones.

Among FinServ respondents who are familiar with RCS, 55% see it as game-changing for customer communications in their industry. Another 35% call it useful even if it isn’t essential.

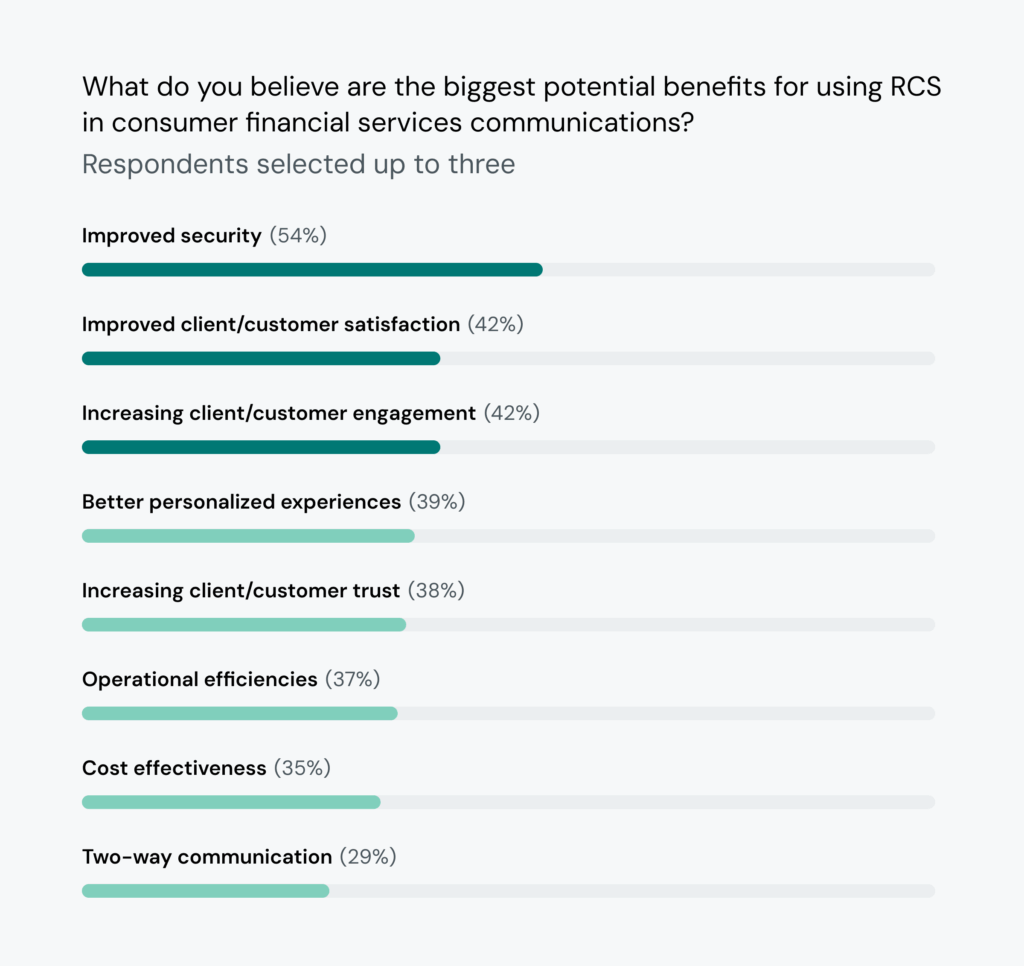

Those familiar with RCS for Business messaging, which allows brands to take advantage of the protocol, believe it offers important benefits that enhance marketing and communication efforts.

Improved security (54%) tops the list of potential RCS benefits in financial services. That’s followed by improved customer satisfaction (42%) and increased engagement (42%).

The main reason RCS can improve factors like security and consumer trust is due to visual indicators that tell recipients RCS messages are safe.

Phishing and smishing are a growing problem, especially in financial services where bad actors are eager to impersonate trusted brands and gain access to customer accounts. RCS helps address this.

Any brand sending RCS for Business messages must first apply to become a verified sender. Once approved, brands can send messages with their official name, logo, and a checkmark/badge. This makes a legitimate RCS message much easier to identify than an SMS with nothing but an unrecognizable phone number. It also makes RCS for Business messages from verified senders very hard to fake.

Our consumer survey found more than half of people recalled receiving a message from brands that was real but at first seemed suspicious. That kind of suspicion can make it harder to reach people and convince them to engage with your messages.

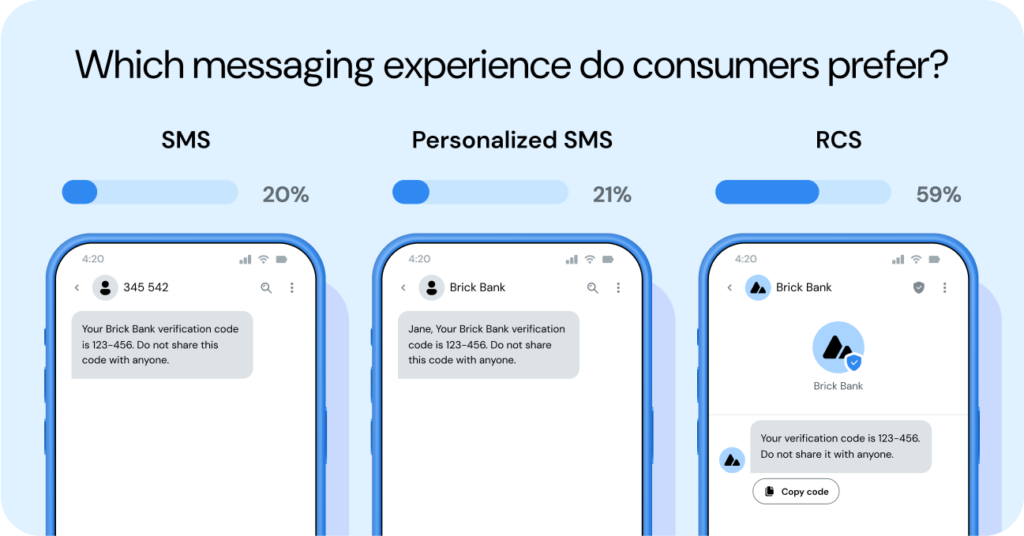

Those verified sender marks do make many consumers feel safer. When asked to choose whether SMS messages or a branded RCS message was more trustworthy, 59% chose the RCS for Business message with a logo and a checkmark.

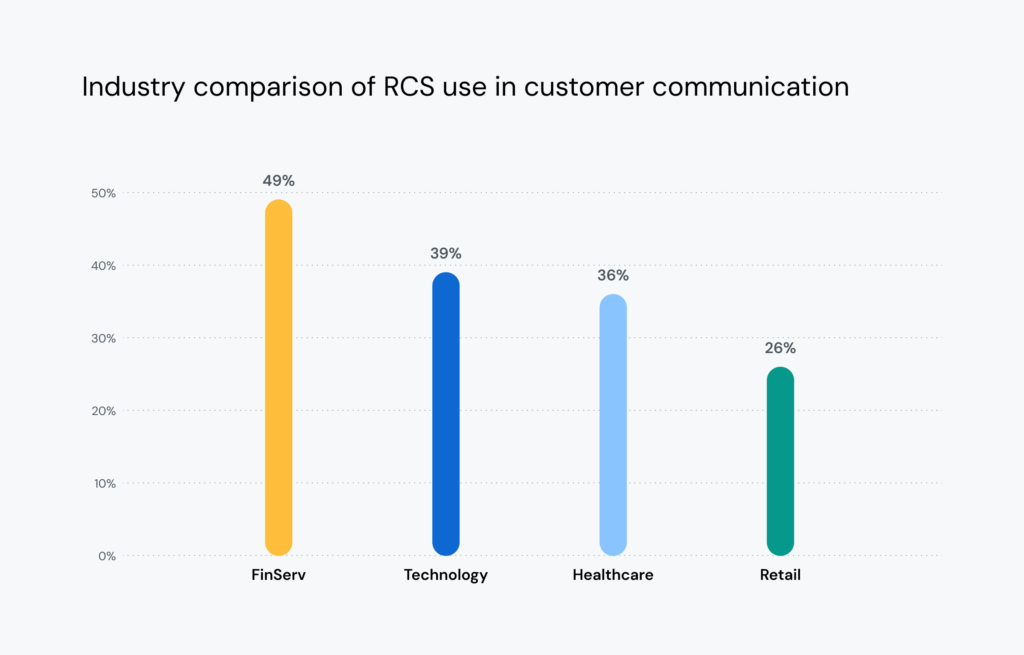

According to The state of customer communications, the financial service industry is among the early adopters of RCS for Business. That’s likely because of how it helps turn mobile messages into a more trusted form of digital communication.

Nearly half (49%) of FinServ respondents told us they already use RCS in customer communications. That’s 10 percentage points higher than technology, the next closest industry.

Curious to uncover more on RCS for Business? Check out Sinch’s RCS hub for a wealth of information on this emerging messaging protocol. Plus, find out more about how RCS is being used in banking and financial services.

Four pillars of effective FinServ communication

The state of financial communications report includes findings that show you how to keep people engaged, informed, safe, and happy.

That’s what Sinch calls “the four pillars of customer communication.” It’s a simple yet impactful framework that categorizes the ways you deliver meaningful messages throughout the customer experience:

- Engaged communications: These are the marketing messages, promotions, and personalized finance advice that keep people connected to your brand.

- Informed communications: These are the updates, notifications, and transactional messages that help people stay on top of their finances.

- Safe communications: These messages provide security and privacy by verifying users for account access through methods like one-time-passwords (OTPs).

- Happy communications: These include the conversations people have with customer service and support representatives as well as other messages that ensure satisfaction.

Next, we’ll look at some key takeaways from The state of financial communications that reflect each of the four pillars.

Engaged: Personalizing personal finance marketing

After a financial institution or any FinServ brand acquires a new member, customer, or client, the best way to keep them engaged is to personalize the communication experience. But you’ve got to go further than using their name in emails and text messages.

Our report found personalization can be both a challenge and a priority for FinServ companies:

of FinServ respondents say they plan to prioritize personalization as part of their 2025 communications strategy.

of FinServ respondents call a lack of personalization one of their biggest customer communication challenges.

In general, 42% of consumers want brands to personalize messages based on their preferences. The state of financial communications report found more than 80% of global consumers want or expect FinServ companies to deliver personalized communications based on their financial situations.

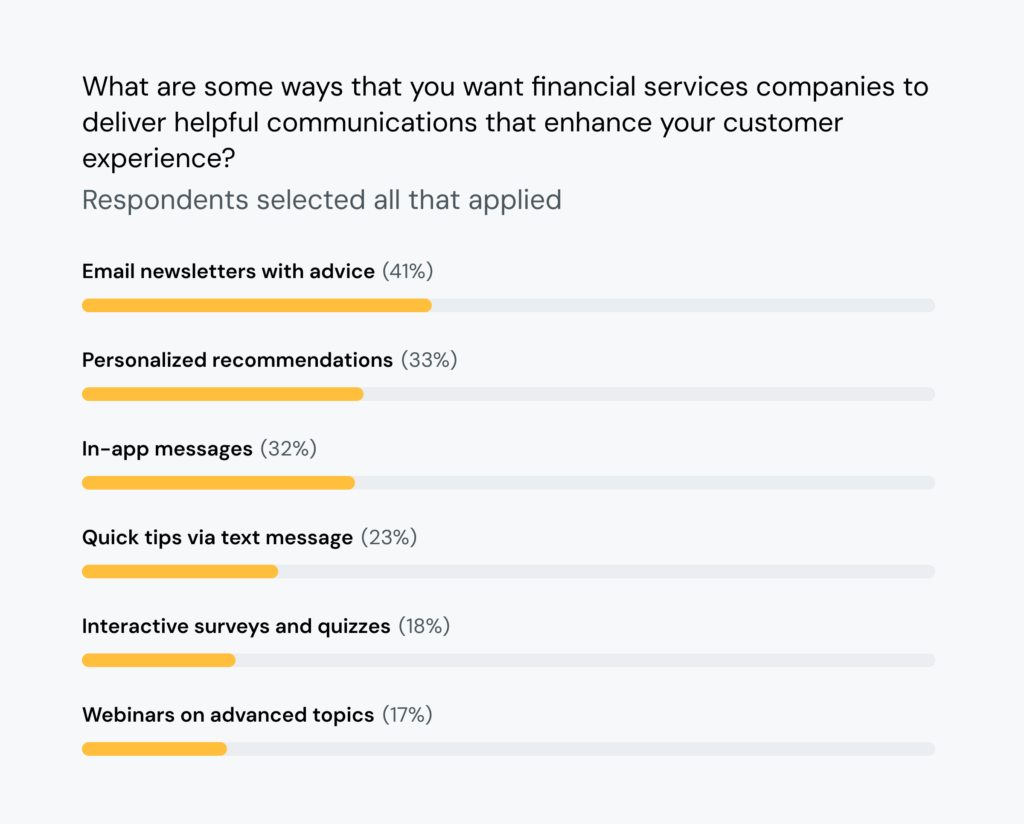

We also asked consumers how they preferred to receive helpful communications that enhance their experience with financial services providers. More than 40% want email newsletters (which can contain personalized content), around one-third want personalized recommendations, and 32% want to receive those communications via in-app messages.

FinServ personalization often has less to do with preferences and more to do with monetary needs and milestones in life that require financial assistance or advice. That includes anything from opening a college savings account to getting a mortgage to planning for retirement.

You need to connect with the right campaigns at the right times. In this industry, that often means time of life. The financial solutions your customers show interest guides personalization strategy – that’s classic lifecycle marketing.

Informed: Delivering what customers and clients need to know

The timing and reliability of informational communications in financial services is even more crucial than well-timed promotions. Your customers depend on the delivery of these messages.

Consumers told us these are some of the most important customer updates:

of consumers view fraud alerts as very or somewhat important.

of consumers view payment due reminders as very or somewhat important.

of consumers view overdraft notifications as somewhat or very important.

of consumers view account balance notifications as very or somewhat important.

Of course, people are likely to view most messages connected to financial accounts as important. Fraud alerts, however, are perhaps the most pressing and concerning update someone can receive. That’s why it’s no surprise that people want fraud alerts delivered quickly.

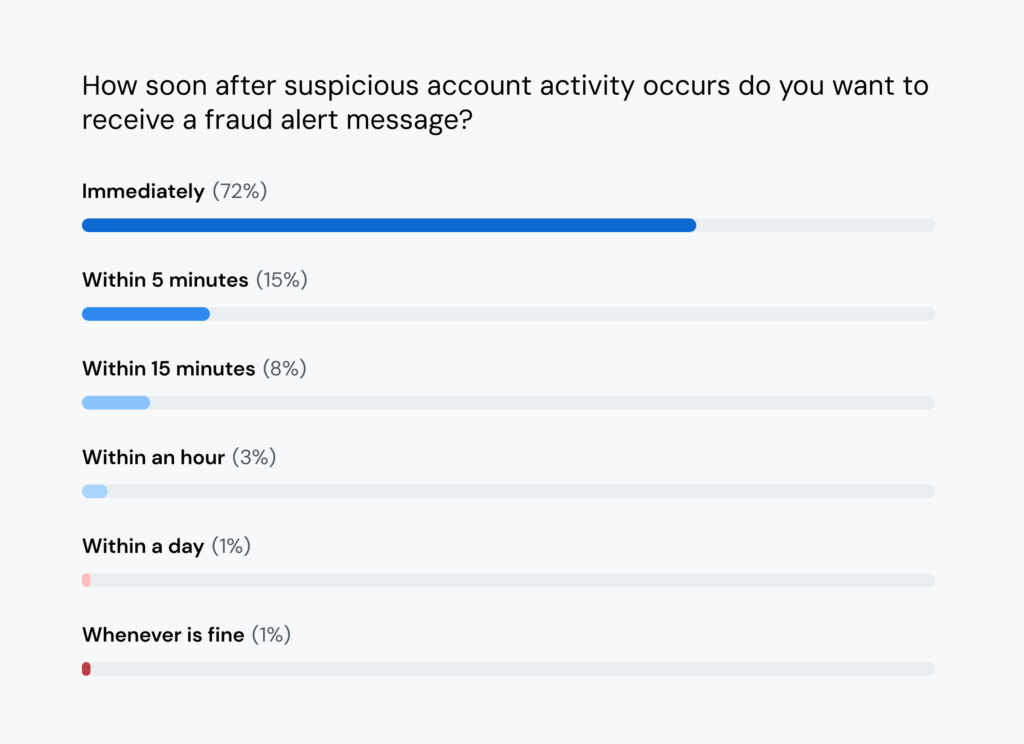

Here’s what “quickly” really means: 87% of consumers expect fraud alert notifications within five minutes of suspicious activity being detected. That includes 72% who want fraud alerts to arrive immediately.

Fraud alerts are one of several common FinServ communications that often arrive via SMS. Others include overdraft notices, account activity, and transaction confirmations. In addition to being speedy, you also need to make sure these messages get delivered. That’s why both text and email deliverability are vital to customer communications and should be prioritized to reliably keep people informed.

Safe: Protecting accounts, privacy, and your reputation

Fraud alerts certainly help keep your customers safe. But the right communications can also protect fraud from ever happening. Specifically, they are the messages that verify users during login and protect account access with one-time passwords (OTPs) and other forms of multi-factor authentication (MFA).

This kind of account security is very necessary because sophisticated phishing attacks make the username and password combination an inadequate way to protect customer accounts. It’s too easy for bad actors to get those credentials.

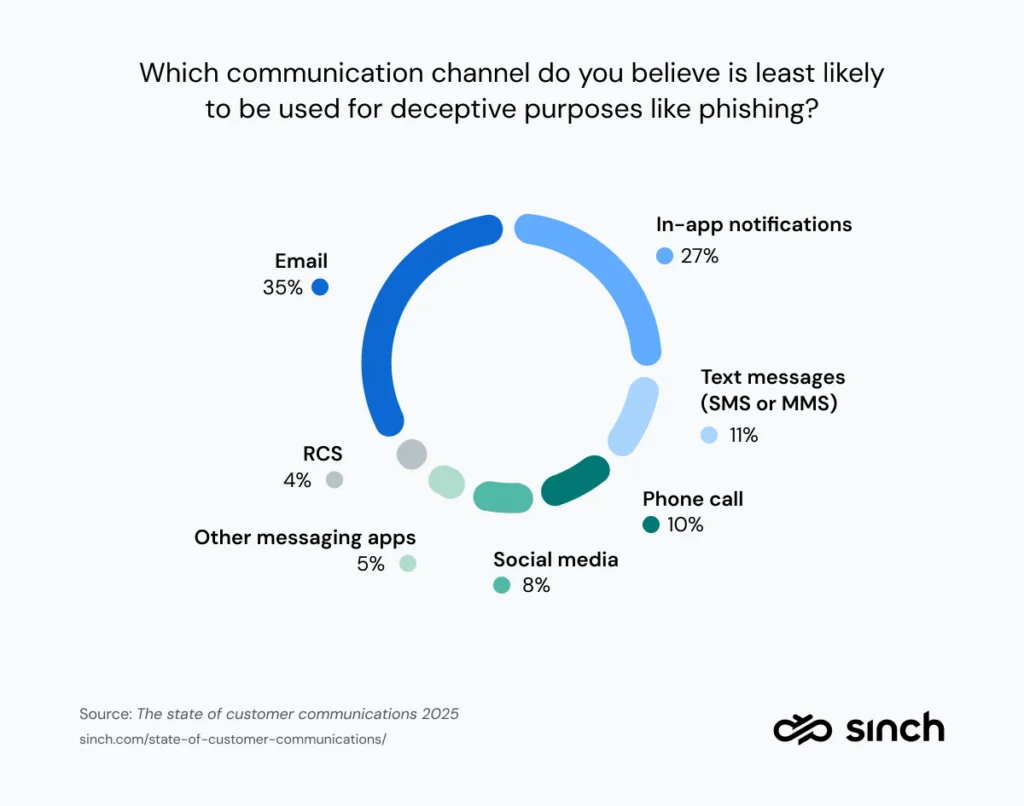

Unfortunately, our research found consumers are likely to be susceptible to phishing. When asked which communication channel is least likely to be used for phishing, email (35%) was the top answer. The opposite is true. Email is perhaps the most common threat vector bad actors use for phishing.

Another 27% of consumers believe in-app messages are unlikely to be phishing attempts. That’s certainly true. The problem is – you usually need to be logged into an account to see those messages.

Earlier, we explained how verified sender features make RCS nearly impossible to use for phishing. Yet only 4% of customers believe RCS is the safest option. We also showed a survey result in which 59% of consumers felt an RCS message was more trustworthy than SMS verification.

That’s likely a big reason why 49% of FinServ respondents already use RCS. However, a little consumer education may be needed. Since more than half of FinServ respondents cited security and privacy as a communication challenge, it may be wise to make a business case for RCS.

WhatsApp is another messaging channel with trust features similar to RCS for Business. That includes authenticated business accounts, blue verified checkmarks, and OTP capabilities through the WhatsApp Business API. WhatsApp also provides end-to-end encryption (E2E) for an added layer of security.

Another option for account verification is Sinch Flash Call®. This method can make account access easier for users while reducing operational costs.

“Flash call is an SMS OTP alternative. It works by sending a missed call to an end user, and instead of the one-time code being in the payload of a message or voice call, it’s actually in the calling party of that missed call. The application that’s authenticating you can process that incoming call, strip off the last six digits of the calling party number, and you’ve logged in.”

Giving customers and clients options when they need to go through a verification process streamlines their experience. Different channels offer more convenience in different situations. That helps them avoid frustration and get into their accounts even if, for example, they can’t access their device at the moment.

Happy: Redefining support with seamless communication

Financial service organizations have many ways to keep people happy through good customer service. That includes AI chatbots answering common questions, call centers providing support, and important conversations with financial experts.

When we asked consumers to choose their preferred channel for support questions, more than 30% chose email. But the next most chosen options were live chat with a human agent (22%) or a call center with a live representative (19%).

A human voice seems to be very important to certain consumers when their personal finances are involved. For example, a phone call is the most preferred way to follow up with questions after receiving a fraud alert.

want to resolve fraud alerts with support over the phone.

prefer to resolve fraud alerts via SMS.

want to resolve fraud alerts with emails to support.

would prefer resolving fraud alerts through messaging inside a client/customer portal.

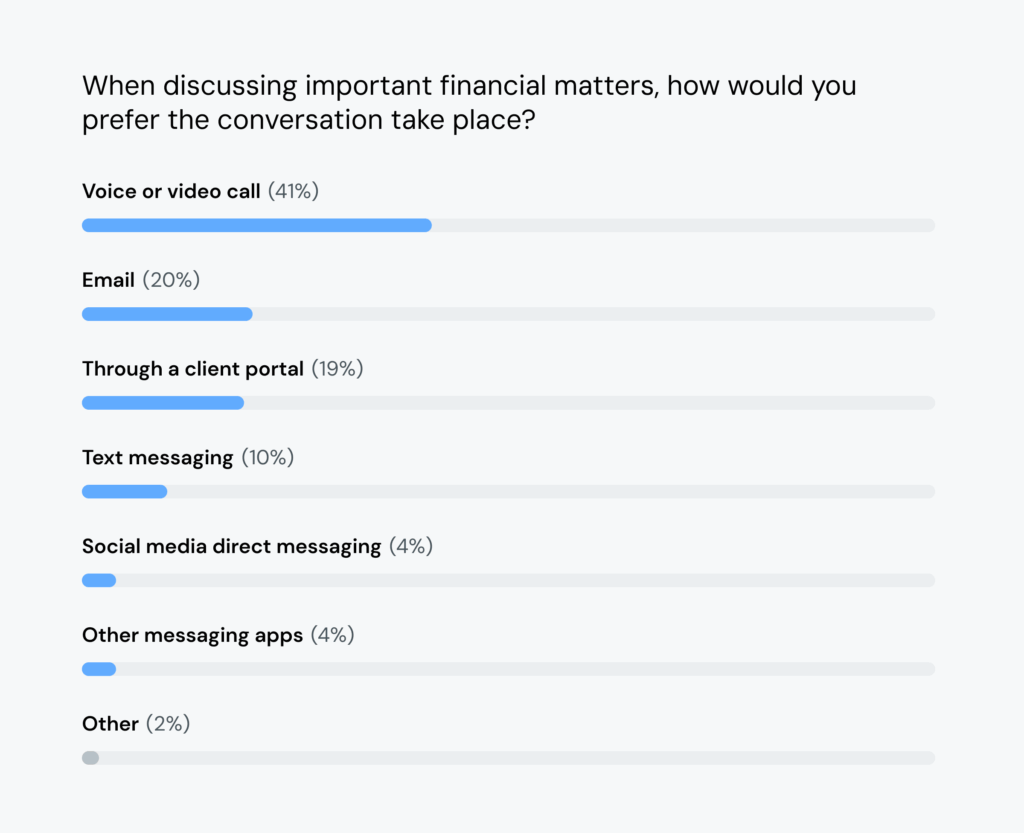

If an in-person meeting isn’t available, most people also prefer to replicate that experience on another channel. When asked how they preferred to receive expert financial advice, 41% would choose a voice or video call – more than double the preference for email.

A key factor of positive support experiences in every industry is the ability for information to be transferred between communication channels. Our research found consumers get frustrated, lose trust, and feel their time is being wasted when they’re asked to repeat themselves during customer service situations.

Interactions with support may begin with a chatbot, email, or SMS before someone gets on the phone with a call center. If your team already has information provided on previous channels, support experiences will be faster and more efficient. That’s good for productivity, and it’s also going to increase happiness among your customers and clients.

Make meaningful financial communication connections

Are there gaps in your communication strategy that need to be addressed? Sinch is ready to partner with you to find ways to deliver messages that keep your customers and clients engaged, informed, safe, and happy.

We’ve worked with financial institutions and FinTech brands around the world to help them find scalable solutions that are trustworthy, secure, and effective. Check out our customer stories to see examples from the financial services industry.

Sinch helps hundreds of FinServ companies deliver billions of messages every year. Find out more about our communication solutions for financial services.