Fraud and security, Products

What is a one-time password (OTP)? Features and benefits explained

Fraud and security, Products

In a world where fraud is all too common, wouldn’t it be great to have a simple way to know you’re talking to the right person? As more of our lives happen online, the need for easy and reliable identity verification is more important than ever.

One-time passwords (OTPs), also known as one-time passcodes or a one-time PIN, add a layer of security to verify and protect users worldwide. With mobile security in high demand, the global multi-factor authentication (MFA) market is projected to be valued at $34.8 billion by 2028, as compared to $15.2 billion in 2023.

OTPs are a straightforward, cost-effective solution for organizations to verify and protect their customers’ and employees’ personal information. If you want to learn how to instantly verify your customers from anywhere in the world while saving time and money, this guide is for you.

Alejandro Murcia, Director of Financial Services at Sinch, explains how businesses can use OTPs

A one-time password (OTP) is a quick way to verify a user’s identity when they’re logging into an account, network, or system. The user receives a unique code – usually a string of numbers or letters – that expires after a short period of time and they can’t reuse.

OTPs can be sent to a user by email, phone call, authenticator app (common ones include Google Authenticator or Microsoft Authenticator), text message, as an RCS OTP or via another mobile messaging channel like WhatsApp, or as a push notification. They can be used as single-factor authentication to replace static passwords with a unique PIN for each session instead of requiring a username and password.

Alternatively, they can be combined with user-generated credentials for two-factor authentication (2FA), requiring both something a person knows (like a PIN) and something they have (like a key fob). This can come into play during sign-up, login, or transaction approvals, where:

Getting an OTP is quick and easy for the end user. Here’s a common scenario:

Pretty cool, right? Behind the scenes, all kinds of magic happened to generate and deliver that one-time passcode to the customer. We’ll reveal the magician’s secrets in the section below.

Whenever a user tries to access a system or perform a transaction on an unauthenticated device, an OTP generator and an authentication server work together using security tokens (or shared secrets) to verify their identity.

First, the OTP generator uses a hashed message authentication code (HMAC) algorithm to create a new, random code for each access request.

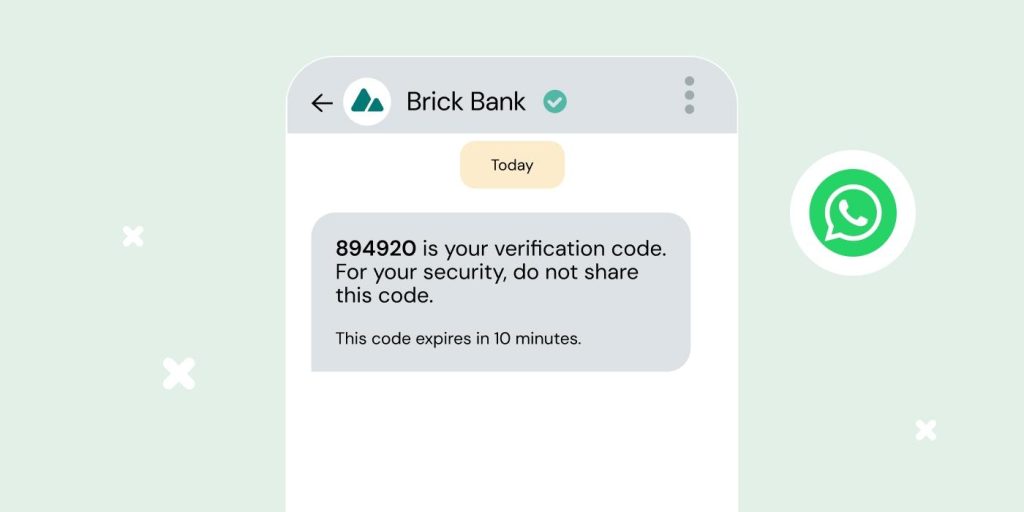

As the name implies, all OTPs only work once, but the unique password will either be hash-based (HOTP) or time-based (TOTP).

The main difference between a hash-based OTP (HOTP) and time-based one-time password (TOTP) is the moving factor that changes each time the algorithm generates the code.

Hash-based OTPs:

Time-based OTPs:

Once issued, the OTP generator shares the new code with the backend authentication server.

When the user enters their code, the OTP authentication server uses the same algorithm as the generator to match the code for easy and instant validation!

Passwords are a weak form of identity verification – 68% of business data breaches in 2024 have involved human error.

So, how can businesses help their customers protect their passwords? Educating them on best practices, like never sharing passwords or reusing them across accounts, helps. But for businesses handling sensitive data, that’s not enough. Adding another authentication method like one-time passwords or two-factor authentication boosts security by changing the verification with every login session or transaction.

Still, OTPs can be vulnerable to hackers. That’s why we recommend SIM-based verification methods which require users to interact with a prompt on their mobile devices, making life hard for opportunistic hackers.

OTPs are highly versatile, leveraging the widespread use of mobile devices to reach users across the globe. They can be delivered through different channels, making them accessible and user-friendly.

With OTPs, organizations can offer their users a secure, scalable, and hassle-free authentication experience, safeguarding sensitive information and instilling trust in their digital platforms.

The core benefits boil down to:

Each benefit deserves some special attention, so let’s dive in.

Businesses using OTPs make it much harder for unauthorized access to customer or employee accounts.

As a demonstration, let’s think about what might happen when an unauthorized person attempts to access another’s online account. The rightful user receives a code they didn’t request – definitely a red flag. While the business might not know if the attempt was legitimate, the user quickly realizes something’s off and updates their password.

Verification messages are also sent if an unrecognized device tries to access the account, so the user can flag suspicious activity easily. This way, the user stays in control without unnecessary account lockouts, and businesses show they’re actively protecting personal information, which goes a long way to earn trust!

For such a simple idea (four to eight random numbers), OTPs are remarkably effective at mitigating the risks that come from weak password security.

Let’s look at this mathematically. If you issue a random six-digit code, an identity thief has to guess each number correctly within a short expiration window.

That means 10 possibilities (zero through nine), six times (10x10x10x10x10x10).

In other words, an identity thief has a one in a million chance of getting your OTP right, or a 0.000001% probability.

That’s just for your standard six-digit OTP. If they include eight digits, the would-be identity thief would probably have a better chance of winning the lottery.

SMS messaging is a popular choice for sending OTPs because it’s fast, reliable, and widely used. In many markets, SMS verification is a budget-friendly option for businesses getting started with OTPs.

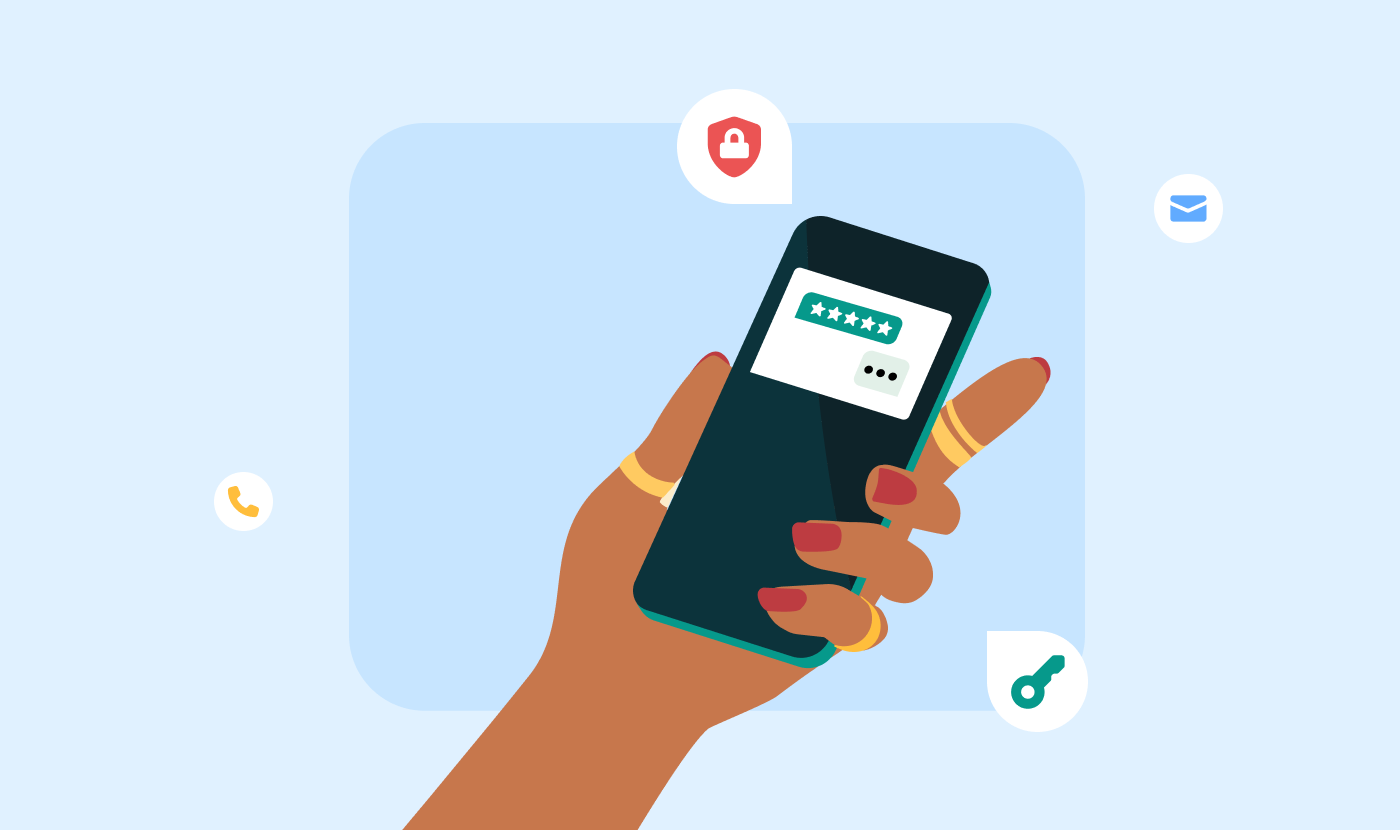

But the beauty of OTPs is that they’re versatile, and you can send them through any channel that your customers prefer, like WhatsApp, Rich Communication Services (RCS), email, and more.

Channels like RCS and WhatsApp are especially effective for OTPs because they allow your brand’s messages to come from verified profiles straight to your customers’ inboxes. This added layer of trust reduces the risk of fraud like smishing, ensuring your customers can spot real messages from your business at a glance.

We’ve all got dozens of passwords and usernames to remember. Who hasn’t forgotten at least one? From the streaming service account to online newspaper subscriptions, it’s no small task keeping track of all that info.

It’s human to be forgetful. Without alternative verification methods, IT staff or customer care will get called in to help people regain access to their accounts, and that time adds up fast.

OTPs can instead be used to reset passwords and save countless hours of manpower. As a result:

Using verification APIs, organizations can easily build OTPs into their apps and products.

In just a short amount of time, these programmable verification integrations can quite literally pay for themselves by:

According to our 2024 research, 61% of consumers expect 2FA messages in a minute or less. That means fast, reliable verification is essential for a great user experience. A seamless, speedy 2FA process can make all the difference in how customers perceive your brand’s reliability and security.

Multi-factor authentication solutions like Sinch’s SMS Verification API provide security at scale and a buttery-smooth UX.

With Sinch, one simple integration makes user verification quick and easy through their mobile device, because:

Okay, not exactly endless, but pretty close. With verification more critical than ever, more and more industries are turning to two-factor authentication and OTPs to verify user identities. Here are some key sectors making great use of it:

Across industries, some additional useful applications of one-time passcodes include validating users when they take certain actions, like:

When we think about OTPs of the future, it’s clear the market will keep evolving – both in terms of stronger solutions and increasingly clever cyber threats. So, how can OTPs and authentication stay ahead of the curve? Here are a few key trends shaping the future:

OTPs will no doubt continue to be a part of this landscape, but the future will lie in solutions that continually adapt to changing user preferences and needs.

So, there you have it. Now you’ve seen how versatile OTPs can be, and learned how they can help you keep your customers safe.

Want to learn more? Check out these resources to level-up your authentication and verification knowledge in an evolving cybersecurity landscape:

For those really looking to nerd-out, check out our whitepaper on Two-factor authentication.

Otherwise, contact us anytime to chat with one of our experts about how to protect your customers and open the door to better customer engagement!