Insights, Products

Clients want safe, personal service – banks struggle to deliver: Can voice help?

Insights, Products

If you’re in the financial service industry, customer communications can feel a bit like a catch-22 right now.

As our 2025 Sinch report on The state of customer communications reveals, the majority of consumers expect not only a very secure, but also a highly personalized user experience from their financial institutions.

At the same time, financial business leaders told us that meeting customers’ needs for personalization while ensuring safe and compliant communications are exactly the two biggest challenges for their industry right now.

This sure sounds like a conundrum, but it doesn’t have to be. As our data also shows: Building your tech stack around a modern voice solution can solve the dilemma. Let’s dive into the survey results and explore how.

Since the first Bank of the United States, opened for business in Philadelphia on December 12, 1791, banking in the U.S. has seen some major changes. Many traditional brick-and-mortar operations like checking an account balance, making an investment, or transferring money have been replaced by internet-based processes like mobile banking, digital wallets, and online payments.

However, other things really haven’t changed at all. Over 200 years in, customers still expect personal and safe interactions from their banks. According to our 2025 state of customer communications survey among over 2,800 global consumers, security and personalization are the top two customer expectations.

of consumers want personalization based on their financial situations

of consumers feel safer when companies take extra steps to protect their personal data online

Sounds like that should be simple enough to deliver, right? Not quite! Meeting consumer demands for a personalized experience on multiple channels while ensuring compliance, data protection, and security across the board is, in fact, a big challenge for the financial service industry.

When we asked hundreds of financial business leaders in the U.S. about their main concerns around customer communication, 55% of respondents said security and privacy were their top challenges.

And when it comes to a truly personalized customer experience (CX), 32% of financial service business leaders also admit that the lack of personalization is one of their top customer communication challenges. At the same time, financial institutions are also concerned about compliance and security.

So, on the one hand, financial institutions need to gather and analyze tons of customer data to be able to offer the personalized experience their clients expect. On the other hand, they deal with highly sensitive information that needs to be handled with extreme care in order to keep their customers safe.

How can they do that, and what’s the best channel for offering a safe and individualized exchange? Customers have a clear preference – a human voice.

As digital as banking has become, Sinch’s State of customer communications reveals that consumers still prefer face-to-face interactions when discussing personal finances. That’s not surprising. After all, sitting down with a trusted advisor is exactly the type of personalized and secure experience customers are looking for.

And when in-person meetings aren’t possible? Then consumers prefer communication channels that come as close to a face-to-face interaction as possible.

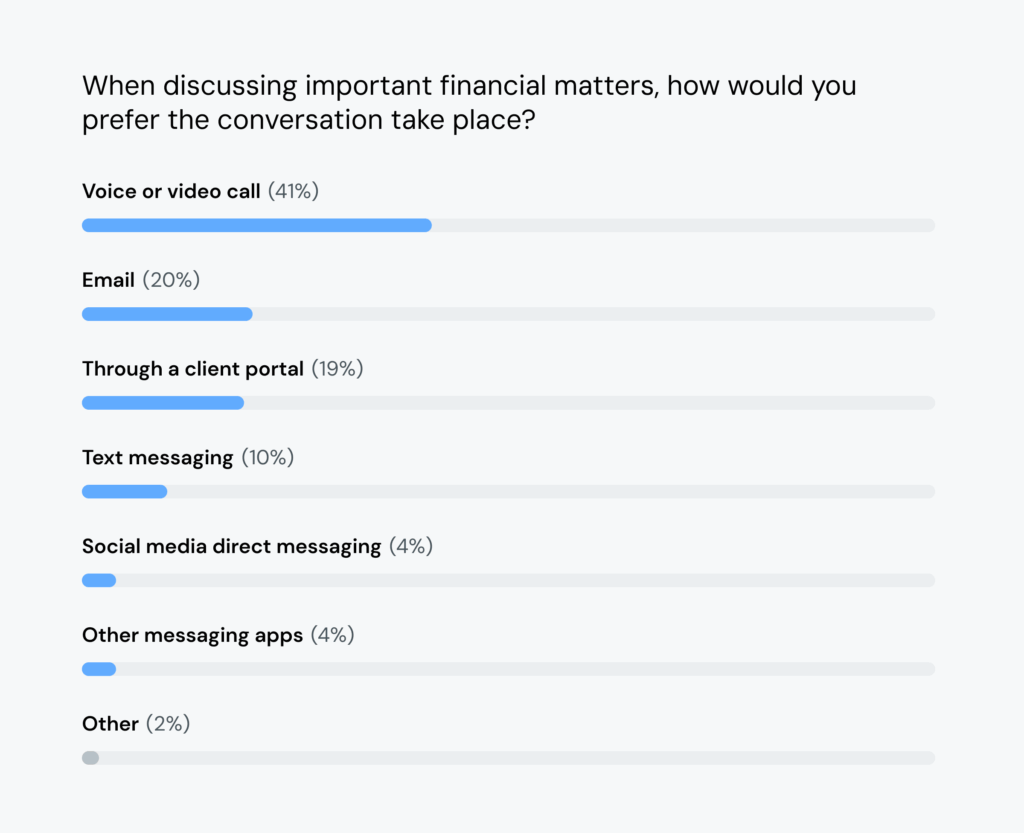

As our survey shows, when it comes to discussing complex or important matters and an in-person conversation isn’t possible, the vast majority of customers (41%) want to talk on the phone or via video call.

The message is clear: When it comes to discussing sensitive data, consumers trust humans the most.

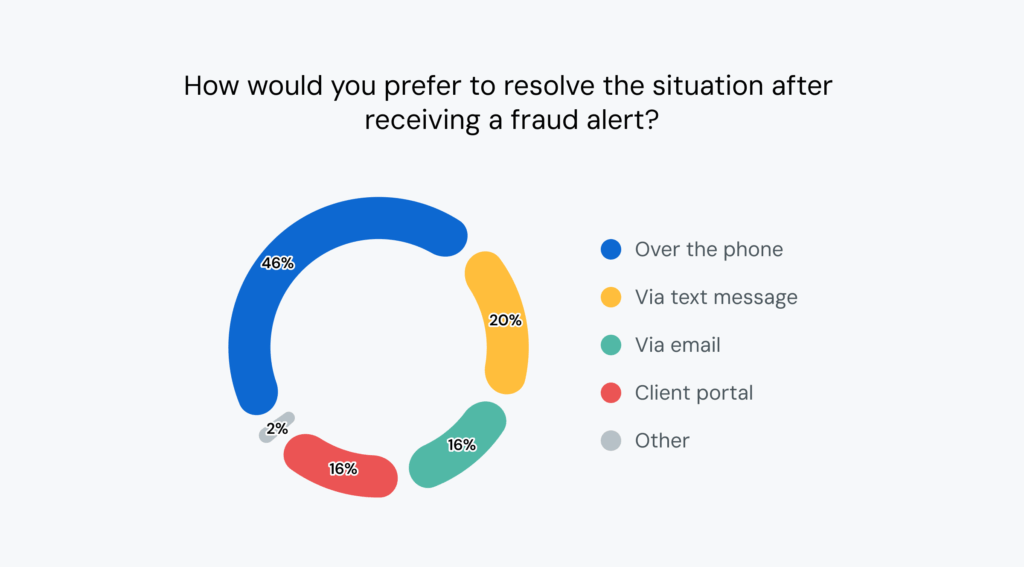

Customers also have very clear preferences on how they want to find out more from their banks about security threats or fraud alerts. According to our survey, 46% of consumers want to follow up on fraud alert notifications over the phone.

In a typical scenario, a customer receives an initial notice about suspicious account activity (maybe via SMS). Then, they’ll have more questions: Was the payment blocked? What are my next steps to secure my account? It’s these sensitive details the customers want to discuss on a channel where they feel the safest: over the phone.

But even when it comes to general support questions, live chats (22%) and phone calls (19%) are the two most popular channels for bank customers after email (31%).

Looking beyond support, 32% of people we surveyed also said that in-app messages would enhance their customer experience with a financial institution.

Here’s what all of this boils down to: Financial service customers prefer human interaction as it delivers that up-and-close and secure experience they’re looking for. They also want to rest assured that the communications they’re receiving from their bank actually come from their bank. And they’re looking for an interactive, personalized exchange. So, even when going omnichannel, calling a human agent should always be available to your customers. Just going digital is not enough. If you want to build trust, reduce fraud, and keep high-value customers from walking – voice isn’t just a nice to have, it’s your building block.

When it comes to customer communications in the financial service industry, it’s all about ensuring that voice is an easy and secure contact option across multiple customer touchpoints.

In the following, we’ll explore three ways to put that into practice.

If you’re serious about winning customer trust and keeping them engaged, voice is essential. A programmable voice API lets you embed voice services across multiple customer touchpoints – and meet your clients’ demands for personal, voice-assisted communication. At the same time, it’ll enable you to use enterprise-grade security and compliance, so you don’t have to worry about meeting the highest safety standards.

Here are three use cases for what a voice API would look like in practice.

Customers expect their financial institutions to contact them with information that’s relevant to them. Like: getting a notification when their loan renewal is due, receiving payment updates, or learning more about their current investment options.

By integrating your CRM system with a programmable voice API, it’s easy to keep your customers updated via phone with the information they actually care about. These call notifications can even be automated. Plus, you get access to features like call recordings, transcriptions, or speech-to-text technology that’ll allow you to safely gather customer data to offer an even better service.

What’s even more: With a reliable programmable voice API provider like Sinch, you don’t have to worry about secure connections. Security is baked into every part of our voice technology, and our platform protects sensitive customer interactions through advanced features like encryption, ISO 27001 certification, STIR/SHAKEN protocols, and meets comprehensive compliance standards like the GDPR.

Clearly, consumers place a lot of trust in live interactions and verified channels like their bank’s app. With programmable voice, you can easily integrate voice and video calls directly into your app.

Let’s say a customer gets a push notification on the banking app about a possible fraudulent activity. They see it right away and want to talk to your support team for more information. Now, the in-app calling feature lets them place a phone or video call directly from within the app. You could also integrate this on your website if that’s a popular touchpoint with your customers. In both cases, it reduces any friction in switching from an app or website to a call, and, in a critical situation, you also offer fast and reliable communication on the channels banking customers trust the most.

A programmable voice API also adds that layer of security your customers are looking for. Think: verifying a user’s identity via SMS, phone call, or flash call before giving them access to their bank account information.

For instance, customers could set up their mobile or even landline number to receive one-time passwords. You could then use the voice API’s text-to-speech software to deliver a phone call with a voice code – even in multiple languages.

This makes fraud detection and prevention easier on your end while also enhancing your customers’ safety.

Learn more about Sinch’s phone call verification method that lets you verify users across the globe.

There are also options for secure communication within apps. For example, Sinch’s programmable voice in-app calling offers call masking to prevent bad actors from impersonating your institution. In-app calling is also end-to-end encrypted, making it harder for unauthorized parties to intercept calls or access sensitive data.

Plus, you can integrate it with your own app’s authentication systems like a two-factor authentication (2FA). This ensures that only authorized users can initiate or receive calls.

With in-app calling, the communication data remains within a secure environment, reducing exposure to third-party vulnerabilities.

These are just a few examples that show how adding modern voice services ensure a smooth, personalized, and secure customer communication on the channels your customers actually prefer and trust.

Plus, depending on your needs, there are plenty of possibilities down the line to bundle Sinch’s programmable Voice API with chatbots, voice bots, AI agents, a cloud-based contact center, email and SMS services, as well as verification methods – all from one provider with the same high security standards, strong SLAs, and a global carrier network. So, you can expand at your pace without the complexity of having to use multiple platforms.

“We chose Sinch based on reputation. I always knew Sinch as a respected provider of voice services and numbering assets. It was a bit of a no-brainer.”

You’re probably wondering if a programmable voice API will increase your overhead or be extremely time consuming? Don’t worry, it won’t. While Sinch’s programmable voice API is developer-friendly, we also provide hands-on guidance throughout: from the initial technical evaluation to detailed documentation and SDK resources to comprehensive technical support from our team of experts whenever you need it.

Ready to learn more about Sinch’s voice offering for financial services? Check out our programmable voice API, or reach out directly to our voice experts.

And for further insights into our cloud-based tools for the banking sector, explore Sinch’s financial services solutions in more depth.