Insights

6 examples of excellent customer service in banking and financial services

Banking customers are in a “right now” mindset when it comes to notifications from their financial institutions. The inbox and the lock screen compete for their attention, so while email earns the job of detailed statements and policy changes, truly urgent moments belong on other channels. Across digital channels like online banking and mobile apps, and even in-branch touchpoints like ATMs, the same truth applies: Relevance, speed, and security now shape how much people trust their financial services institution with their money.

According to our 2025 research, consumers are clear about what’s important to them when it comes to communications from their financial institution: Fraud alerts top the list of very important messages, and most people (72%) expect to be informed immediately when fraud is suspected. Payment-due and overdraft notices also matter because they help people avoid fees and surprise balances.

But there’s a line between helpful and overwhelming. Nearly half (48%) of consumers say that information overload from brands is a top frustration, and 28% are upset when they can’t reply to a transactional message.

The solution is simple in theory: Use the best channel for the moment and make every alert actionable. Do that consistently and you’ll deliver excellent customer service. But what does that look like in practice? The stories below show how banks turned make-or-break moments, like a disputed charge, a late payment, or a new sign-in, into memorable customer interactions with measurable outcomes.

What is excellent customer service in banking?

Excellent banking customer service, from digital banking, mobile banking, and in-person service, shows up in the moments that matter – when a card is declined, a payment is late, interest rates change, or someone needs assistance choosing between banking products. It’s both omnichannel and customer-centric, and it respects customer expectations at every touchpoint. The best‑in‑class programs in both consumer and commercial banking do four things well:

- Give customers control with clear options and next steps to have personalized service at every step of the customer journey.

- Engage proactively based on customer data so problems don’t snowball.

- Explain security in plain language and make user verification quick.

- Connect channels so chatbots and human agents work from the same CRM and knowledge base. This way, customer conversations on different channels don’t start from scratch and can provide personalized support without repeat questions.

These six stories illustrate those principles in action and the operational moves that make them work behind the scenes.

6 examples of great customer service in banking

Here are some real-life examples of customer service from banking and financial services organizations will show you how to take your customer interactions from good to great, and why they work. Get inspired!

1. Avtal: Self-serve, message-led debt resolution

Debt resolution is rarely anyone’s favorite task. Avtal, a U.S.-based financial services technology company, set out to make it less stressful and more successful by meeting people where they are – in their email and SMS inboxes – with clear, respectful guidance and self-service options to resolve their debt instead of repeated phone calls.

What they did

- Replaced one‑way, phone‑first outreach with compliant SMS and email that link directly to a secure self‑service payment portal.

- Simplified choices so customers can view balances, set up payment plans, or dispute a charge without needing to call.

- Sent millions of messages per month while meeting carrier and regulatory requirements (10DLC and short code registration) and preparing for new channels like RCS.

Why it works

When outreach arrives on familiar channels with a clear next step, more people will engage and resolve accounts on their terms. Avtal reports a 50-70% increase in recovery rates after introducing SMS and email, with seven million messages sent in a single month and a ramp to 20 million per month by the end of 2025. The experience has improved both customer engagement and customer relationships, and it supports customers to have informed decisions about financial products.

“Sinch’s tech is really well built out, there’s a ton of documentation that makes it friendly for our engineering team. And then on the support side, we get amazingly quick responses.”

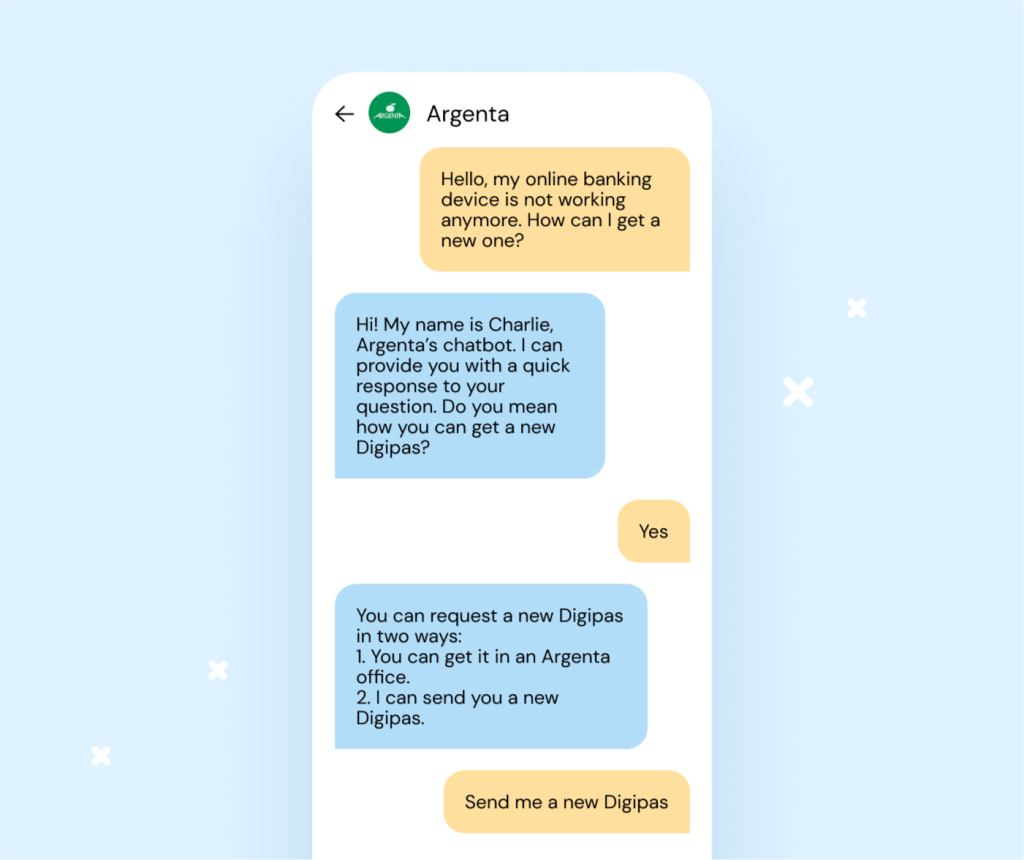

2. Argenta: An AI bot that boosts CSAT to 95%

As Belgium’s fifth-largest banking institution, Argenta set out to help an overworked team focus on higher-value work and keep response times fast. The solution? A virtual assistant named Charlie that handles common questions and simple transactions so agents can concentrate on complex tasks.

What they did

- Deployed Charlie, an AI-based chatbot, inside their mobile banking app to answer FAQs and complete straightforward flows.

- Taught the bot to recognize common intents (like requesting a new card reader) and run a short data-capture flow to capture the customer’s name, address, and email before sending the request to the right internal team.

- Scaled coverage so the bot now handles around 20% of all incoming questions, easing the load on a 23-agent team that receives over 20,000 messages per month.

Why it worked

Simple questions get instant answers, and agents spend more time on the conversations that need them. In the first six weeks alone, Charlie saved 24 hours of agent time. Customer satisfaction rose as wait times fell, and their customer satisfaction score (CSAT) reached 95% in the contact center and 80% in messaging channels.

3. BPCE: Gamified, compliant education that drives action

Educating customers about revolving credit can feel dry or confusing. But not at BPCE Financement, part of one of France’s largest banking groups, where they found a way to turn education into digital experiences that are helpful and human, all while staying firmly within regulatory guardrails.

What they did

- Launched Rich SMS campaigns that link to a secure mobile landing page to streamline customer education.

- Created an interactive, cycling‑themed mini‑game designed for customer education on key benefits of revolving credit at each checkpoint.

- Kept the entire journey inside BPCE’s trusted environment, ending with a financing simulator and the option to submit a funding request on mobile.

Why it worked

The experience turns education into a simple, fun progression. Customers discover how revolving credit works, then take the next step and make financial decisions without leaving a secure flow. Results beat benchmarks: 8% click‑through rate (four times BPCE’s average), 85% of clickers engaged with the experience, and conversion rates doubled versus standard campaigns.

“Working within a regulated environment actually pushes us to be more creative in how we engage with customers… This campaign proved that we can successfully balance regulatory requirements with engaging customer experiences.“

4. FirstBank: Real-time, personalized SMS alerts

Colorado-based FirstBank reimagined alerts as a service, not just a compliance checkbox. Customers could get notifications that actually mattered to them, like for balances, deposits, withdrawals, card‑not‑present purchases, and security alerts for suspicious activity. The key was timing: SMS alerts arrived right when the event happened, with just enough context for them to make a decision.

What they did

- Sent customers alerts and notifications about everything they needed to know (like account balance/projected balance, foreign transactions, security alerts, etc.)

- Delivered messages in real time.

- Prioritized critical security alerts and made them two‑way when helpful.

Why it works

Banking customers like the convenience of messaging-based services to manage their finances. And FirstBank’s alerts weren’t noise – they were useful. In fact, more than 60% of FirstBank’s online banking customers sign up to receive personalized messaging alerts because they improve their overall banking experience.

“Technology enables a superior customer experience. Mobile messaging is integral in the mix…vital in delivering not just messages, but on our promise of meeting customers where they want to be met.”

5. Nets: Fighting fraud without adding friction

For a payments leader like Nets, fraud checks must be both fast and safe. The team designed two‑way confirmation flows using SMS so that if suspicious activity appeared on a credit card, cardholders could validate or block transactions in seconds. Unlike one‑way email or push alerts that require opening an app or calling in, two‑way SMS lets cardholders respond on the lock screen and resolve the issue in the same message thread. That way, if the purchase was legitimate, access continued uninterrupted; if not, the card could be blocked and follow‑up handled.

What they did

- Sent immediate notices for suspected fraud with a simple reply action to validate transactions.

- Kept the interaction in one place and made it possible for cardholders to respond right away.

- Handled validation directly with the cardholder, which also saves time for banks.

Why it worked

Two‑way SMS hits the lock screen fast, prompts a speedy reply, and maintains minimal friction. In turn, cardholders get a better service experience, and banks save time on cases that would otherwise require follow‑up.

“The two-way communication solution allows us to react instantly towards cardholders while ensuring the best user experience and a high level of security at the same time.”

6. Triodos: Guided, secure onboarding

Triodos Bank, a European leader in sustainable banking, needed to find a secure solution to verify users logging into their mobile banking app or online portal without making everyday access harder. Their goal was to keep sign‑ups and logins smooth while strengthening account security.

What they did

- Rolled out SMS Verification (OTP) to all active online and mobile accounts in Spain so customers would verify their identity at sign‑in.

- Sent approximately 250,000 verification messages per month, supporting a community of 170,000 customers in Spain.

- Integrated user verification to simplify new‑account sign‑ups and protect ongoing transactions.

Why it worked

A quick OTP at login adds a visible layer of security without slowing people down. Triodos reports increased account security, a simplified sign‑up process, and higher conversions after introducing SMS Verification.

“Sinch has simplified our operations with OTP functionality. Customers receive a password quickly and easily, and then they can readily perform secure transactions in their accounts.”

What the data says banking customers want in 2026

You’ve now seen how different financial institutions have raised the bar on customer service. To do the same, you need to first know what your customers need.

In our State of financial services communications report, which included a survey of over 2,800 financial services customers and 400 financial institutions, we found that today’s financial consumers appreciate:

- Proactive, fee-saving notices: Payment-due notices are very or somewhat important to 84% of consumers, and overdraft notifications are very or somewhat important to 80%.

- Omnichannel programs by design: For important informational updates, 24% of consumers prefer to receive messages via email and text together, and about 10% prefer a three-channel mix (email, SMS, automated voice) for critical events.

- Having the right mode for stressful issues: When suspicious activity is detected, consumers most often prefer to resolve it by voice (46%), followed by text (20%) and a secure portal (16%).

- Channel options beyond email: For personal‑finance updates, 32% prefer email, 23% prefer a secure client portal, 13% prefer phone, and 11% prefer text.

- Automation that respects choice: Consumers are open to automation when it’s useful and easy to escalate, with 42% saying they’d use an AI chatbot trained on a company’s support documentation, and 36% were open to using AI for getting personal financial advice.

Use these expectations to shape your 2026 roadmap. You can measure progress in a few key ways; we’ll go through those next.

How to measure customer service in banking

A balanced scorecard captures speed, containment, and confidence across digital channels and in-person service:

- Time to resolution for fraud and support cases, time to decision for loan applications, and wait times in chat, call center, and in-branch experiences.

- Opt-in, delivery, and read rates on alerts and statements; customer feedback and customer satisfaction (CSAT) trends by channel.

- Containment rate for chatbots/virtual assistants and handoff satisfaction on complex issues when human agents step in.

- Verification success vs. abandonment on sign-in and high-risk actions.

- Post-interaction CSAT/NPS after claims, fraud alerts, and onboarding; customer retention signals across the customer journey.

Tie every metric to a customer moment, not just a channel. For example, report “payment-due reminders read within 1 hour” instead of a generic open rate.

Bottom line: It’s all about value

The most important thing to remember about these examples of excellent customer service in banking and financial services is that you always need to think about the value you’re bringing to your customers. The banks that earn customer loyalty send meaningful messages at the right moment, on the right channel, with clear next steps that build trust. To get started on this yourself, keep a few key lessons in mind:

- Make it easy to act: Avtal turned a stressful task into a simple, self‑serve flow; Nets let cardholders resolve fraud concerns in seconds; FirstBank made alerts useful rather than noisy.

- Educate without friction: BPCE showed that guidance can be engaging and compliant at the same time.

- Protect confidence: Triodos added visible security with fast OTPs, keeping sign‑ups and logins smooth.

If you’re refreshing your service playbook for 2026, start here: map the top 10 customer needs you influence, decide the best channel for each, make alerts actionable, and measure what happens. Then iterate based on financial goals and outcomes. The brands above didn’t overhaul everything at once; they picked a few high‑impact moments and made them great.

Sinch helps over 200 financial service providers worldwide prevent fraud, stay compliant, and offer a smooth customer experience. Get in touch to start creating customer experiences your customers will love.