Insights, Products

RCS in banking: The next step in digital customer experience

Insights, Products

Something big is changing the way financial services institutions communicate with their customers.

And no, it’s not another digital wallet or payment tool. It’s Rich Communications Services (RCS), a messaging channel that feels like an app but offers more secure, branded messages right in a customers’ regular text message inbox.

Adoption is happening fast. Financial services organizations are embracing RCS faster than other industries, likely because it offers more than SMS in a highly regulated environment – and because it aligns with customer expectations for trust, clarity, and engagement from their banks.

According to our 2025 State of customer communications survey which includes insights from over 2,800 global consumers and 400+ financial services business leaders, RCS is already reshaping financial customer communications:

When we asked why, one thing stood out: security. More than half (54%) of financial institutions pointed to improved security as the top benefit of RCS. And with fraud and impersonation scams on consumers on the rise, that carries serious weight.

Plus, consumers are also pushing for better. Our survey found that global consumers increasingly value speed, trust, and relevance when it comes to messages from their financial institutions.

In this post, we’ll break down what our survey revealed about what consumers want from their financial institutions, and why RCS might be exactly what banks need in 2025.

RCS offers banks and financial institutions a change to evolve how they currently use messaging channels – not by replacing SMS outright, but by solving for what it lacks. Here’s what sets it apart:

Miriam Liszewski, Sinch RCS Product Manager, walks through what RCS could look like for a modern bank.

Our 2025 State of customer communications report confirmed what many financial services companies have long suspected: People want their financial messages to be clear, timely, and secure.

From fraud alerts to payment reminders, RCS can help banks and financial services companies communicate better across the entire customer journey. Let’s take a look.

Bank fraud is unfortunately all too common. A 2024 J.D. Power study found that 45% of bank consumers experienced multiple incidents of fraud in just one year. It’s probably no surprise, then, that consumers expect their bank to respond with quickly and clearly when something’s wrong.

From our 2025 survey:

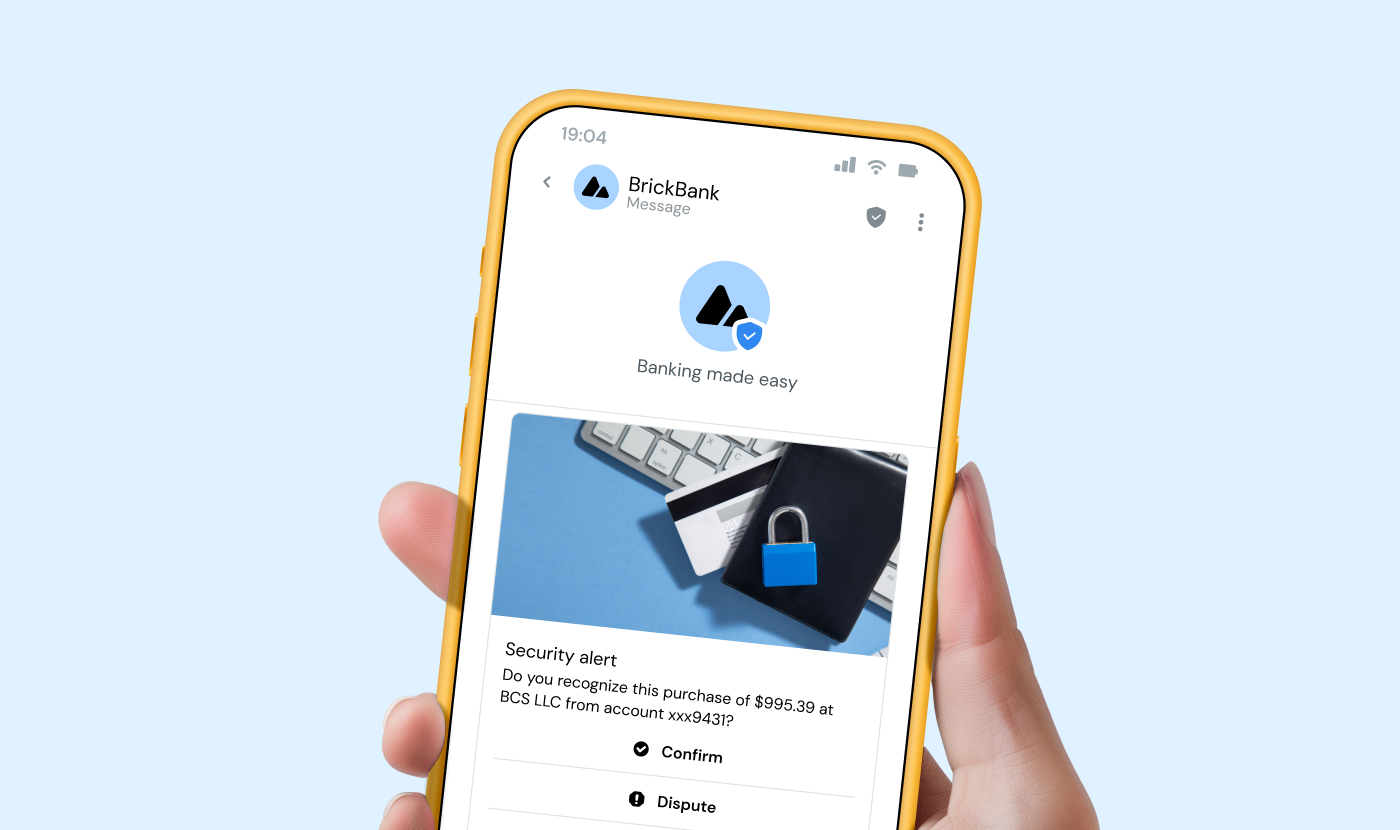

Most institutions still rely on SMS for fraud notifications, but RCS makes them much better. Branded sender profiles make sure customers instantly know who the message is from. And thanks to built-in action buttons like the ability to call right from the message, customers can go from getting a fraud alert to resolving it faster than ever.

That same J.D. Power survey found that 92% of banking customers said they’d stick with their bank after a fraud issue was successfully resolved. Speed builds trust – and RCS helps deliver both!

of consumers say fraud alerts are critically important

of consumers want fraud alerts immediately

of consumers want to resolve a fraud issue over the phone

of banking customers would stick with their bank after fraud was resolved successfully

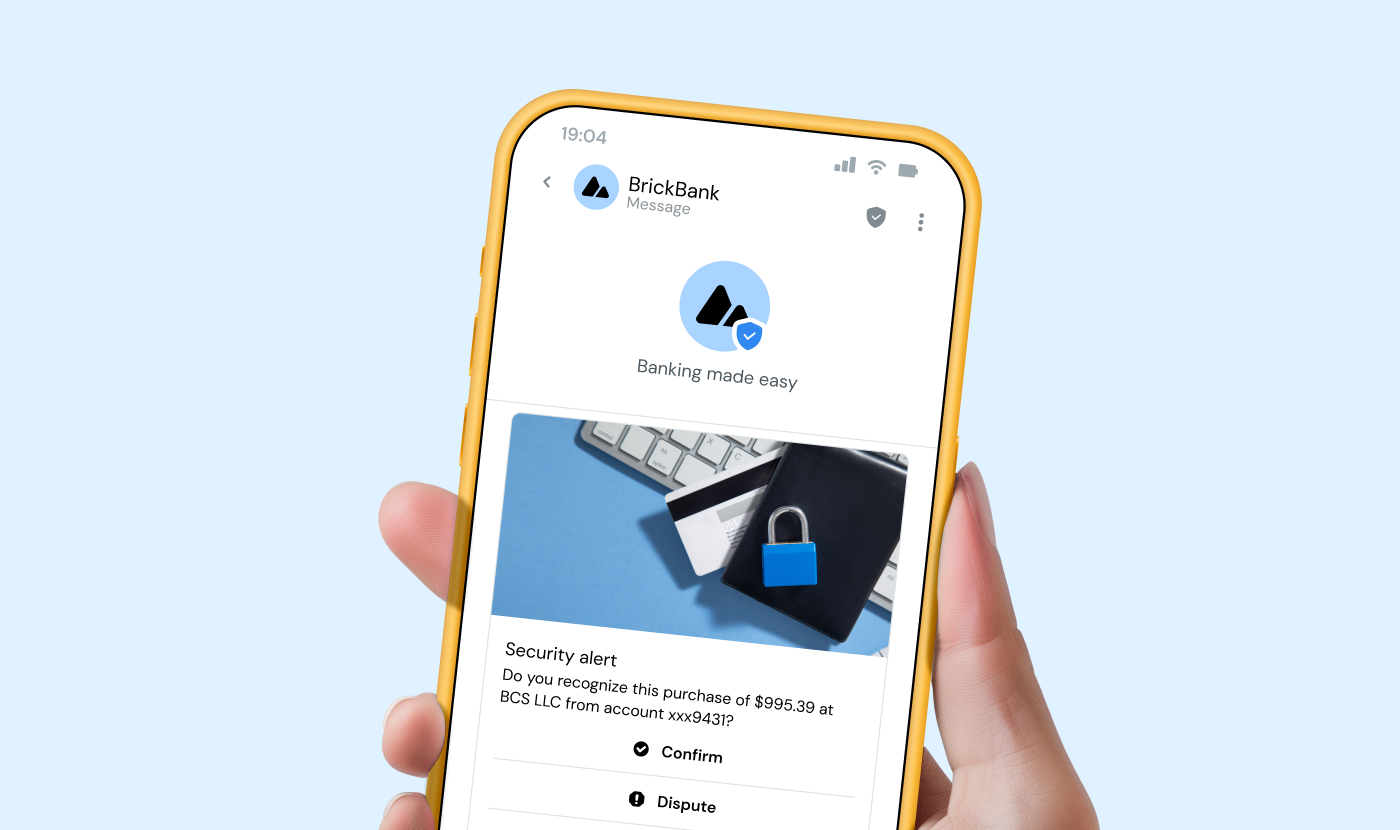

SMS is a common channel to send one-time passwords because it works on nearly every mobile phone, anywhere in the world. That kind of reach is hard to beat. But SMS is also vulnerable to smishing attacks, where fraudsters try to trick users into sharing sensitive information by impersonating a business.

And consumers are taking note, making them question valid messages. According to our research, more than half of consumers had received a legitimate message from a brand in the last year that they at first found suspicious.

RCS helps solve for that. Every RCS for Business sender must be verified, so users know exactly who the message is coming from, complete with a logo and a name. This makes it much easier for customers to instantly recognize messages and act on them with confidence.

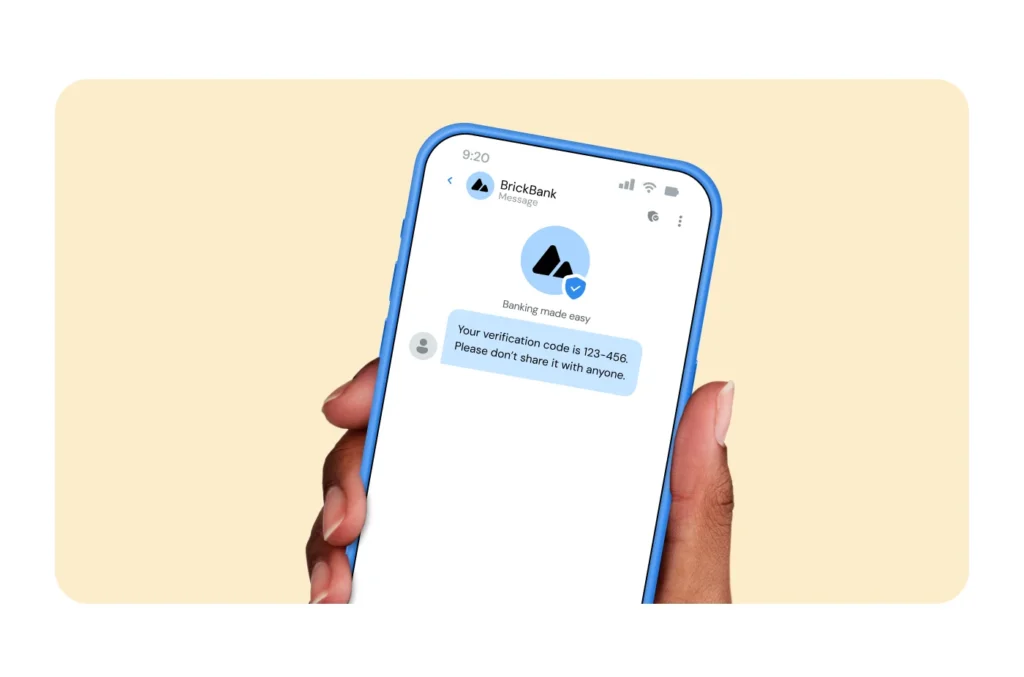

Today’s consumers are looking for providers who can help guide them through their financial journeys. Our research shows 63% of consumers expect at least monthly updates about their financial accounts, and 73% find balance notifications important in their money management.

RCS can make those updates easier by letting you send branded, actionable messages from everything from transaction activity to policy updates. You can also add rich visuals, buttons, and more context in your messages so they feel way more personalized than just a text.

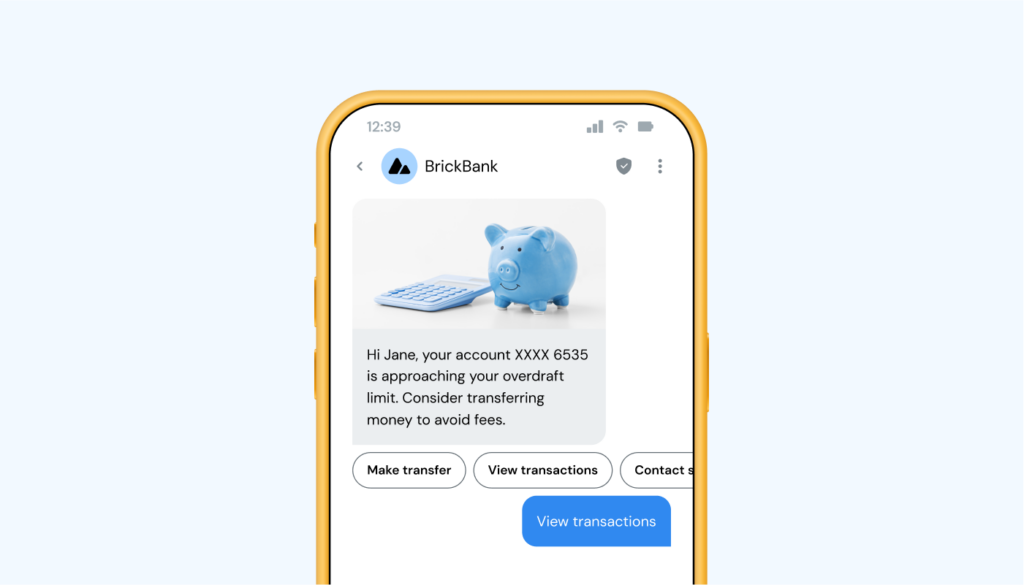

Late payments are a pain for both consumers and financial institutions. Our data shows that 84% of consumers consider payment due reminders important.

RCS lets you send payment reminders that are harder to miss. With a recognizable sender profile and actionable buttons (like “Pay now” or “Talk to Support”), you can help customers act instantly and avoid frustration later.

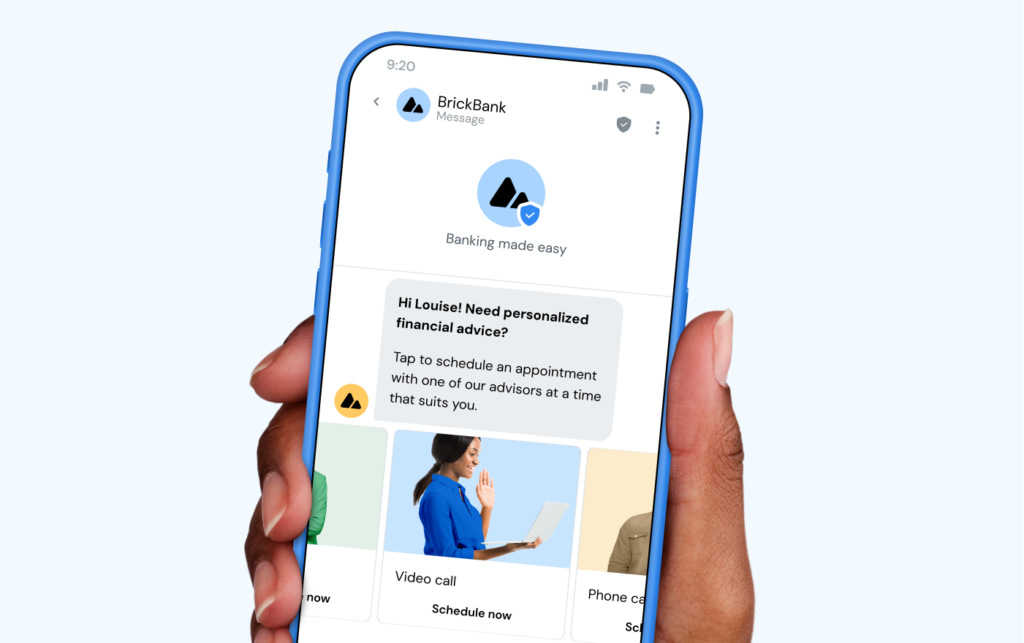

Not every task needs a human agent on the other end. And for simple things, like booking time with a financial advisor or getting answers to FAQs, most people just want to get things done quickly.

And many institutions are already moving in that direction. Our research found that:

While younger generations lead AI adoption, general concerns among consumers about data privacy remain, and many people still want the option to talk to a human.

When RCS is integrated with an AI chatbot, you can automate straightforward interactions but still offer the option to connect with a human when needed. It’s the kind of service that makes life easier for your customers and reduces pressure on your support teams.

We all know consumers in 2025 expect personalization. This is especially true in financial services, where nearly 50% of consumers told us they want personalized communications based on their real financial situation. This means no more “one size fits all” approach.

RCS helps deliver on that expectation and gives you the ability to include rich elements like carousels, images, and more so your promotions are as engaging and relevant as possible, and drive the most impactful results.

WeCredit, a digital lending platform in India, uses RCS to make it easier for customers to discover and apply for paperless loans.

They send their customers:

Before using RCS, they relied heavily on SMS and WhatsApp. SMS was affordable for their market but limited when it came to interactivity and tracking – meanwhile, WhatsApp supported richer conversations but required subscribers to have a separate app.

“RCS sits in the perfect middle ground between SMS and WhatsApp. It has the visual appeal of WhatsApp with the cost-effectiveness of SMS, plus great tracking and analytics.”

Now, with 35-40% of their customers using RCS-enabled devices, WeCredit can reach a large chunk of their audience in a way that’s visually rich and easy to interact with. And because RCS doesn’t yet cover their entire base, they use RCS where possible and WhatsApp and SMS as fallbacks. This way, no customer misses important updates.

Both WhatsApp and RCS can help you offer great customer experiences depending on your customers’ needs. Check out our full guide on WhatsApp Business API for more information.

SMS will remain a critical channel for banks because of its universal availability. But it just wasn’t built for the fraud risks, privacy concerns, or customer expectations of 2025. Trying to stretch it to fit those needs can only go so far.

RCS gives you a powerful way to make your customer communications so much better, from fraud alerts, to OTPs, and account updates. And it does it in a way that’s familiar for customers, but in a way that’s far more powerful than plain text.

So, now’s the time to ask yourself:

Because here’s the thing: Your customers already expect this level of clarity. RCS can help you deliver it. It’s time to raise the bar on what great financial communications can look like.

Ready to bring branded messaging to your financial institution? Reach out to our team and start the conversation.