Insights

How to choose the best communication channels by region

Connecting with customers around the world is no small feat. Juggling platforms, culture nuances, and communication habits can make or break your brand. Miss the mark, and your competition will gladly pick up the slack, taking your customers (and revenue!) with them.

Each region around the world has its own unique communication habits. For example, WhatsApp dominates in Latin America, where over 90% of internet users rely on it, while WeChat integrates messaging and payments in China.

These aren’t just popular channels — they’re essential for communicating with people in the region. If you’re marketing in Latin America or China but ignoring these tools, you’re as good as invisible.

Yes, regional diversity adds complexity, but it also creates a rare chance for brands to show cultural fluency and build trust across markets. In this article, you’ll get region-specific guidance on how to choose the best communication channels. By the end, you’ll have a cheat sheet to navigate global communication like a seasoned pro.

The best communication channels for each region

Messaging channels vary wildly across the globe. Each region has its own digital DNA, shaped by technology infrastructure, cultural norms, and user behavior. To truly connect with your audience, you need strategies built around these local patterns.

Identifying popular messaging channels and what drives their popularity helps you create strategies that engage local audiences.

North America: A saturated market with mobile-savvy consumers

North America’s digital saturation offers both challenges and opportunities for brands. With 94% of the U.S. population online and 70% active on social media — higher than most regions globally — the potential reach for brands is unparalleled.

Take American Eagle’s innovative approach to mobile messaging. Recognizing WhatsApp’s growing influence among Gen Z consumers, they became North America’s first fashion retailer to launch a WhatsApp shopping experience in late 2024.

The strategy aligned with Gen Z’s habits and made conversations and purchases seamless.

They created a frictionless journey from discovery to purchase by integrating Meta ads with AI consultants tailored to their audience’s preferences.

The decision was driven by data showing 50% of Gen Z already active on WhatsApp, with projections suggesting U.S. users will exceed 100 million. This approach shows how brands can find meaningful connections in a saturated mobile market by using emerging channels.

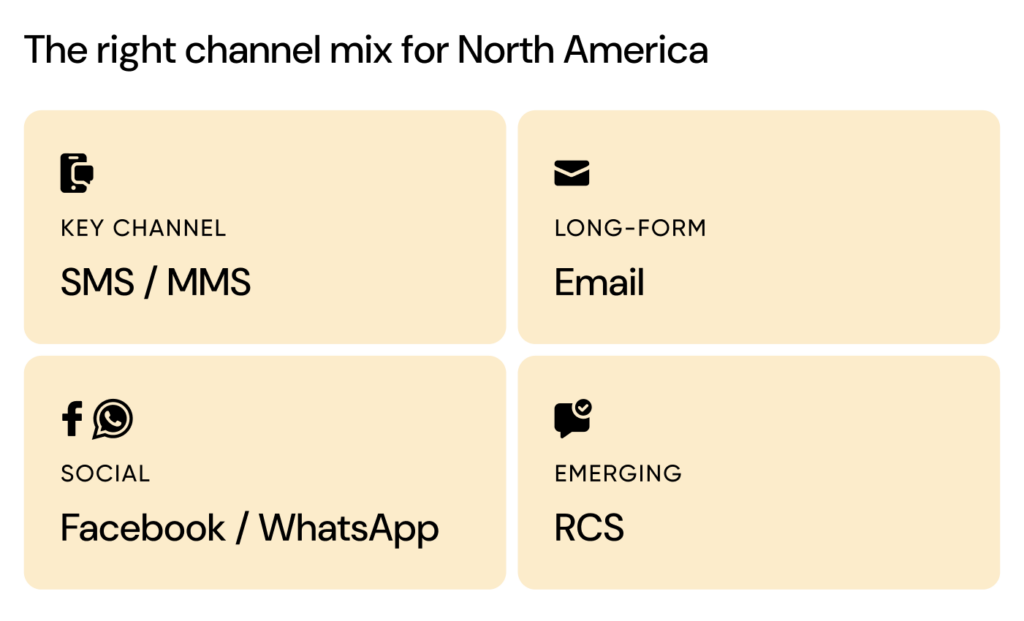

For brands looking to connect with North American audiences, the winning channel mix based on the data is:

- Primary channel (SMS/MMS): With open rates near 98% and response rates 8 times higher than email, text messaging is ideal for urgent offers.

- Social messaging (Facebook Messenger and Instagram DMs): Interactive channels like Facebook Messenger (29.4 million active users in Canada) and Instagram DMs (170 million active users in the USA) excel for real-time engagement.

- Long-form channel (Email): Email is still vital for detailed communication and nurturing campaigns, with 84% of U.S. marketers relying on it.

- Emerging channel (RCS): RCS combines SMS simplicity with rich-media interactivity and delivers app-like engagement without downloads.

Europe and the U.K.: A mobile-first, privacy-conscious audience

Europe’s digital landscape blends widespread mobile use with strict privacy standards. You need to respect regional preferences while maintaining GDPR compliance, and create personalized experiences without compromising privacy.

Western Europe alone has 459 million smartphone users, with the UK leading at a 93% penetration rate. It’s a unique environment where convenience and compliance intersect – and where tailored approaches are successful.

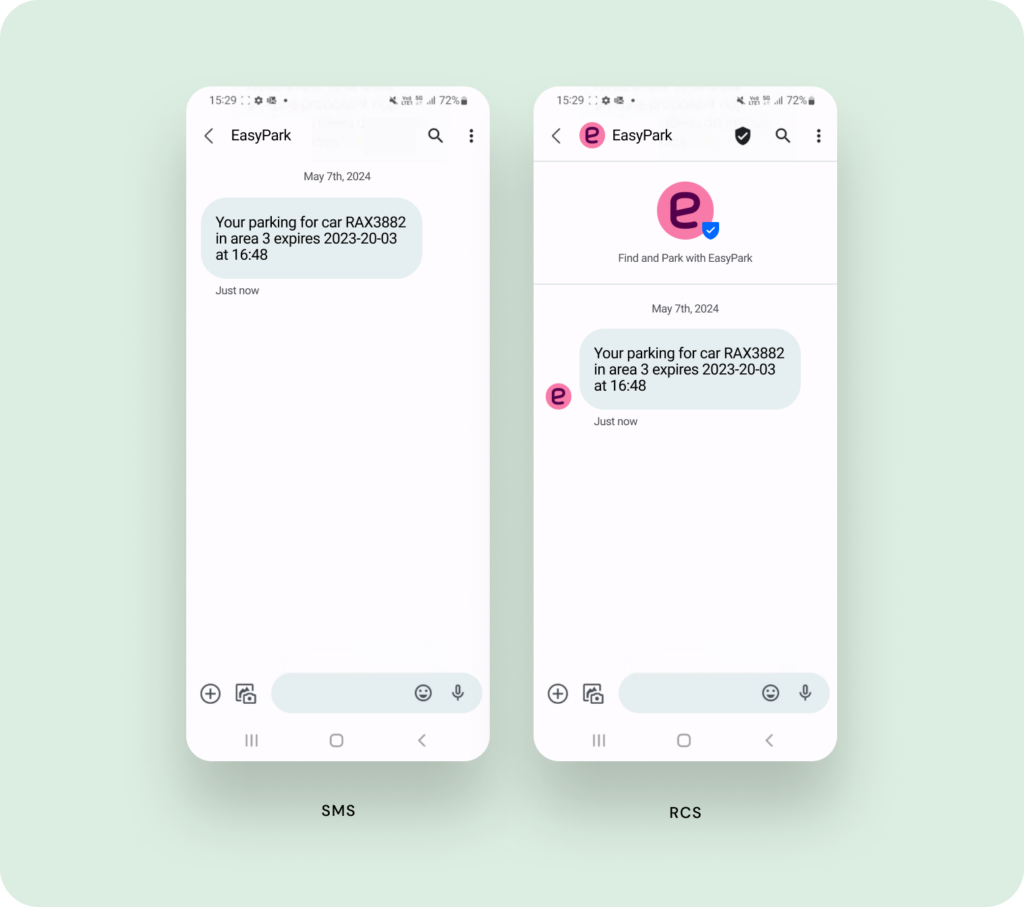

EasyPark Group, a leading digital parking app, is a prime example. Operating in Germany across Europe, replaced multiple SMS vendors with a single provider to send parking reminders, all while navigating the regulatory landscape.

This balance between accessibility and privacy defines successful European campaigns. WhatsApp’s dominance varies by country — from 90.3% in Italy to 63.7% in France — but its business messaging features have become crucial for brands wanting to maintain direct, compliant customer connections.

For brands targeting European audiences, the optimal channel mix looks like this:

- Primary channel (Email): Europeans still prefer email for formal business communication, with higher-than-average open rates of 15.92%.

- Messaging (WhatsApp): The go-to platform for instant communication, especially in Southern Europe where usage exceeds 90% in some countries.

- Secondary channel (SMS): Particularly effective in markets like Sweden, where it ranks as the favorite messaging channel.

- Emerging channel (RCS): Growing 40% year-over-year in Europe, with 90% open rates within 15 minutes of delivery.

Latin America: Where WhatsApp reigns

Latin America’s internet penetration jumped from 43% to 78% in just a decade. But what’s most striking is how deeply messaging apps have become a part of daily life.

iFood, one of Latin America’s largest food delivery platforms, is a prime example of how businesses are tapping into this trend. They introduced a conversational AI solution on WhatsApp that provided drivers with updates, instructions, and quick responses to common questions. The result? Faster issue resolution, improved driver satisfaction, and a smoother operation across a vast network.

This shows how messaging platforms can modernize business operations and deliver real impact in Latin America.

This preference for messaging apps stems from practical considerations. With mobile service costs relatively high in the region, many users rely on internet-based messaging apps as their main communication channel. Businesses are taking note, and Mexico and Brazil have become key testing grounds for WhatsApp Business API, with brands using it for everything from customer service to sales and appointment booking.

For brands targeting Latin American audiences, the channel mix is clear:

- Primary channel (WhatsApp): With over 90% penetration in most markets, it’s non-negotiable for business communication.

- Secondary channels (Facebook Messenger/Telegram): Used by 65.1% and 56.5% of the population respectively, providing additional touchpoints.

- Traditional channel (SMS): Though less common, SMS still plays a role in reaching customers without data access.

- Emerging channel (RCS): Growing in popularity as users demand richer messaging experiences.

Asia: A diverse, dynamic messaging landscape

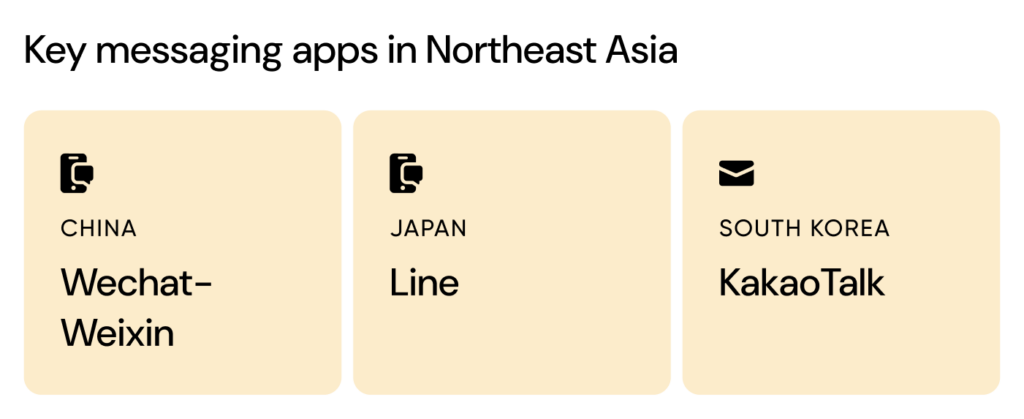

Northeast Asia: The super-app ecosystem

In Northeast Asia, messaging apps do much more than send texts. Take WeChat in China — with 1.3 billion monthly users, it’s how people pay bills, book doctor’s visits, and even apply for loans. It’s a daily necessity.

Luxury brands are catching on fast. Longchamp spotted an opportunity with WeChat’s mini-apps, becoming the first luxury brand to use them. For their 70th anniversary, they launched two clever features: an easy shopping platform and a Shanghai city guide.

Shoppers could customize bags and pay without leaving WeChat, while tourists got tips about the best spots in Shanghai. It’s a perfect example of how brands can use super-apps to connect with Chinese consumers.

WeChat actually comes in two variations: one for international users and Weixin for mainland China, each with its own servers and rules.

Japan and South Korea have their own favorites. LINE owns Japan with 95 million users checking in daily, while KakaoTalk reaches virtually everyone in South Korea — 98.5% of the population uses it.

- Primary: WeChat/Weixin (China), LINE (Japan), KakaoTalk (South Korea)

- Secondary: Email for formal communications

- Emerging: RCS, particularly in developed markets

Southeast Asia: Young, mobile, and moving fast

Southeast Asia loves mobile. Malaysia (93%), Singapore (92%), and the Philippines (91%) lead the charge in smartphone use. But what’s really interesting is how local companies are changing the game.

Even global brands are finding creative ways to use messaging apps in Asia.

Tang drove impressive results in the Philippines using Facebook Messenger for their biggest promotional campaign in years.

Their ads that clicked to Messenger achieved a 14-point lift in ad recall and a 9.9-point lift in engagement in Asian markets.

- Primary channel: WhatsApp, Viber, LINE

- Social channel: Facebook, Instagram

- Secondary channel: SMS for broad reach

South Asia: Big numbers, bigger potential

India’s story is all about scale: 825.3 million internet users (and that’s with only 60% of people online). WhatsApp leads with 487.5 million users — its biggest market anywhere. But regular SMS reaches even more people — 1.1 billion mobile users.

Pakistan’s numbers tell a similar story of growth. With 71.70 million social media users (29.5% of the population), WhatsApp leads the pack alongside Facebook and YouTube.

This massive reach is why businesses are increasingly turning to messaging to connect with customers. Take Orion Malls, for example. They wanted to boost foot traffic and sales, so they tapped into WhatsApp with a 24/7 chatbot that helped shoppers with everything from store info to promotions.

The results? A surge in visitors and a clear uptick in sales.

The pattern is clear: Messaging apps are becoming the go-to way to connect in South Asia.

- Primary channel: WhatsApp

- Focus channel: SMS (reaches broader audience than internet platforms)

- Emerging channel: RCS showing rapid growth

Middle East: A market embracing digital growth

Mobile phones dominate the Middle East’s digital landscape. By 2028, the region will have 780 million smartphones. More telling: UAE residents spend nearly three hours daily on social platforms, while most banking, shopping, and healthcare across the UAE, Saudi Arabia, and Egypt now happens through mobile apps.

WhatsApp leads messaging in most Middle Eastern countries. In the UAE, 85.8% use WhatsApp monthly, with Facebook Messenger (80.3%) and Instagram Messenger (80.1%) close behind.

For brands targeting Middle Eastern audiences, here’s the ideal channel mix:

- Primary channel (WhatsApp): 85.8% of the UAE population uses it monthly

- Secondary channel (SMS): Preferred by 41% of customers for brand communications

- Messaging (Facebook Messenger): Reaches 80.3% of UAE population

- Emerging (RCS): Regional adoption growing as rich messaging capabilities expand

Australia and New Zealand: A market of endless mobile connections

Australia’s 26.7 million person population manages 33.59 million mobile connections. New Zealand follows a similar pattern, with its 5.2 million residents deeply embedded in digital culture.

This market shows an intriguing contrast in messaging preferences. While Facebook Messenger leads in both countries (69.9% in Australia, 71.8% in New Zealand), traditional SMS remains remarkably resilient.

But what’s particularly interesting is the region’s openness to richer messaging experiences.

Recent research shows 46% of consumers find RCS appealing, with 68% more likely to engage with messages containing rich media like images and interactive elements. This signals a market ready for more sophisticated mobile engagement, even as they maintain their connection to traditional channels.

For brands targeting the ANZ region, the data points to the following optimal channel mix:

- Primary channel (SMS/MMS): Still the most reliable way to reach customers, with proven engagement rates and universal accessibility.

- Social messaging: Facebook Messenger dominates (around 70% penetration), followed by Instagram messaging and WhatsApp.

- Secondary channel (Email): Used by 59% of businesses, making it a crucial part of any comprehensive strategy.

- Emerging channel (RCS): Growing rapidly as consumers show strong interest in rich media messaging experiences.

Best practices for regional messaging strategies

Effective communication starts with understanding the unique advantages of each messaging channel and tailoring your approach to regional preferences. Here’s a quick guide to best practices for rolling out different channels across diverse markets:

SMS and MMS

SMS and MMS are the backbone of business communication, offering unparalleled reach and reliability. With open rates near 98% and no need for an internet connection, these channels are ideal for time-sensitive or critical messages, like appointment reminders or security alerts.

To make the most of these channels, brands should:

- Personalize messages with names or relevant details

- Keep frequency manageable to avoid overwhelming recipients

- Ensure compliance with opt-in and opt-out regulations

RCS

RCS creates interactive, branded experiences that go beyond plain text and offer capabilities like multimedia messaging, dynamic buttons, and real-time interactivity. As Apple’s support leads to an expanding each, it’s the best time to explore this channel.

To get the most out of RCS, brands should:

- Personalize messages with customer-specific details and preferences

- Incorporate interactive features like carousels and in-message actions

- Use analytics to optimize future campaigns based on engagement insights

Over-the-top (OTT) messaging

OTT platforms like WhatsApp, WeChat, and Telegram dominate in many regions, and these are the same channels people use to chat with friends and family. The conversational nature and enhanced features as compared to SMS helps brands build trust and engagement.

For OTT, brands should:

- Build out their business profiles to build brand recognition and trust

- Use multimedia features (e.g., videos, images, and links) to make messages more engaging

- Respect user consent with clear opt-in options and easy ways to unsubscribe

While SMS and OTT messaging grab attention, email shines for delivering in-depth content and nurturing long-term relationships. Its ability to handle detailed communications like newsletters, thought leadership, and transactional messages makes it indispensable.

When it comes to email, brands must:

- Write compelling subject lines to boost open rates

- Use consistent branding elements to enhance recognition

- Include clear calls-to-action (CTAs) that guide readers to the next step

Turning regional messaging insights into action

Not tailoring your communication to regional preferences risks customer relationships and competitiveness. Channels like SMS for urgent updates and RCS for app-like experiences offer unique ways to engage audiences.

Using regional insights helps you craft personalized messages that drive engagement, trust, and ROI. Sinch simplifies multi-channel management with integration, real-time data, and AI-driven personalization.

Reach out to our team to optimize your global messaging strategy and deliver impactful messages that help you build lasting connections.