Insights

Black Friday trends 2025: Key data, stats, and consumer expectations

Since its beginnings back in the 1950s, Black Friday shopping has always been chaotic. The madness, however, has shifted from inside stores to customer communication chaos.

Retailers fight for attention inside inboxes and messaging apps, and there’s a good reason why. In 2024 alone, U.S. holiday sales hit $241.4 billion – an 8.7% jump from the year before.

The stakes are high, and competition is fierce. Sinch data from 2024 showed a 22% growth in email and SMS volumes compared to 2023 – clear signals that brands have been doubling down on digital engagement. And all signs point to 2025 being even bigger.

But are brands actually hitting the mark with their customer communications? What do consumers expect from retailers during Black Friday and Cyber Monday (BFCM)? We asked 3,180 shoppers across the globe about their digital communication preferences during peak sales events.

Let’s dig into the trends shaping the 2025 holiday shopping season.

Black Friday trends 2025 at a glance

Every year, Sinch surveys global consumers to understand how they want to hear from brands during peak shopping events. For 2025, we asked 3,180 shoppers in the U.S., Canada, Germany, France, India, the U.K., Spain, Brazil, Mexico, and Australia what matters most when it comes to BFCM brand communication.

Here are the top Black Friday stats for 2025:

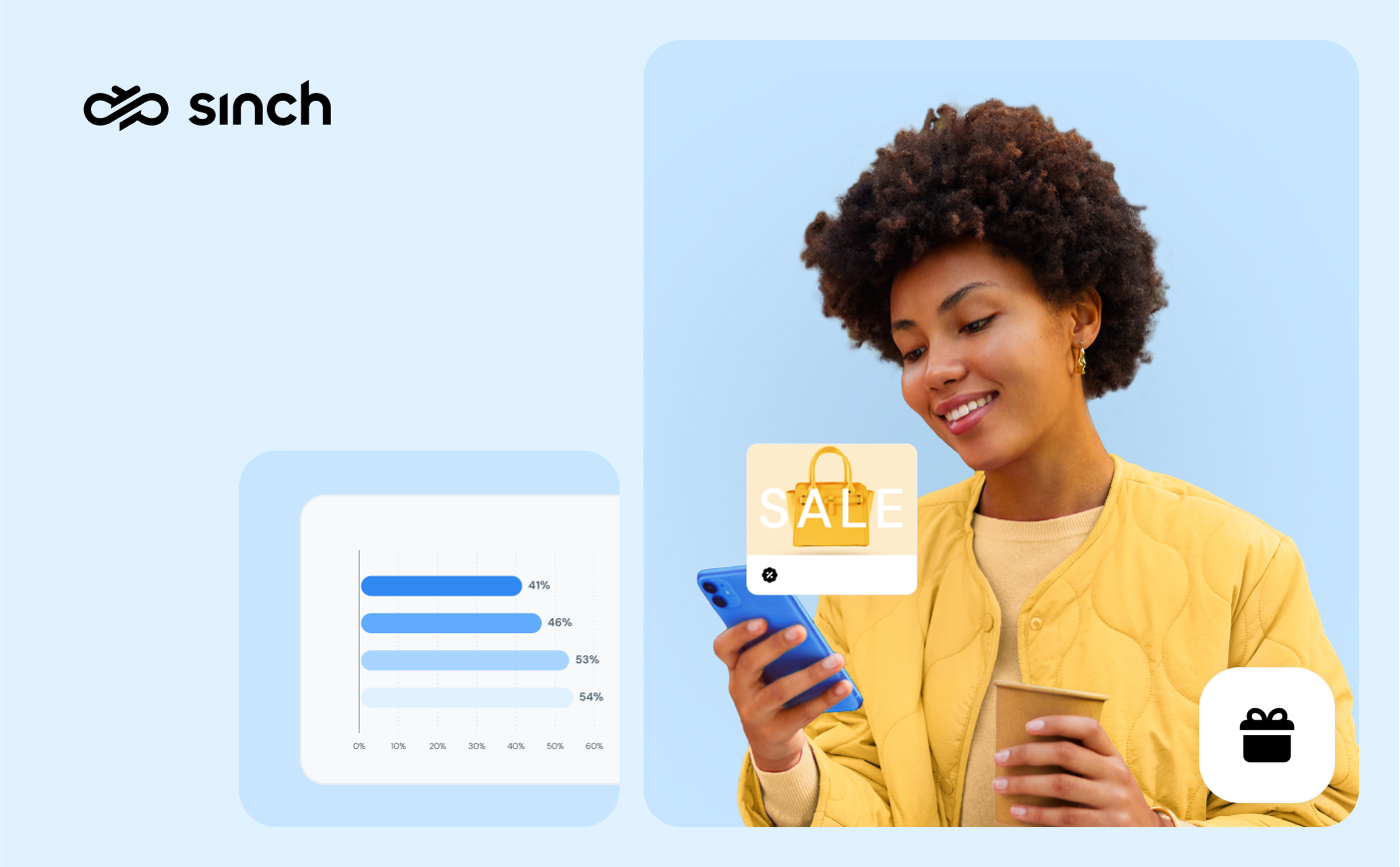

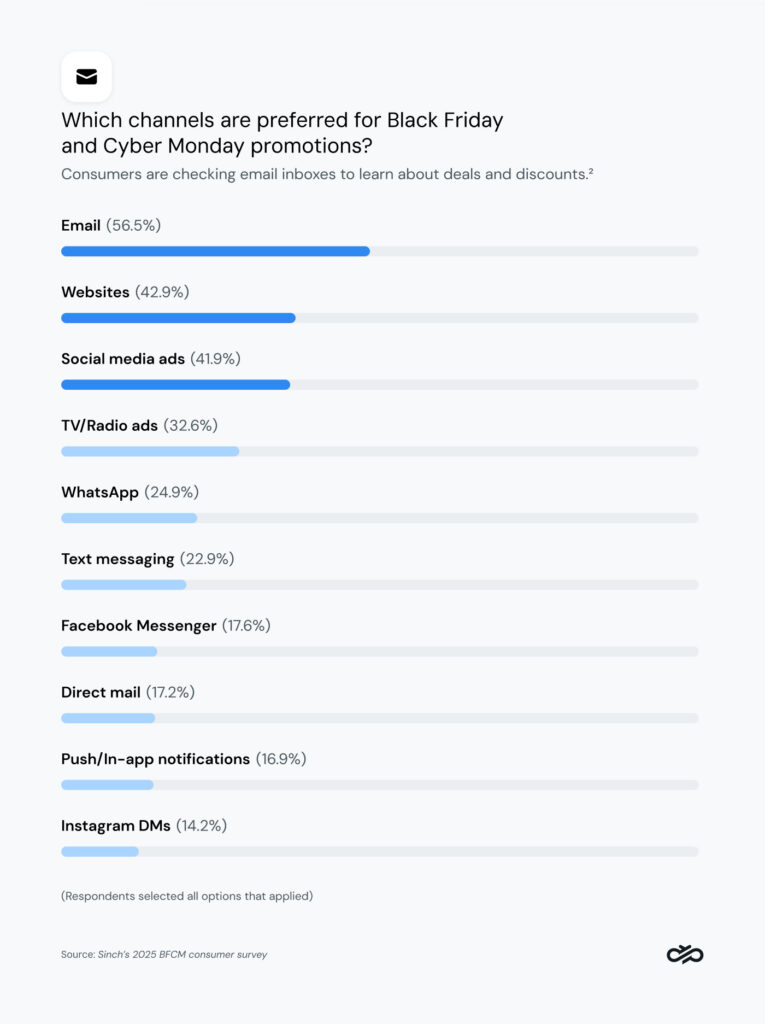

- Omnichannel is non-negotiable: 71.7% of consumers want brands to communicate across more than one channel. Email leads (56.5%), followed by websites (42.9%), and social media ads (41.9%). A combined 46.5% of shoppers want to hear from brands through at least one mobile messaging channel.

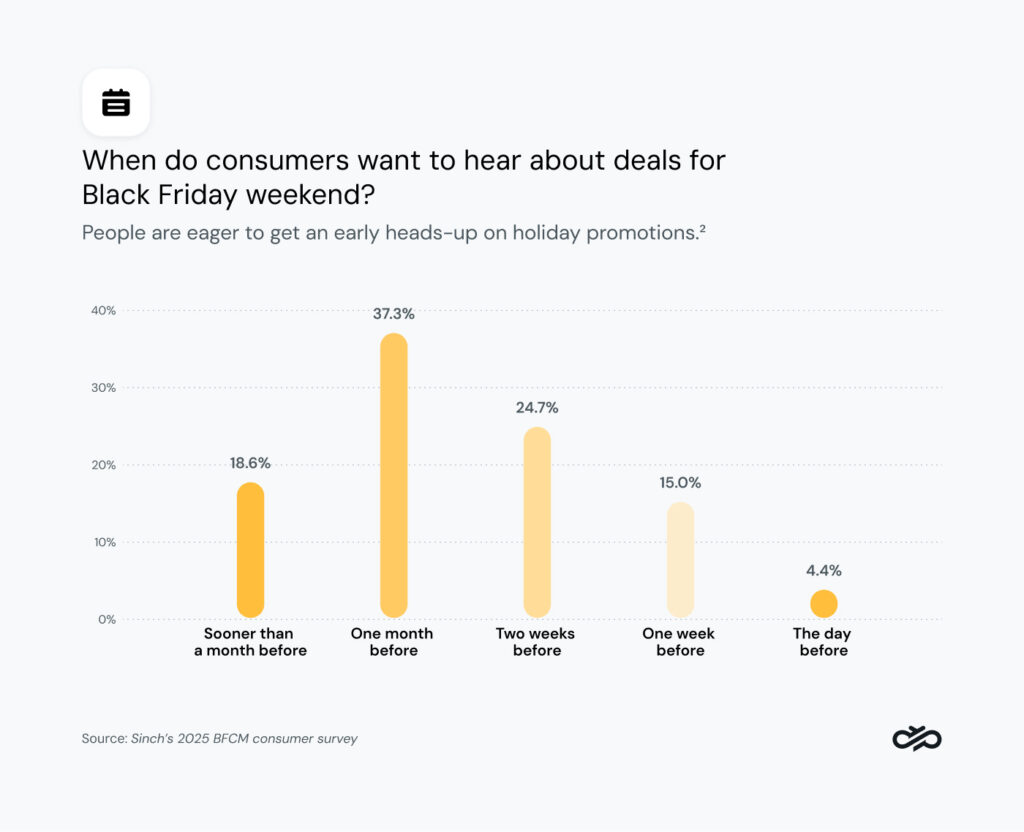

- Start early or risk missing out: 37.3% expect promotions to begin by October 28 – a full month before Black Friday – and 18.6% want them even earlier. Just 19.4% are OK waiting until Cyber Week.

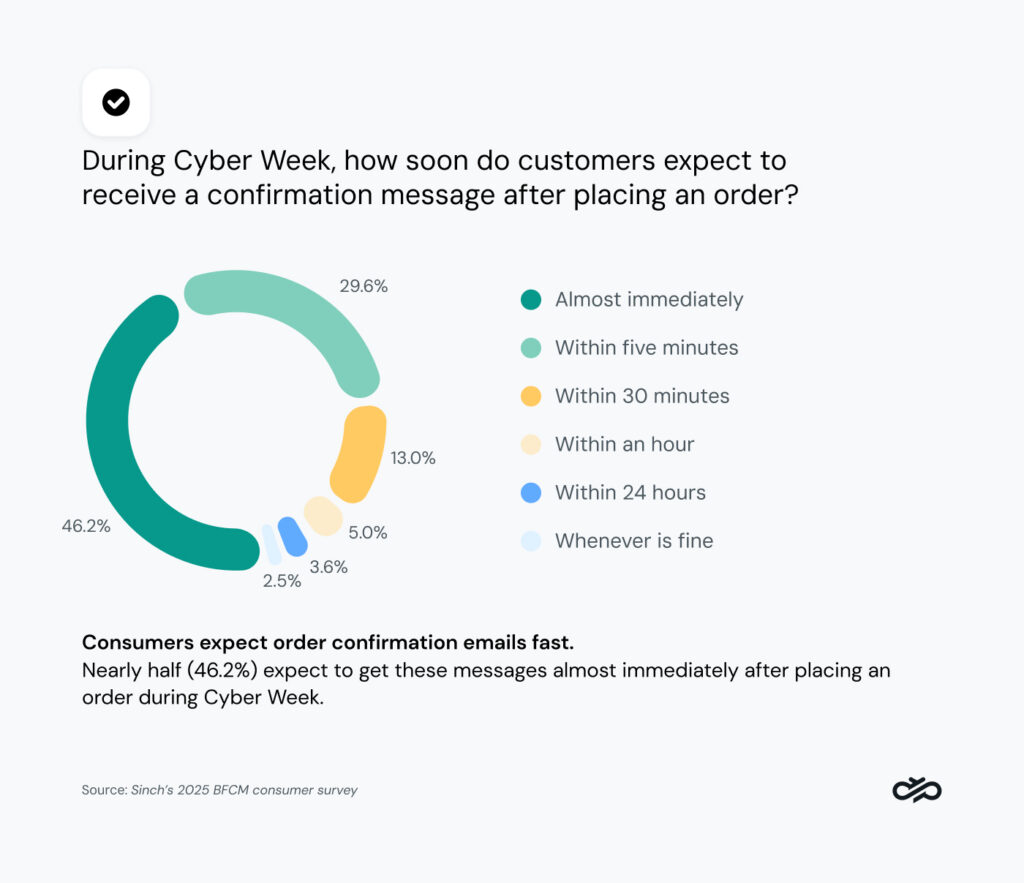

- Speed matters: 93% of shoppers say transactional messages are important during the holidays, and 75.8% expect order confirmations within five minutes of purchase.

- Email dominates for customer updates: 73.9% of consumers prefer email for transactional communications. Text messages come next at 40.9%, with WhatsApp leading in mobile-first markets like India, Brazil, and Mexico.

- Shoppers want options: 52.1% prefer multichannel delivery for customer updates and transactional alerts, often combining email with messaging options like SMS or WhatsApp (37%).

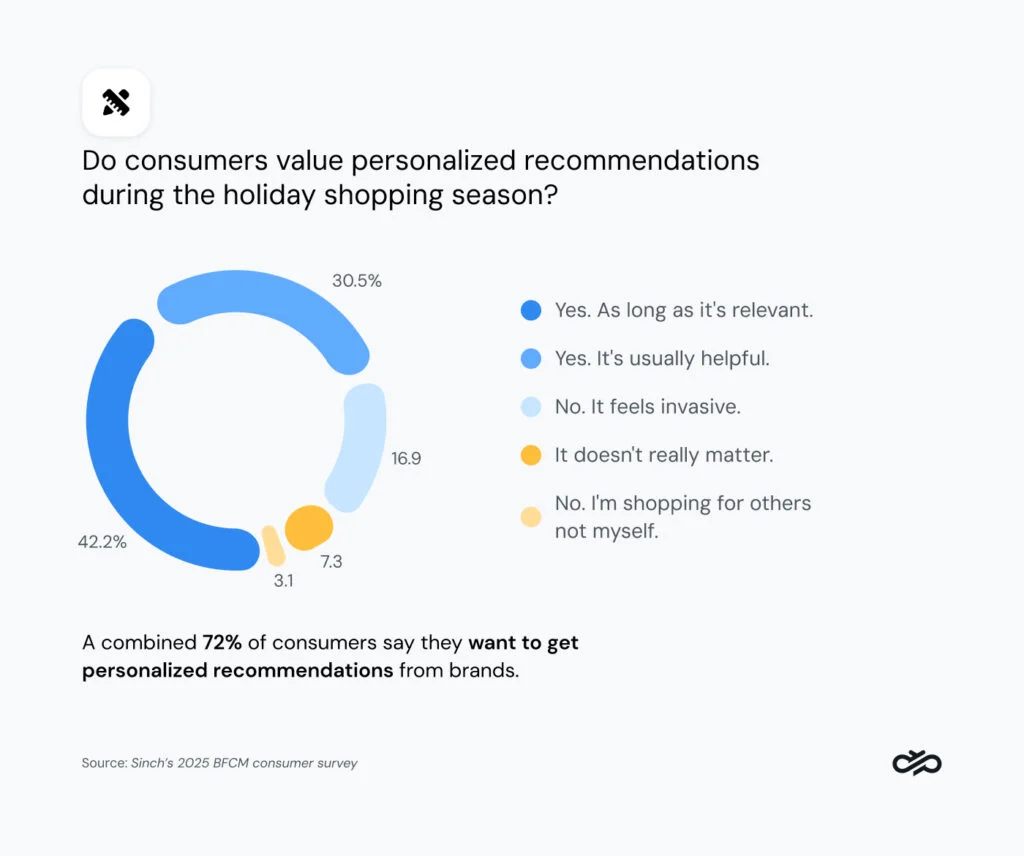

- Personalization is under pressure: 72.7% value personalized offers – but that’s down 7% year over year, with more shoppers calling them intrusive or not valuable.

- RCS remains a big opportunity for retailers: 47% of consumers say they would likely engage with this type of interactive messages, highlighting a growing opportunity for mobile-first engagement.

- AI is (cautiously) earning trust: 47.9% think AI will make holiday shopping easier, and 49.3% trust its recommendations as much (or more) than those from a human.

- Chatbots are here to help: Top use cases for consumers include order tracking (52.9%), product discovery (43.5%), and getting after-hours support (37.9%).

- Privacy still matters most: Over 90% have reservations about using AI during peak shopping. Privacy and data use top the list of concerns, flagged by 43.6%.

Sinch’s 2025 BFCM consumer survey was conducted in July 2025 and features answers from 3,180 respondents across the U.S., Canada, Germany, France, India, the U.K., Spain, Brazil, Mexico, and Australia.

Key Black Friday statistics: A year-over-year comparison

Some things about Black Friday never change: the jaw dropping Black Friday sales stats, the deal-hunting frenzy, the fierce competition among retailers… And in digital customer communications, many tried-and-tested strategies remain essential in 2025.

But not everything is staying the same. Here are some year-over-year changes that stood out in our 2025 BFCM consumer survey:

Momentum is shifting to new markets and younger generations

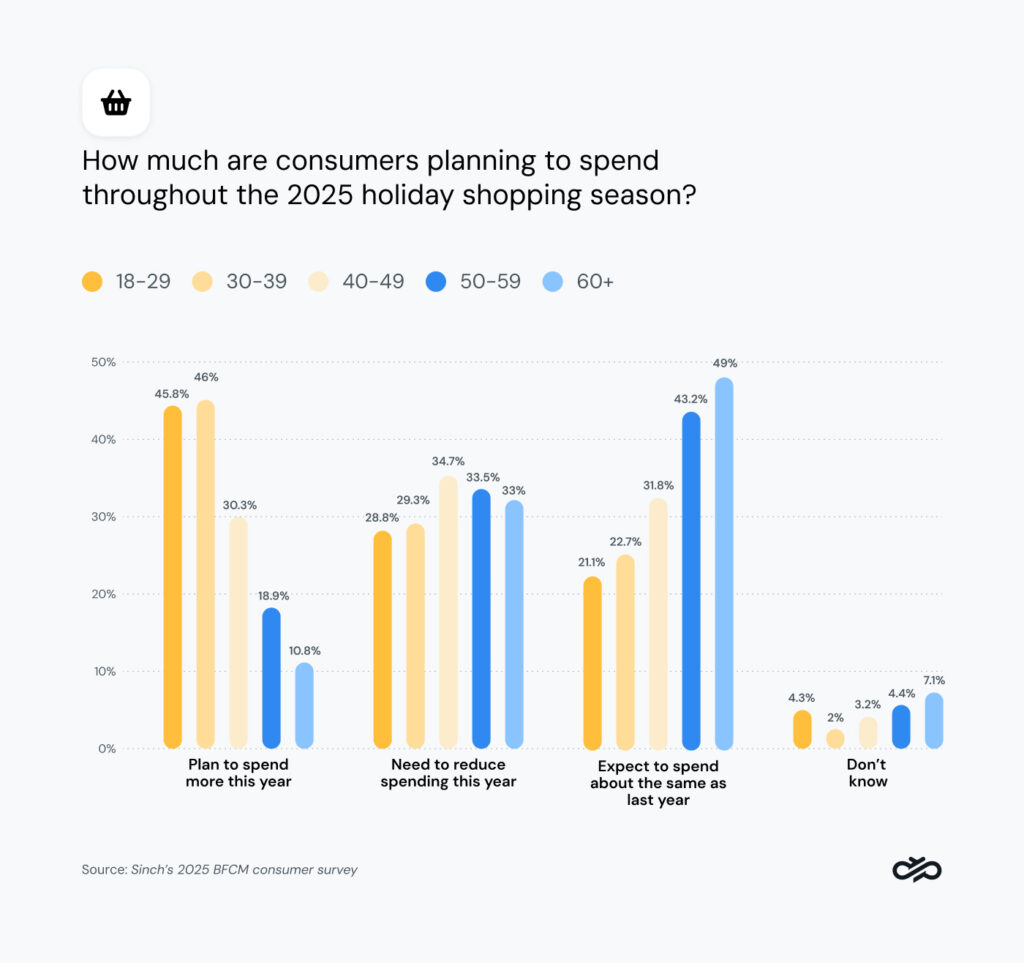

Black Friday’s global footprint is growing. While momentum appears to be slowing in traditional markets like the U.S. and U.K., where 3 in 4 consumers say they plan to spend the same or less in 2025, new markets are ramping up.

India (63.5%) and Brazil (45.4%) lead in consumer intent to spend more than in 2024. In contrast, only 17.9% of Australians and 17.1% of Canadians plan to spend more this year.

of Indian respondents plan to spend more in 2025.

of Brazilian respondents plan to spend more in 2025.

of Mexican respondents plan to spend more in 2025.

of Canadian respondents plan to spend less in 2025.

of Australian respondents plan to spend less in 2025.

of German respondents plan to spend less in 2025.

Across age groups, our survey shows Gen Z and millennials are set to drive holiday spending growth, while older shoppers are more likely to spend the same as in previous years.

Messaging channels are gaining ground

Email is still the top channel for promotional messages, but the gap is narrowing. Email preference dropped by 5.5% year over year, and messaging channels – particularly WhatsApp – made notable gains in 2025.

This shift is partially driven by new survey markets like India and Mexico, but we’re also seeing sustained growth in regions like Brazil and Spain. WhatsApp also grew by 5.1% globally as a preferred channel for order confirmations and customer updates.

It’s no surprise that mobile messaging continues to gain traction during flash sale events like Black Friday and Cyber Monday, especially for promotional messages. When time is limited, the speed and immediacy of SMS and messaging apps help shoppers access deals faster and act before they’re gone.

Channel fatigue is creeping in

Yes, omnichannel still matters – 71.7% of consumers still prefer to receive promotional messages via multiple channels. But that’s down 6.8% year over year.

of respondents said they wanted promotional messages via multiple channels in 2024.

of respondents say they want promotional messages via multiple channels in 2025.

Our takeaway? Consumers aren’t rejecting multichannel outreach – instead, they’re getting more selective and demanding smarter, more intentional use. It’s time to trade “more is more” for opt-in precision: thoughtful, trusted delivery across the channels that matter most to each customer.

Personalization is under the microscope

In the age of AI, consumers are questioning how their data is used and are drawing clearer lines.

While 72.7% still value personalized messages, the number decreased 7.1% year over year. Meanwhile, 16.9% now say personalization feels invasive (up 5.1% compared to 2024) and 7.3% say it no longer makes a difference – nearly double last year’s 3.8%.

What this data highlights is that, to be effective, personalization must be relevant and welcome. With more and more data available to them, retailers must prioritize using it with empathy, transparency, and clarity.

Consumer behavior during the holiday season: How shoppers make purchase decisions

Understanding Black Friday consumer behavior in 2025 means going beyond purchase intent. Today’s shoppers want timely communication, channel choice, and smart tech that adds value – not noise.

The latest Black Friday insights from our 2025 BFCM consumer survey reveal how and when shoppers want to engage, what channels they trust, and how they really feel about AI, so retailers can build effective BFCM marketing campaigns.

Shoppers want and trust AI to support their holiday shopping

Artificial intelligence is set to transform how consumers shop and interact with brands, and it’s shaping up to be one of the biggest Black Friday shopping trends in 2025. That’s why this year’s survey included deeper questions around AI adoption and trust.

Here’s what we found: Consumers are open to using AI-powered tools and chatbots during the peak shopping season, and nearly half of them (47.9%) think AI will make their shopping easier. 49.3% also say they trust AI recommendations just as much (or more) as those from a real person.

The top use cases for AI chatbots remain consistent with last year’s. Order tracking (52.9%), product discovery (43.5%), or getting after-hours support (37.9%) top the list according to our survey.

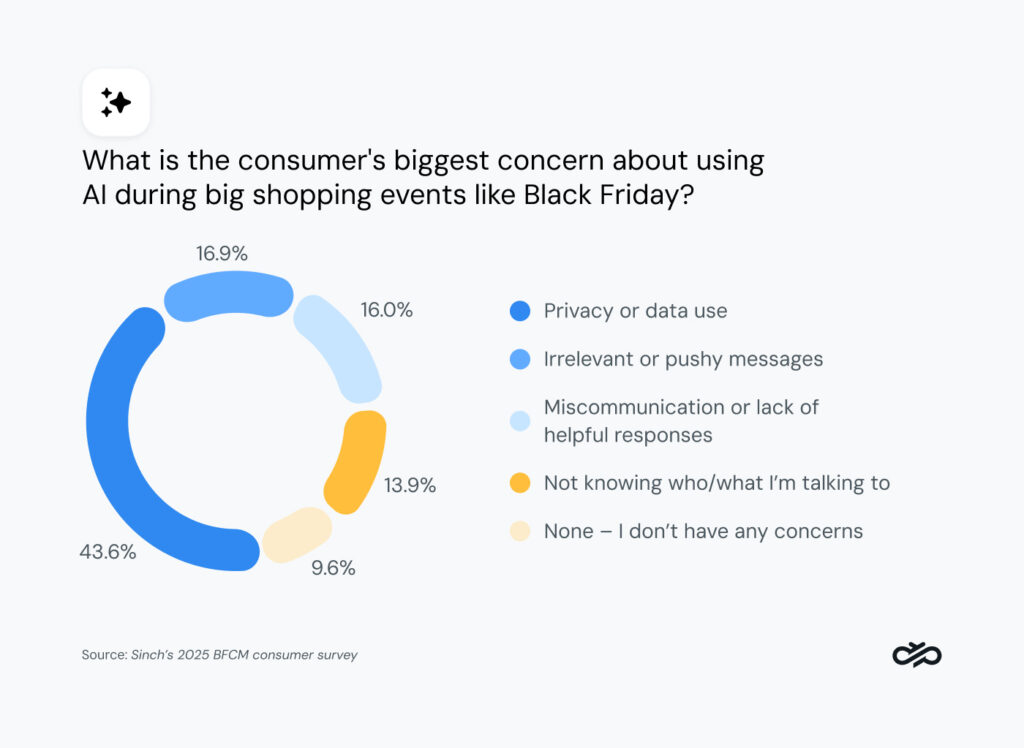

But AI adoption comes with caution. One in ten consumers still has concerns about using AI tools, with nearly half of respondents citing privacy and data usage as their biggest worry.

Consumers don’t want to wait until November

A lot has changed since Black Friday started in Philadelphia in the 1950s, and today’s shoppers aren’t willing to wait around for deals to drop during Cyber Week. They’re ready to shop early and expect to hear from brands well before the official BFCM window.

So, how early is early? According to our survey, 37.3% of consumers want to start hearing from brands as soon as October 28 – a full month ahead of Black Friday. Another 18.6% want to get deals even earlier. Start messaging just a couple of weeks before Black Friday, and you’re already behind.

For retailers, messaging early and often throughout the holiday period has become a baseline expectation. Only 19.4% of respondents said they wanted to wait until Cyber Week for deals, meaning brands that wait risk being left out of consumers’ buying plans altogether.

One channel doesn’t fit all for promotions or customer updates

Despite the slight year-over-year drop, most consumers continue to want – and expect – omnichannel communication during BFCM.

When asked how they prefer to hear from brands about holiday season deals, 56.5% of consumers chose email, followed by websites and social media ads. Messaging remains a popular choice among consumers too: A combined 46.5% of them chose at least one mobile messaging channel.

More importantly, 71.7% said they want to hear from brands across more than one channel. That figure may be slightly down from last year, but the takeaway is clear: Retailers can’t rely on a one-size-fits-all approach if they want to engage shoppers during peak sales periods.

Instead, brands need to focus on omnichannel messaging strategies that give consumers what they want – choice and control over how and where they want to receive promotions and updates.

Channel preferences vary widely by region and generation

Another top reason to embrace omnichannel communications is that not all channels work the same across regions or age groups. In fact, a closer look at the data reveals sharp differences in how people prefer to connect:

- SMS for promotional messages is most popular in India (38.4%), France (33.9%), and the U.S. (26.7%), but far less common in Germany, Brazil, or the U.K.

- WhatsApp adoption is surging for promotions in India, Mexico, Brazil, and Spain. It’s now also the top choice for customer updates in India and Brazil, outpacing even email.

- RCS campaigns are more attractive to younger generations: Over 60% of Gen Zs and millennials say they’d likely engage, but only one in five baby boomers say the same.

- AI adoption and trust declines with age. Older generations are less likely to engage with AI chatbots for processes such as contacting support or receiving product recommendations.

Global brands must tailor channel strategies by region and audience. But instead of rigid segmentation by age or geography, the smarter path is to offer flexibility and let customers choose the channels that work best for them.

Effective customer communication strategies for Black Friday sales

Sinch’s 2025 BFCM consumer survey reveals what today’s shoppers expect: early, relevant, and respectful communication that’s delivered on their terms, through trusted channels, and supported by smart and transparent use of AI.

As consumer behaviors evolve, so must retailers’ strategies. These Black Friday insights provide a blueprint for running more impactful BFCM campaigns this 2025.

1. Reach out early and through the right channels

The days of waiting for Cyber Week are behind us. Shoppers now expect early access to deals and Black November is the new normal.

At Sinch, we’ve seen year-over-year growth in digital communication volumes in the weeks leading up to Black Friday, across both email and mobile messaging. With more crowded inboxes and increased competition, getting your channel mix right is more important than ever before. In 2025, the key to success is sending the right message, at the right time, and on the right channel.

Start campaigns no later than October 28. Use a combination of email and messaging channels to keep the momentum going all month long.

2. Make personalization relevant, not creepy

Yes, consumers still want tailored communications. But they’re becoming more aware – and more cautious – about how brands use their data. 30.5% of consumers say they find personalized recommendations helpful, but 42.2% say they only want it if it’s really relevant.

In 2025, personalization only works if it’s helpful, contextual, and respectful. Shoppers know that AI is making it easier for brands to access their personal information. Now, they expect retailers to use this information to provide real value, not just slap their first names on an email subject line.

Prioritize personalization when it adds clear value. Avoid over-targeting or assumptions that might feel like surveillance and, instead, think about the full experience: what you’re personalizing, when you deliver it, and where it appears.

3. Rely on advanced conversational messaging to keep shoppers engaged

Messaging apps like WhatsApp and interactive formats like RCS are now essential engagement tools during peak sales periods like Black Friday, especially among younger generations. Why? Because they enable rich, branded, two-way conversations that convert.

Sinch’s The state of customer communications revealed that 96% of retail leaders said they’re already using conversational commerce in some form. But interestingly, RCS adoption in retail was the lowest across all industries surveyed.

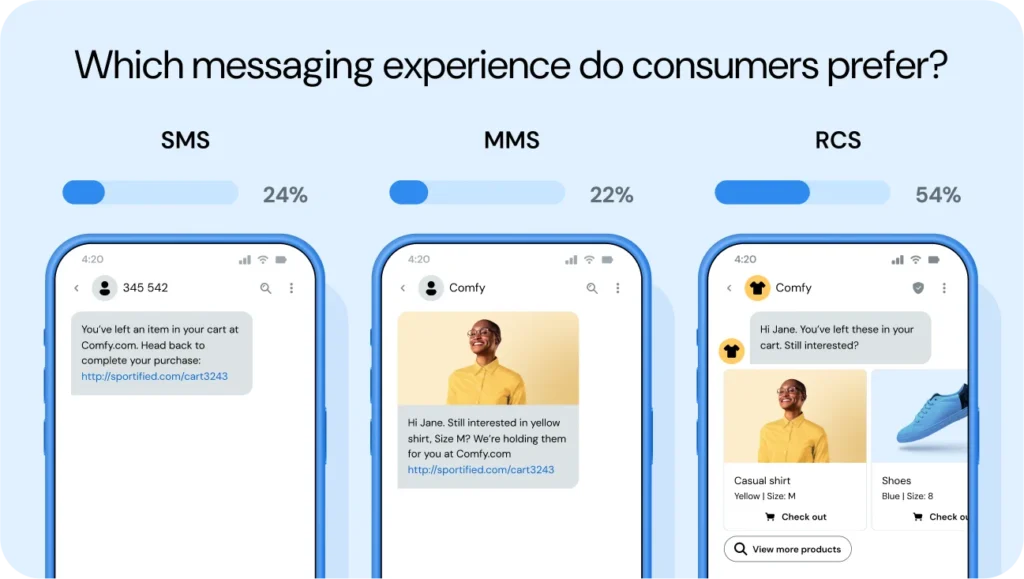

When we asked consumers, only 15.9% said they prefer basic SMS over interactive holiday promotions. And when we asked shoppers to pick between SMS, MMS, and RCS abandoned cart messages, 54% of respondents chose the RCS message as the most engaging.

When we asked consumers in our 2025 BFCM consumer survey, only 15.9% said they prefer basic SMS over interactive holiday promotions. And when we asked shoppers to pick between SMS, MMS, and RCS abandoned cart messages in The state of customer communications, 54% of respondents chose the RCS message as the most engaging.

That leaves a wide-open opportunity for brands to lean into WhatsApp and RCS to stand out and connect more meaningfully during the BFCM season.

Use AI-powered chatbots on conversational channels like WhatsApp or RCS to increase engagement, improve customer service, and scale operations. See how Orion Mall and Picard drove success during peak season doing just that.

4. Provide a strong post-purchase experience

Holiday shopping doesn’t end at checkout, and your communication strategy shouldn’t either. Post-purchase touchpoints are critical to customer satisfaction, especially during high-pressure retail moments like BFCM.

According to our survey, 93% of shoppers consider confirmation and shipping updates essential during the holiday season, and 75.8% expect to receive them within five minutes of purchase.

That means retailers must prioritize speed, deliverability, and reliability across channels like email and SMS, or risk serious reputational damages and service breakdowns.

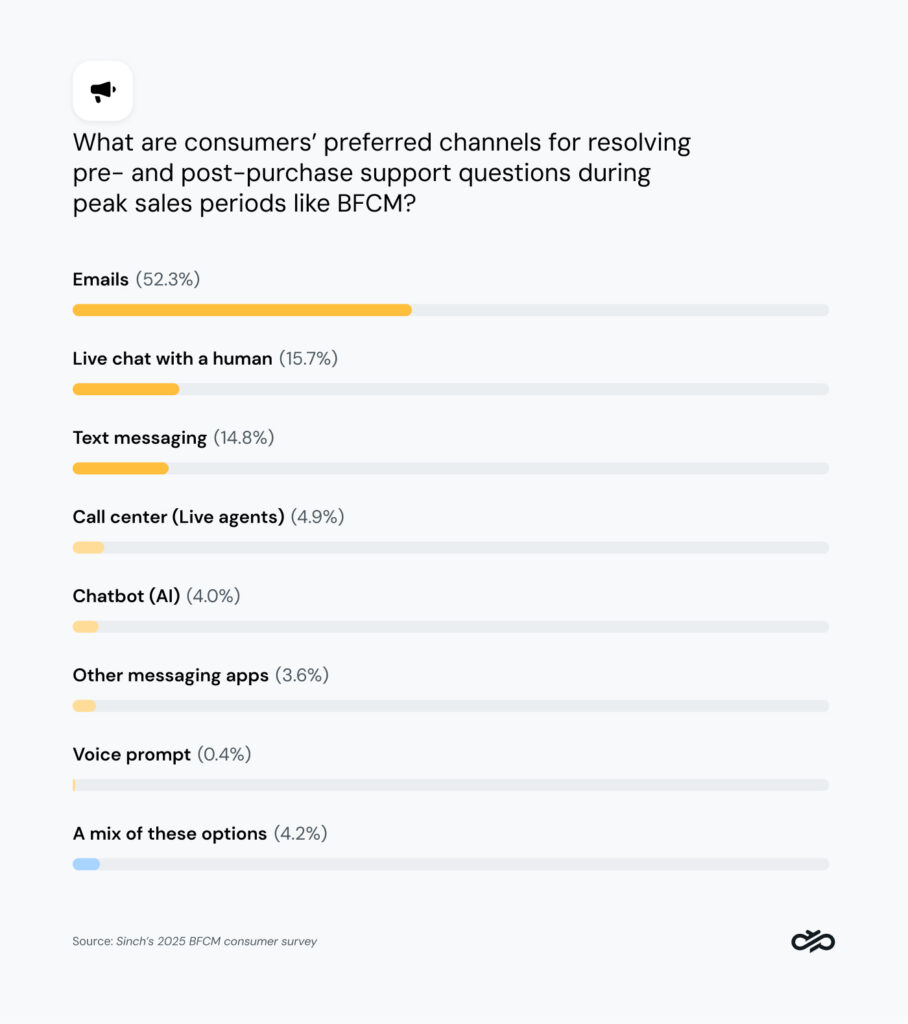

Proving efficient customer service across the right channels is also critical. Email is the top choice for over half of consumers, followed by live chats with a support agent and text messaging, both close to 15%.

While chatbots might only be the top choice for 4% of consumers, in a separate question, all consumers surveyed stated they were open to using them for different retail use cases. For example, 52.9% of shoppers said they’re open to using chatbots for order tracking, and 37.9% would use them for after-hours support.

Combining AI-powered bots with traditional channels like email, messaging apps, and live chat can help teams manage the usual high volumes during BFCM.

Ensure support conversations flow smoothly across channels to reduce friction and deliver a strong post-purchase experience.

5. Build AI trust through transparency

AI has the power to enhance the shopping experience, but only when it’s used responsibly.

While most consumers are open (and even excited) about using artificial intelligence to help with their holiday shopping, just 9.3% say they have zero hesitations. When we asked them to identify their top concern, the biggest sticking point was privacy and the way their data is used, flagged by 43.6% of respondents.

This doesn’t mean retailers should avoid using AI. It means they need to use it with care and communicate clearly. Transparency around how AI is applied, and when human support is available, goes a long way in building trust.

Be clear about how AI is used. Build trust by providing transparency around how data is handled and understand customer sentiment to know when it’s time to offer a way to speak to a real human.

Looking ahead: What to expect from the 2025 holiday season

Every year, Black Friday becomes a longer, more demanding retail season, and consumer expectations continue to rise. In 2025, shoppers want early access, richer engagement, and timely and reliable customer updates.

To meet these demands, brands need messaging strategies that are fast, flexible, and built for how people actually shop, powered by timely communications that are helpful and consistently on point.

That’s where finding the right partner is key. At Sinch, we’re experts at driving customer communications at scale, across email, SMS, voice, RCS, WhatsApp, AI chatbots, and more. With direct operator connections in more than 60 countries and coverage that spans over 200 territories, we combine global reach with local market expertise and ensure reliable message and call delivery at scale. Last year, we processed over 800 million SMS during Black Friday, helping leading brands stay connected when it matters most.

Explore our product portfolio to see how we can support your complex sending needs or reach out to chat with us if you need help with your BFCM strategy. The Sinch team is ready to help you make this holiday season a success.