Insights, Products

5 ways messaging is changing banking customer experience

An updated version of this post is available here: 5 digital banking trends you should know for 2023.

In late 2019, Sinch surveyed 2,300 global consumers to understand their attitudes about messaging, and how they prefer to interact with businesses using messaging.

One of the most powerful findings relates to banking-in particular, consumers are open to getting messages and notifications from banks, but they either don’t have access to these features or aren’t aware of them. The lesson: In no other industry is there more pent-up demand for messaging functionality than in financial services. Now it’s up to industry leaders to capitalize on this gap.

Let’s review the key findings from the research:

1. Consumers are 35x more likely to open mobile messages than emails

Mobile messages, even those quickly scanned from a home screen, are more likely to hit the mark than emails, which can be filtered into “promotional” folders or even relegated to spam.

2. Consumers find value in being able to message their bank

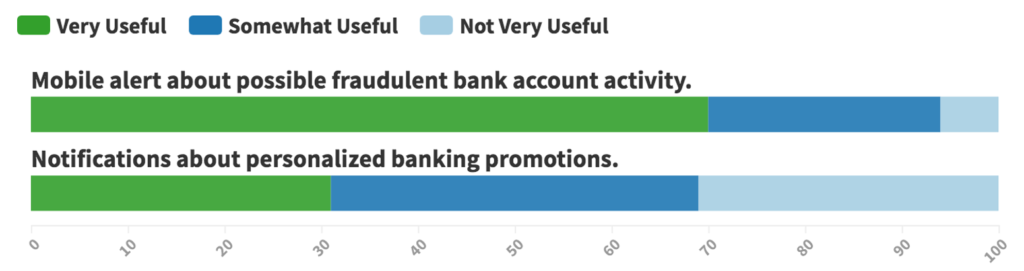

Nearly 3 in 4 (70%) say they would find mobile alerts about suspicious banking activity “very useful,” and 94% say these types of alerts would be at least somewhat useful. Attitudes about personalized banking promotions delivered via messaging were a little less enthusiastic but still positive.

Measuring messaging utility

Which of these scenarios would you find useful?

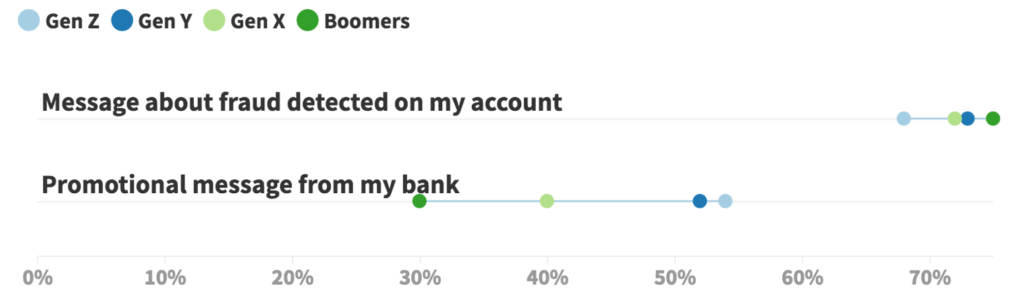

3. Younger consumers are more open to promotional messaging

According to Sinch research, nearly all banking customers welcome messaging when it comes to potential banking fraud, but attitudes about promotional messages differ widely by generation. Baby boomers are least likely to welcome these types of interactions (just 30% say they welcome it), while more than half of millennials and Gen Z say the same.

Messaging attitudes by generation for the banking industry

Which of these scenarios do you welcome?

(Showing only ‘welcome’ responses below)

4. Consumers want more messaging options

The research shows a clear “opportunity gap” between how consumers use messaging today, versus how they would like to use it. In the banking industry, 70% want banks to message them about suspicious activity in their accounts, yet only 35% receive this today.

Recent research from Facebook shows younger people’s enthusiasm for messaging will put further pressure on the banking industry. It found 90% of checking account consumers ages 18-34 say that they’re comfortable interacting with a bank on a messaging app.

5. Consumers like chatbots as an efficient alternative

2 out of 3 who have used a chatbot report a positive experience, citing speed and efficiency as the reason why. Most say chatbots served them as well or better than a human agent.

What does this mean for the banking industry? Consumers are ready for more … if financial institutions would offer it. Among the big opportunities in banking:

Make it channel agnostic

Some of your customers will feel comfortable with in-app messaging, while others will prefer speaking to a real person on the phone. The key is ensuring you have the right channel for each of your customers-whether it’s SMS, MMS, RCS, chat apps, social apps, email or voice. All of these play a critical part in digital customer experience.

Real-time, security-focused interactions

Let your customers easily set low-balance and unusual activity notification triggers. Remember, 90% of consumers aged 18-34 say they are comfortable interacting with a bank using a messaging app.

Support secure conversations

Give customers options to chat with representatives through the banking app or using a verified phone number over messaging apps–always with an eye toward security. These messaging-based interactions are an important option for customers, who nearly always have their phone on them for a messaging exchange, but may not be in a spot to conduct a voice call or login via computer.

Automating customer service

Not all customer questions require a human touch. For more routine interactions (e.g. how late is my local branch open?), banks can deploy messaging chatbots or rich media messaging response chips (these are pre-programmed scripts and interactive features delivered automatically through messaging). And for customers that need even more support than automated conversations can provide, the app can quickly re-route the customer from messaging to a live call.

Personalized solutions

A young consumer may be looking for a used car loan, while an older customer may want on-demand retirement advice. Messaging can be an important part of the conversation, giving banks the chance to engage in conversations triggered by a customer’s recent financial milestone. For example, “I noticed you recently set up a direct deposit to your savings account. Would you like to discuss money market options to get a higher return on those funds?” Using rich media or RCS, banks can also deliver rich features such as assessments to recommend specific mortgage products.

Push-based financial news

For customers that want to stay abreast of leading financial indicators or news, design push-based campaigns customized to the individual–whether breaking news about specific stock holdings in your customer’s portfolio, or releases of economic indicators that affect those nearing retirement.

Ultimately, no matter the ecosystem of channels and features, the key is ensuring customers trust their financial institution to keep their money and their data secure. Personalization of messaging and features is part of the trust equation, says Facebook. It found 2 out of 3 millennials and Gen Z say that “feeling understood” by their financial provider is an important signifier of trust.

Want to find out even more about consumers attitudes about messaging, data privacy and mobile apps? Read the Mobile Consumer Engagement 2020 report here.