Insights

5 digital banking trends changing customer communications in 2025

Insights

The only thing growing faster than technology is consumers’ expectations of how it serves them. Nowhere is this more apparent than in the financial services industry, where secure, timely, and personalized communication is as important as the services themselves.

Banks deserve a lot of credit for their consistent embrace of modern communications technology, and for using it to better serve their customers. But as FinTech continues to evolve, so do customer expectations of their digital banking experiences.

Are banks actually doing what customers want when it comes to communication? To find the answer, we first need to fully understand what the latest customer expectations really are. Our 2025 State of customer communications research, built on insights from over 400 financial service businesses in the U.S. and 2,800 global consumers, uncovers where banks are getting it right, where they’re falling short, and what it’ll take to earn trust and stay relevant in the years ahead.

Let’s start with what our data revealed about the five trends every financial services leader needs to understand.

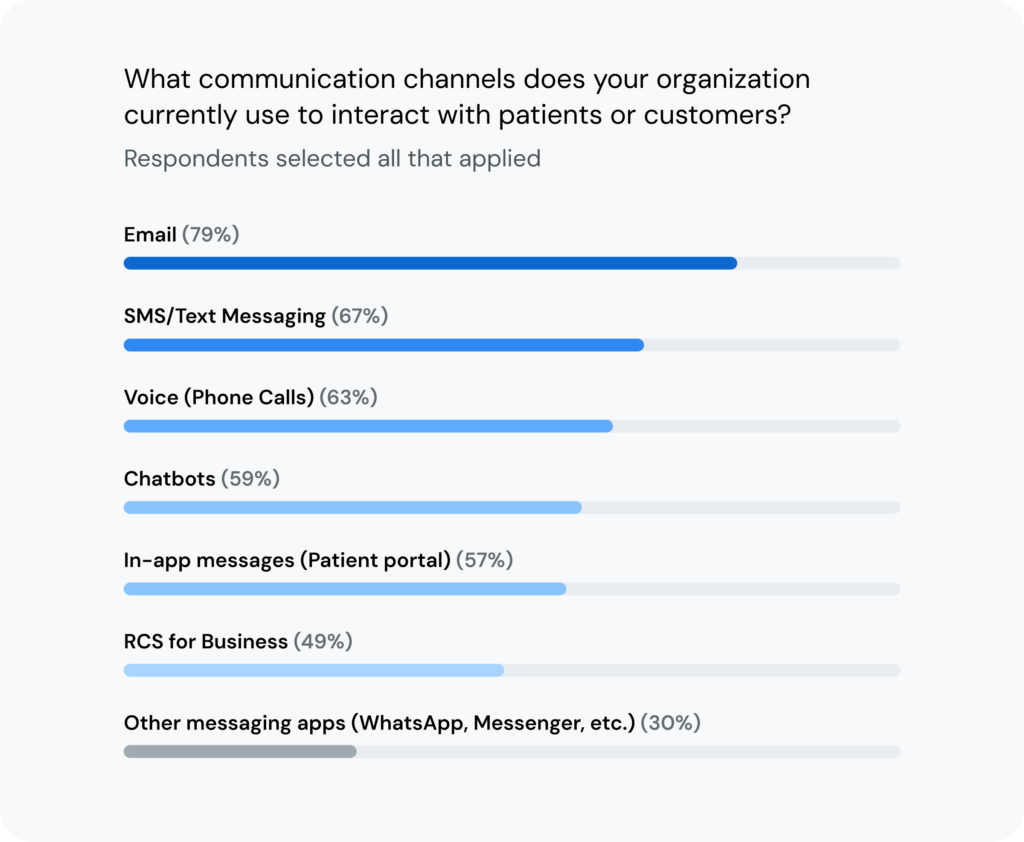

Email, used by 79% of financial services companies we surveyed, remains the go-to communication channel for updates and promotions. It’s reliable, expected, and effective for many use cases. But it’s no longer the only channel for banks to care about.

In our survey, 67% of financial services organizations said they use SMS, and 49% indicated they use RCS messaging. These channels offer speed and are super personal – traits customers are increasingly asking for when it comes to time-sensitive alerts, verifications, and two-way interactions.

Additionally, 36% of businesses use multiple channels to deliver informational messages. Consumers like this approach, too, because it’s easier to miss a message if it only comes on one channel. If it’s important, they want to be sure and see it.

In fact, 58% of consumers we surveyed said they want to be asked for their preferred communication channel. That means the majority of your customers prefer to be given a choice.

If your financial company is still siloing customers into a single communication channel, you probably are hearing complaints if you’re not already seeing churn. Email, SMS, RCS, WhatsApp, and more channels all play roles. A promotion or update might best land in an email inbox, but fraud alerts, OTPs, or urgent messages need SMS-level immediacy or branding when sent via RCS.

And don’t forget timing. Three out of four consumers expect transactional messages to arrive within five minutes of a purchase or activity. Miss that window, and their trust in your institution will erode.

Cybersecurity challenges aren’t getting any easier. Banks and their customers are both concerned about the increasing number of people dealing with bank account hacks. SMS spoofing is becoming a bigger problem as well. It’s not surprising, then, that our survey found that 55% of financial services respondents say security and privacy are their top communication challenges.

And consumers are right there with them, with 53% of the consumers we surveyed saying they’ve received a legitimate message from a brand they first found to be suspicious. For banks, that could mean that consumers could ignore legitimate bank messages if they’re worried they’re scams. That’s a big trust gap to close.

of financial services businesses say security and privacy are their top challenges

of consumers have received a suspicious, but legitimate, message from a brand

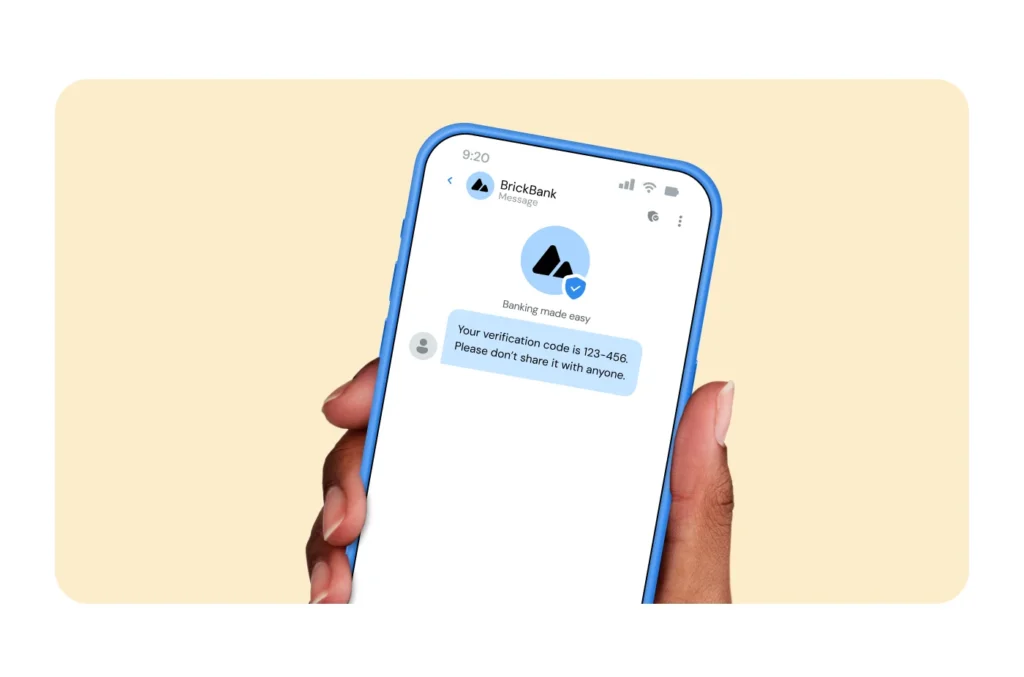

So how can companies respond? By implementing tools that can offer both scalability and built-in safeguards for message authenticity. And RCS messaging stands out as one of the most powerful advancements you can adopt for your digital transformation initiatives.

That’s because a business must be verified in order to use RCS, and messages include visible trust cues like logos and a verified checkmark. This means these messages are much more difficult to impersonate.

Here’s an example of an OTP message sent as RCS.

Of the businesses we surveyed, 54% said that they see RCS as a security upgrade. And when you’re sending sensitive content like OTPs or account alerts, trust signals can make all the difference.

Financial services companies aren’t wasting any time when it comes to AI – 98% already have plans to use it in their customer communications. But with that comes hesitation: 41% worry about maintaining privacy as they start rolling it out, and 37% worry about trust.

of financial institutions worry about maintaining privacy with AI

of financial institutions worry about customer trust in AI-generated responses

The fix? Transparency. Be transparent about when you’re using AI in your communications, and when you aren’t. Don’t let AI pretend to be human – and yes, this applies to voice bots. Be upfront when a customer is talking to AI, and when they’re not. Make it clear when a hand-off has taken place. Trust is a lot easier to lose than it is to earn!

And while only 5% of global consumers said they prefer AI for customer support, 42% say they would be comfortable working with an AI-based system that has been properly trained. Our advice: Design AI experiences that are both useful and honest.

Nearly half (49%) of consumers we surveyed said they expect personalized communications, but a third of financial institutions still struggle to pull it off. And no, just dropping in a first name doesn’t really count anymore. Personalization is so much more than that.

of consumers expect personalized financial communications

of FinServ organizations struggle to deliver personalized communications

Real personalization means context. For example, do you know which customers recently bought a house? A few years from now, those customers might be great candidates for refinancing. How about customers who recently paid off their car loans? You can create personalized offers and other educational content for both scenarios, and numerous others in each customer’s financial journey.

Personalization also means honoring channel preferences. If someone says that they want messages via SMS and WhatsApp, and you actually follow through? That’s a personalized service.

And in cases where speed matters, like time-sensitive fraud notifications, RCS can help you take things even further. It combines branded profiles, so your recipients know the message is coming directly from you, with the possibility to add rich content and interactive features so that customers can act instantly.

This could be part of the reason why 55% of financial services leaders see RCS as a game changer for business messaging. And while improved security came out as the most popular reason respondents thought RCS could make an impact on their industry, 40% of FinServ respondents selected that better personalized experiences increasing trust would make an impact.

“There’s no denying that RCS is becoming the go-to channel for digital banking services who want to offer both security and personalization. When a customer gets a fraud alert that’s branded and more secure, that will lead to a better experience with their bank.”

What makes personalization so challenging? One of the biggest obstacles is haphazard software integration. Despite years of digital investment, many banks are still wrestling with fragmented tech stacks and legacy systems that weren’t built to talk to one another.

Our survey found that 51% of financial institutions say their customer communications are fully integrated into their tech stacks, and 52% of respondents said that their communication channels themselves are fully integrated together. That suggests that one in two financial institutions don’t have fully integrated systems, which can be frustrating when a customer gets involved.

And customers notice. Just ask the 80% of consumers we surveyed who said that they have a highly negative reaction when required to repeat all their information during customer support calls. Once they’ve had a taste of truly integrated service, there’s no going back.

Banks need infrastructure and integration that can keep up with what customers expect: flexibility, security, and better connections. Because if your systems aren’t speaking the same language, your customers won’t be either.

If there’s one thing that’s clear from our research, it’s this: Financial institutions aren’t standing still. A full 98% of financial services respondents indicate that they plan to invest in or improve their customer communication channels over the coming year.

So which digital channels is the money going to?

That last one is no surprise. Financial firms are leading the charge on RCS adoption, even ahead of tech companies. Why? Encryption, branded sender information, and personalization abilities could be a few reasons.

When it comes to AI in banking, the biggest priorities are automating responses, analyzing customer data, and using those insights to offer financial advice and predictive communication.

This is the convergence we’ve been building towards: Security, personalization, and intelligence all working together.

Miriam Liszewski, RCS Commercial Product Manager at Sinch, presents the better and more secure banking experience when receiving an RCS message compared to SMS.

If there’s one thing our latest Sinch survey has made clear, it’s this: Banking customers want fast, secure, and personalized communication – on their terms, through their favorite channels. That goes for traditional institutions and digital banks alike.

At the same time, financial institutions are concerned about security, and are grappling with a complex mix of legacy systems and high customer expectations. They’re turning to AI, automation, and innovative messaging technologies to bridge the gap as integration and personalization remain hurdles.

The upside is that these are exactly the challenges worth solving, because they shape the entire customer experience from onboarding, to fraud alerts, and everyday transactions. And they’re central to building the kind of trust that drives long-term loyalty.

The most successful financial services companies of the next decade will be those that deliver value, peace of mind, and relevance at every step of the customer journey. The future of banking is about using all of your customers’ favorite channels – from SMS, WhatsApp, email, RCS, voice, and more in a scalable, secure way. That’s omnichannel banking done the right way.

Want the full picture? Check out the full State of customer communications report to see where your peers are heading, and how to stay ahead.