Insights

6 signs your user authentication is failing you

Insights

Passwords. PINs. Fingerprints. Face ID. One-time codes or passwords.

However you do it, user verification is a standard part of the sign-in or sign-up process, helping you reduce fraud, protect your platform, and assure customers that you take security seriously. Even though verification can sometimes feel like a hassle, Sinch’s latest research found consumers say these extra steps either make them feel safer (49%) or are a necessary inconvenience (27%).

While almost every business is on board with user authentication in some form, forward-thinking companies are reassessing their verification strategies to stay ahead of evolving threats and changing customer expectations. If your process isn’t optimized for security, user experience, and cost-efficiency, you could end up with frustrated customers and spiraling costs. Worse, it could compromise security and leave your business open to fraud.

Not sure whether your process is working? Here are six signs that it’s time for a verification update.

Are your verification costs creeping up? You’re not the only one. Verification costs can mount quickly for several reasons: inefficient processes, working with multiple third-party providers, and hidden fees for failed verifications.

The key to reducing costs is optimizing your verification process. Switching to a provider that offers direct carrier connections eliminates the middleman, which can reduce fees and improve reliability at the same time. It can also be useful to take a closer look at your authentication methods. For example, if SMS is expensive or unreliable in your region, tools like WhatsApp OTP or Flash Call could be more cost-effective.

Are you noticing higher verification costs without a corresponding rise in sign-ups? This could be the result of Artificial Inflation Traffic (AIT). AIT increases verification costs by generating fake requests, clogging up your system and making it difficult to distinguish real users from fraudsters. Without proactive monitoring, these requests can significantly increase your verification costs and – worse – increase security risk for your business.

Advanced fraud detection tools and providers with direct carrier connections can help minimize AIT. With fraud-fighting tactics like real-time monitoring and analytics to detect suspicious requests, you can reduce the volume of fraudulent traffic and keep your verification budget down. More importantly, you’re mitigating the risk of fraud and maintaining trust in your platform.

“It can take just one bad actor to disrupt parts of the mobile ecosystem and generate fake SMS OTP traffic. And the longer the chain of trust, the more opportunities there are for bad actors to take advantage of this system. Ultimately, this is an issue for the whole industry.”

Want to know more about fraud, waste, and AIT? Read the insights on combating AIT in our 2024 report.

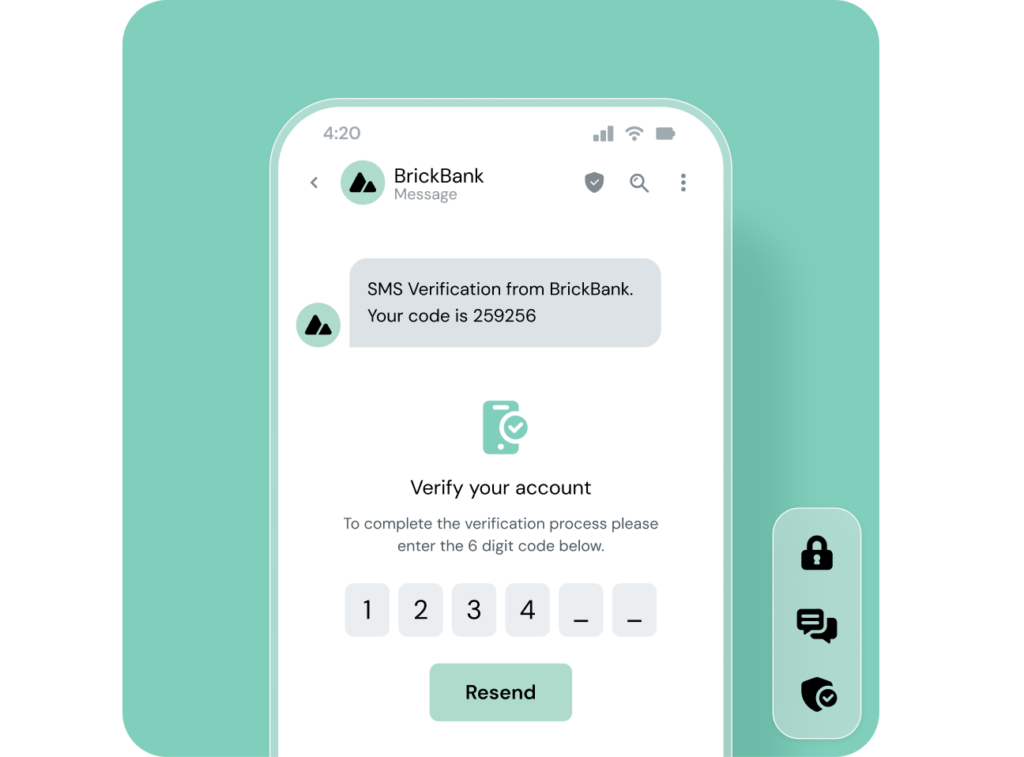

Few things are more frustrating than failed verifications. A customer types in all their details, clicks to confirm, then a missing SMS OTP (one-time password) means they can’t complete their sign-in or make a purchase. It’s a recipe for frustrated customers, abandoned sign-ups, and lost sales.

Thanks to increasingly sophisticated verification and sales platforms, customers expect a smooth, stress-free user experience – any fuss or friction in the process could make them switch to a competitor.

Preventing verification failures requires fast, secure authentication methods and built-in backup systems. For example, you could use an optimized delivery route to send SMS codes, with an alternate method for users in areas with poor connectivity. The goal is a reliable process that works for everyone and minimizes log-in failures.

Want to know more? See how seamless verification can boost conversion rates and keep users engaged from the start.

Saving money on verification should never come at the cost of quality. Some businesses switch providers in an attempt to lower verification costs, only to face failed verifications, increased customer queries, or higher fraud risks. Dealing with these outcomes can eat into any cost savings and erode trust in your business. These unexpected costs can outstrip the savings involved, undermining the reason for the initial change.

A strategic approach balances affordability with performance. It’s important to weigh the direct costs of your verification system against success rates and customer experience – not to mention security and fraud risk. Look for a well-regarded provider that offers realistic, long-term savings instead of rock-bottom prices.

You’ve seen the signs, spotted the red flags: Your old API just isn’t as efficient as it used to be. For a while now, your instinct has been telling you it’s time for a change. But you keep pushing the thought away.

Switching verification providers can feel daunting – you don’t want to deal with integration challenges, migration issues, and potential disruptions to service. That’s probably why so many businesses continue to use their older verification API, even when it’s inefficient or out-of-date.

However, if your system is starting to crack, it’s time to take the plunge and find a newer provider. It could be much less stressful than you think. Modern verification APIs are designed for seamless integration, which means minimal migration headaches and a smooth implementation. And when your new system is up and running, improved performance, reliability, and cost savings should make it worth the effort.

“Since we launched Sinch Verification in our app, our conversion rate went up by about 7% compared to our previous supplier. This is a huge increase for us; the numbers are much more stable now than previously, and the errors and support cases have essentially stopped altogether.”

SMS OTPs are a handy verification method – but only if you can trust messages to reach customers almost every time. Choose a carrier based on cost alone, and you could end up facing low delivery rates, missing passcodes, and exposure to AIT, which can affect customer experience and operational efficiency. Again, it’s a case where initial savings lead to higher indirect costs down the road.

If you’re choosing an SMS provider, it’s crucial to consider reliability, security, and scalability as well as price. Partner with a provider that offers direct carrier connections and high delivery rates, along with modern fraud prevention tools and redundancy options. If an SMS code does fail to land, your system should failover to another method automatically, with minimal impact on the customer experience.

As always, it’s about creating an effective, future-focused verification system that works for you and your customers.

Seeing signs of strain in your verification process? As the verification landscape evolves, customer expectations rise, and fraudsters find new ways around security systems, businesses that optimize their systems now will be better-prepared for the future. With that in mind, smart user authentication as much a strategic advantage as it is a day-to-day operational tool.

Whether your business is a global powerhouse, a big-name brand, or an emerging SMB, Sinch can help you enhance platform security with scalable multi-factor authentication solutions built with the user in mind. Learn how you can keep customers safe and costs under control with Sinch’s Verification API. Or, if you want to discuss what makes Sinch the best choice for your business – let’s chat.