Insights, Products

4 reasons to build an ecosystem for customer experience

Insights, Products

Customer experience is at the core of mobile consumer engagement, but where should companies focus their efforts in 2020?

New research from Sinch shows the mandate for 2020 is diversification. Five years ago companies could comfortably focus on the CX trifecta: social media, branded apps and mobile-optimized websites. In 2020, the CX ecosystem is much bigger and more complex. There is no longer a shortlist of key channels global companies should focus on. Enterprise organizations must develop customer ecosystems to support omnichannel experiences. With well-diversified ecosystems, your customers choose their own path, leading to higher engagement, satisfaction and retention.

Let’s run down the reasons why 2020 is the year of growing your customer experience ecosystem. Each of your customers is unique; let them choose their own cross-channel experience

The concept of personalization has been around for the last decade, but for many, personalization still means creating experiences by target market or by persona (which is a nicer way of saying a company sorts their customers into limited ‘buckets’).

In 2020, personalization means having an ecosystem of integrated channels such that a single individual chooses how they want to interact with your brand, and can have a seamless customer experience, regardless of channel. A consumer may get cooking inspiration from a company’s Instagram content, buy a needed cooking tool on that company’s website, and finally, get answers to questions about the purchase using a chatbot inside the company’s branded app. In each channel, the company serves content and solutions based on individual preferences, purchase history and demographics. Also, companies can aggregate insights from all channels for cross-channel marketing, serving up recommendations and ads based on browsing and purchase histories.

Most compelling of all: the more channels a customer uses, the more loyal and profitable that customer becomes to the business. Retail research from the Harvard Business Review shows omnichannel customers spend roughly 4% more on every shopping occasion in store and 10% more online than single-channel customers.1 And omnichannel shoppers are more loyal. Within 6 months of an omnichannel shopping experience, says HBR, omnichannel customers logged 23% more repeat trips to the retailers’ stores. They were also more likely to recommend that brand to friends and family compared to those who use only a single channel to interact with a retail brand.

Messaging usage by global regions: What types of messaging are consumers across the globe using?

The way people use their phones varies significantly based on home country. These differences are not solely based on preferences, but also on what is available in each country and how mature the mobile transactions market is in each region. Below see a few scenarios of how consumers use their phones to transact everyday messaging-based activities with companies. In Asia these scenarios are widely used; and in Australia a large share of consumers already use their phones to set up bill payments, get electronic tickets and chat with rideshare drivers.

Companies rolling out new mobile features or transaction types must be wary of whether the offering matches how consumers use their phones in that country. It may be easy to imagine chatting your ridesharing driver via in-app messaging, but consumers may be much more reluctant to engage a healthcare provider or banking representative in the same way.

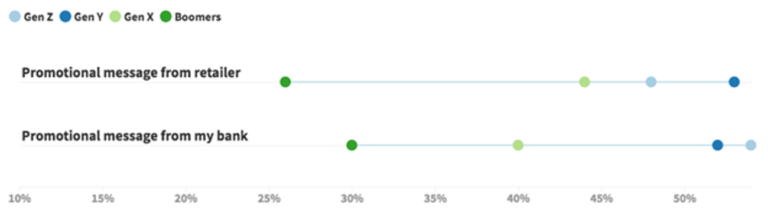

Willingness to receive promotions via messaging: Younger people are much more likely to welcome personalized, promotional messages compared to older consumers

When most people refer to ‘digital natives’ they’re talking about the ways young people are more facile using technology. But the Sinch research also shows that ‘natives’ are much more open to interacting with businesses on their phones than older generations are. This is most visible in the degree to which younger consumers welcome and find value in promotional messages. Roughly 1 in 2 from Generation Y and Generation Z welcome promotional mobile messages from their banks and from retailers they’ve done business with; for Boomers, fewer than 1 in 3 welcome these scenarios.

Remember that companies weighing up whether to use messaging to send promotional messages are not only considering whether they will reach their customers, they must also ensure they do not alienate them. Clearly the risk is far greater to alienate an older customer with promotional mobile messages.

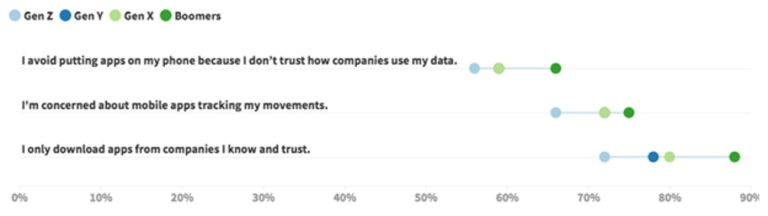

The research also shows Boomers are simply more wary about how businesses access and use their data than younger people are, particularly when it comes to downloading apps. (See below).

Data concerns by generation: Boomers are more concerned about their privacy and how companies are using data

A company with wide-ranging customer demographics must offer options that span both younger and older preferences about everything from learning about a new product, getting inspiration and purchasing, to seeking customer support.

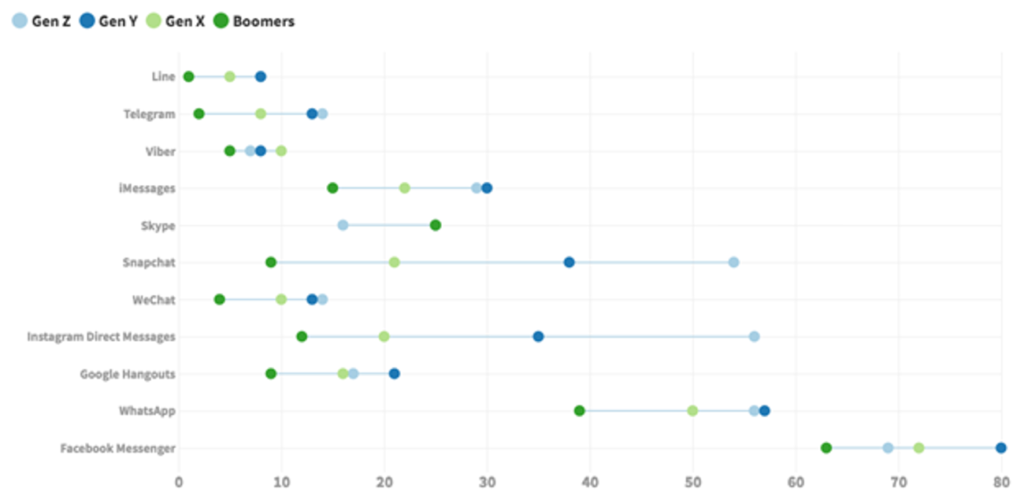

Clearly WhatsApp and Messenger lead the global messaging market, but the habits and preferences of the world’s youngest consumers–Generation Y and Generation Z–show us the messaging landscape is in a state of transition. By all measures, Facebook Messenger dominates across all generations, but it’s much less popular among younger generations than their older cohorts. And Generation Z uses Snapchat and Instagram Direct roughly at the same rate they use WhatsApp, and only slightly less than they use Facebook Messenger. (See graph below.)

Channel usage by generation: Channels like SnapChat and Instagram Direct are significantly more popular among younger generations

And it’s not just about having a presence on a variety of channels your customers use. Marketers must think about the ways consumers use each channel (and how advertisers incentivize different behaviors). The types of mobile experiences and interactions companies offer on Messenger will differ substantially from those on Snapchat, for example (to say nothing of local preferences on each channel).

Again, the mantra for 2020 is diversifying how customers can engage with your company, answer questions, purchase, and stay in touch.

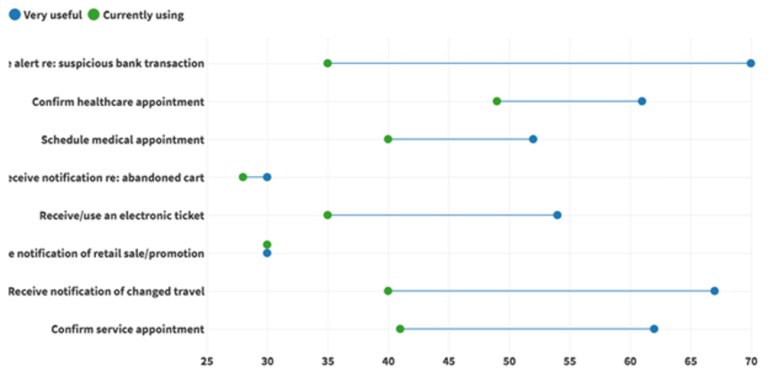

The Sinch research explored to what extent (a) consumers currently use various messaging types and (b) whether they would find those types useful, regardless of whether or not they use them.

The results show that enthusiasm for different types of consumer-to-business mobile interactions is much higher than current usage rates. In other words, consumers want to be able to do these things but businesses have not made them available (or consumers don’t know they exist). These are missed market opportunities for mobile-focused global companies!

For example, 52% say they would find it ‘very useful’ to confirm healthcare appointments via mobile but only 40% do so today. And 54% say it would be ‘very useful’ to receive e-tickets through messaging, but just 35% do this today. (Find many more examples below.) This pent up demand should be a rallying cry for businesses to diversify how consumers can interact via messaging.

Opportunity gap: Which types of messaging do consumers currently use; which do they find useful

Want to find out more about how consumers like their messaging served, or how business can better meet their needs? Get all the insights in the full report here.