Insights, Products

Banking industry poised for digital transformation in the COVID era

New research from Sinch shows a dramatic shift in consumer behavior — away from public spaces and physical meetings, and in favor of digital interactions. How will banks deliver on best-in-class customer experience in this transformed world?

The Sinch study, which surveyed 2,890 consumers across 14 countries, documents dramatic shifts in customer behavior or and pinpoints the features and solutions customers want most from their banking relationships. In short: The research shows banks aren’t yet meeting the needs of their digitally empowered customers.

Delivering customer experience from a distance

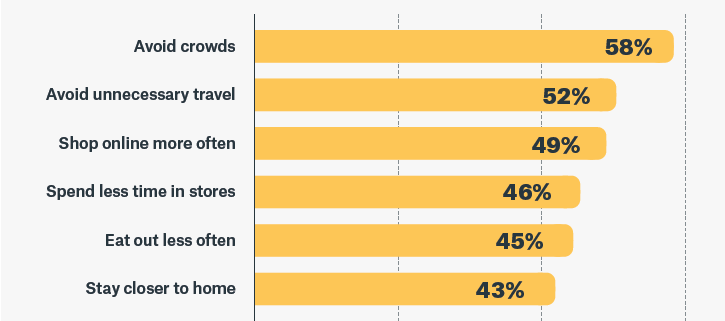

The survey asked consumers what daily habits they agreed would continue to be affected even after the pandemic has passed. More than half said they would continue to avoid crowds and unnecessary travel. Forty-nine percent will continue to shop online more often, and 43% will stay closer to home. These predictions signal unprecedented shifts by consumers, away from public gatherings and crowds, retreating to the security of home.

Post pandemic behavior changes

People say that even after the pandemic is over, they will continue to limit their activities and movement.

And the changes will have a profound impact on banking, including:

- What will be the role of bank branches as consumers adopt digital technology over in-person banking? A study by Boston Consulting Group (BCG) found usage of digital channels for banking is up significantly during COVID-19, particularly among millennials. The BCG study found 44% of those aged 18 to 34 enrolled in online or mobile banking for the first time during the pandemic.

- How will banks maintain relationships in a stay-away economy? “It’s a human business at the end of the day, no matter how digital we make it,” says Mary McDuffie, Navy Federal Credit Union CEO.

- Will a move away from cash payments persist post-pandemic? A study by AT Kearny found that usage of contactless cards in the US grew by 150%.

- How will banks ensure equity as they deploy more digital solutions (and in some cases, limit in-person banking)? A report from Forbes explains, “Those without [Internet] connectivity not only have fewer ways to communicate with financial institutions — they have fewer resources, period. This includes digital tools that might help them build wealth, such as financial literacy materials, account management apps, or virtual advisors.”

The role of AI-fuelled conversations in banking

One bright spot: consumers’ optimism about artificial intelligence (AI) or chatbots. First, an explanation: For many banks, automated conversations and chatbots are an important way to improve wait times, improve customer satisfaction, and reduce costs. That’s because many queries are easy to answer — an ideal application for chatbots. This was a particular benefit during the pandemic, when banks were overwhelmed with customer queries about everything from bank hours and social distancing protocols, to more complex questions about accessing federal relief funds and requesting loan payment leniency.

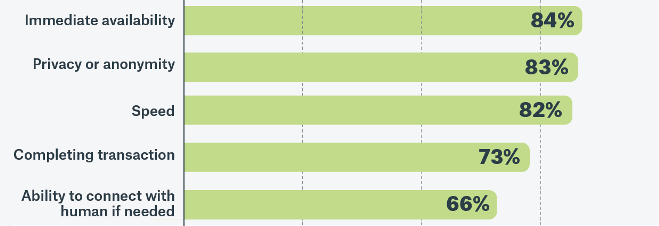

Of those consumers who use chatbots, more than three in four say they had a positive experience with the speed of response to their call/query, the privacy/anonymity of the interaction, and the speed with which their issue was resolved. Using AI and natural language processing to automate conversations has been a big challenge for organizations; but due to significant advances in the field, companies are now finding chatbots can resolve a much wider spectrum of customer queries, reduce time-to-serve and increase conversion.

Consumers like the speed, efficiency, and anonymity of chatbots

Personalization represents an ongoing challenge for banks, which must break down data silos inside institutions, safeguard customer data, and offer highly personalized services. Rather than responding with messages designed to fit the needs of thousands, banks should target responses to the needs of just one: the customer in the chat stream.

Pinpointing the biggest opportunities in banking

The research also examined to what extent banking customers are using the mobile messaging features and solutions they like best. The survey asked consumers to identify the various ways they use their phones to interact with businesses, as well as which of these scenarios they find useful. Comparing the two, the study isolates which features show the biggest gap between usage rates and “usefulness” — something Sinch calls the opportunity gap.

For example, just 31% globally say they receive notifications about suspicious activity in their bank accounts via messaging, but 92% would find this useful — a gap of 61 percentage points. Other areas to focus on include making appointments, filling out forms, and getting customer support via messaging.

Measuring the opportunity gap

Consumers are enthusiastic about mobile messaging options, but adoption remains stubbornly low.

These features and utilities are not futuristic, complex investments; they are solutions available on the market today for banks ready to deploy them. And in a COVID-19 world where customers have many more questions and trepidation about banking, they represent a clear way to deliver a positive customer experience in an uncertain time.

Resolving the global/local conundrum

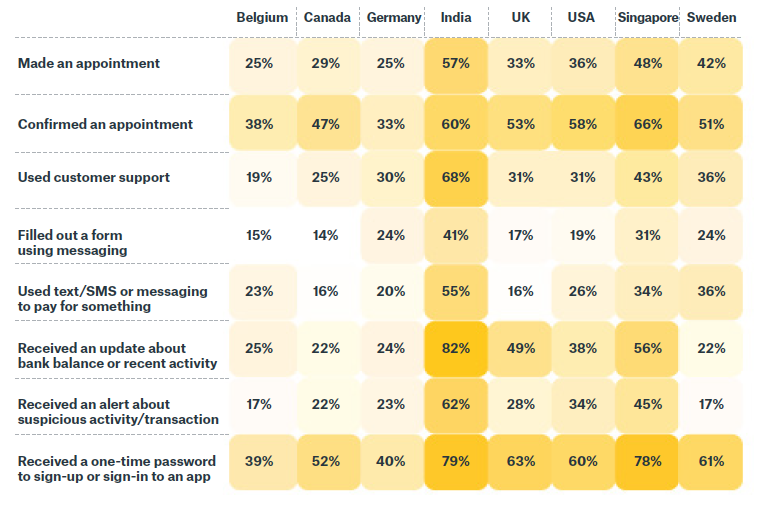

One big challenge for banks is scaling banking solutions to make sense at the local level. When we examine how consumers use their phones, country differences are often significant — in both the channels customers use and the features they prefer.

Uptake of mobile messaging features

India is the world leader in mobile-savvy, using mobile features at more than double the rate of some European countries

India stands out as an ultra-adopter of mobile features, while other countries lag. In India, 82% receive banking updates via mobile, versus 22% in Sweden, 24% in Germany, and 38% in the US. These variations can make it challenging to know where to deploy resources along the path to digital transformation.

However, it’s clear that consumers are ready to do more on their phones, and the COVID-19 pandemic will likely accelerate CX transformation at a rate not imaginable just one year ago. The focus will be on individual customer journeys, and how to deliver the highest level of value and utility to each individual.

The pandemic represents a vital opportunity to double down on digital channels, investigating the role of notifications, online forms and assessments, and chatbots to streamline customer experiences and remove roadblocks at a time when many are anxious about their financial position.

Want even more details? Download Sinch’s latest industry report: Banking disrupted. Or find the entire series of industry reports at Customer experience in a transformed world as they become available.