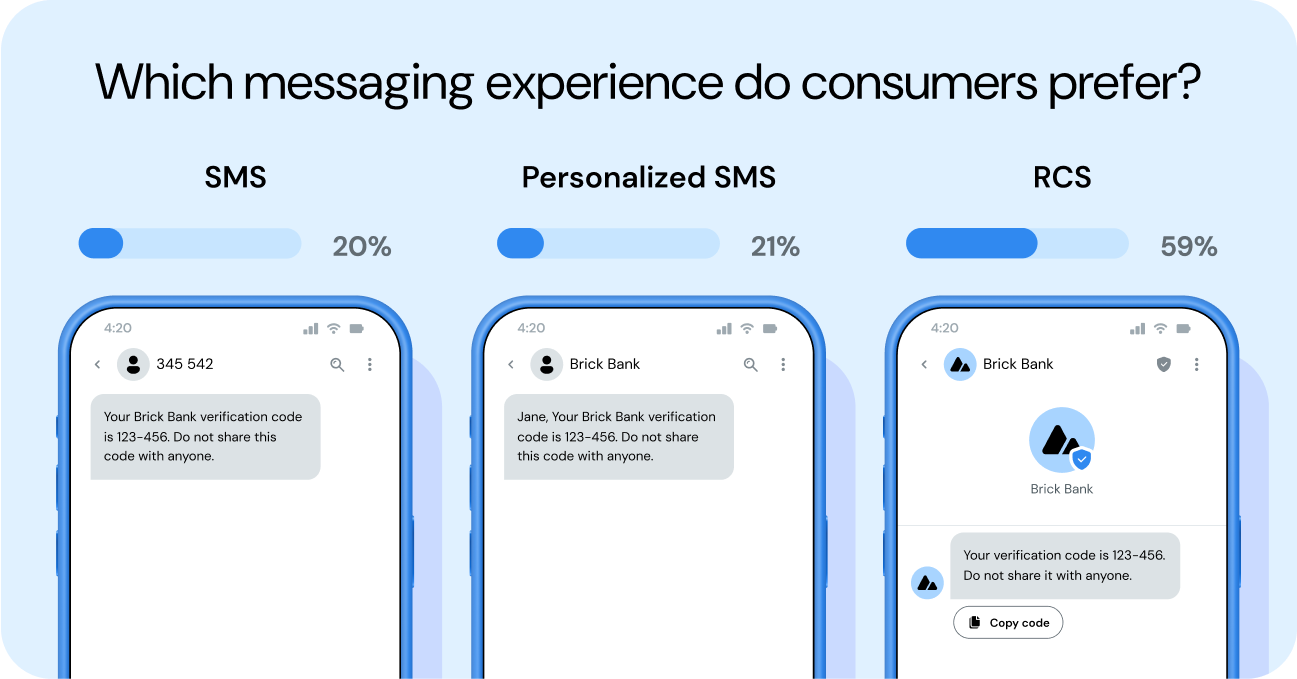

RCS for Business messages include an official logo and checkmark. These visual indicators not only support branding, but they also serve as a sign that the message came from a verified sender. This involves a third-party review to confirm you are a legitimate business that is allowed to send RCS business messages.

Nearly 42% of consumers said these elements make it more likely they’d see the message as safe. Another 37% said they’d feel somewhat safer.

Younger consumers place even more trust in logos and checkmarks. Generation Z (71%) and millennials (59%) were more likely to view these messages as safe.

Keep in mind, RCS messages are encrypted during transit but only provide end-to-end encryption (EE2E) through peer-to-peer (P2P) Google Messages. Consumers who require more privacy may prefer other messaging applications, like WhatsApp, which does offer EE2E. Similar to RCS, the WhatsApp Business API also provides verified business accounts with checkmarks to increase trust.