Insights

From SMS to AI: Navigating the CPaaS universe

Communication Platforms as a Service (CPaaS) had its Big Bang moment in the early 2000s, exploding onto the scene and expanding outwards ever since. The number of vendors, their capabilities and the almost limitless applications continue to grow too, but getting your head around where CPaaS is going has always been an astronomical task.

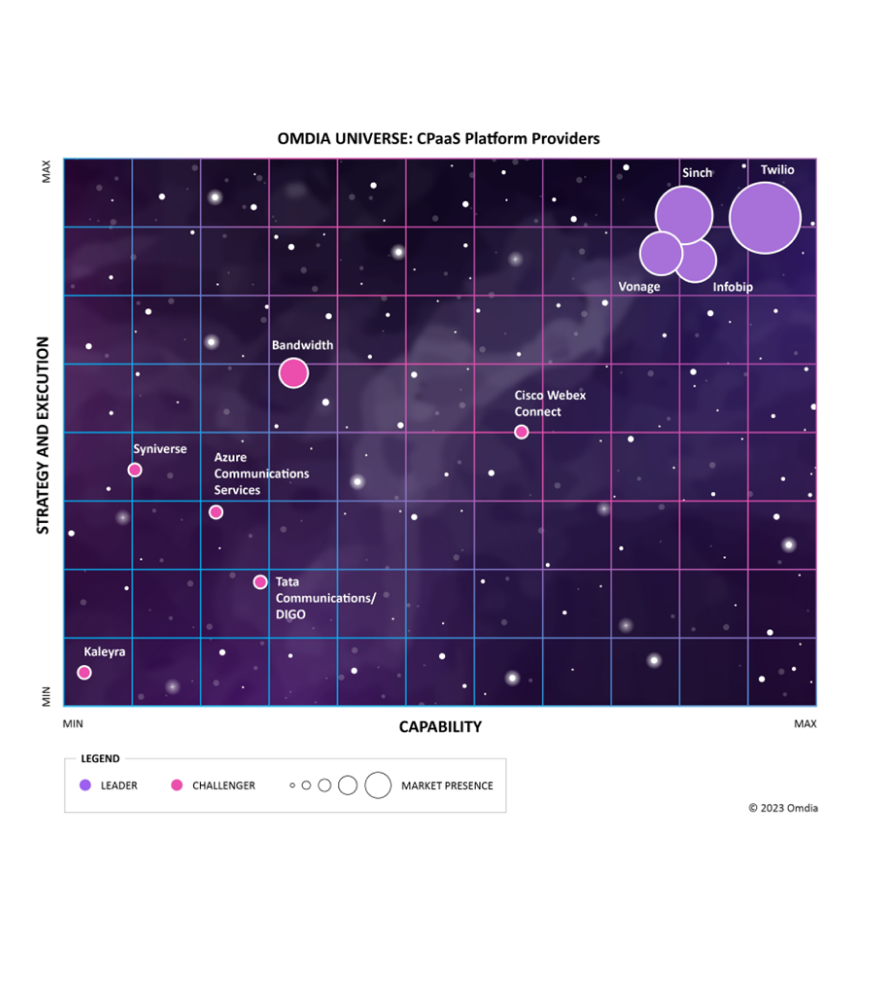

That’s why earlier this year, we held a LinkedIn Live event with Pamela Clark-Dickson, principal analyst at Omdia and one of the authors of the Omdia Universe 2023-24 CPaaS Providers Report. Pamela expertly guided us from CPaaS’s humble beginnings to its present state and onto its potential future, where it’s predicted to reach a global market size of more than $116 billion by 2031.

Let’s dive into that discussion and shed some light on what is CPaaS driving adoption, the challenges and opportunities providers face, and how it benefits the customers and end users they serve around the world.

You gotta start somewhere: Cloud communications connect customers

Pamela began by reminding us about why CPaaS, or cloud communications as it was called at the time, came into being in the early 2000s. Enterprises wanted to engage more directly with customers, and the best way to do that was to add SMS and voice capabilities directly to back-end systems.

“At that point,” says Pamela, “if an enterprise wanted to connect with a consumer, they had to go through, say, an SMS aggregator or a telco. It was a lengthy and time-consuming process, but by providing communications APIs, CPaaS providers were able to make that process a lot easier for developers. Back then, it was primarily developer oriented aimed at early adopters.”

Around a decade later, there was real growth in the industry which meant more APIs. Number verification, SIP trunking and other applications brought in connectivity service providers and enterprise software vendors, along with telcos and aggregators, all of whom could see the growth potential.

“CPaaS vendors started to target enterprises as well as developers,” Pamela says. “That’s when the use cases across different departments within organizations expanded.

“We started to see the more channels introduced as well,” Pamela continues. “With the inclusion of video, messaging apps, email, and number verification, these were huge additions in this space. It was the rise of omnichannels, where organizations wanted to use more than one channel in an orchestrated way. It was also the emergence of the partner ecosystem across a number of areas that got different tech platforms to fill out gaps in the portfolio.”

“It’s gone beyond merely enabling communications for enterprises. It’s about supporting the whole customer experience for enterprise customers.”

Mergers and innovations: Growth of an industry

By the 2010s, there were more APIs, more comms capabilities and the expansion of geographic networks. Growth during this time for CPaaS providers came in the form of mergers and acquisitions. This helped providers get immediate expertise and enable the development of applications being offered horizontally across industries.

“By that time, there was a lot of richness added to the CPaaS portfolio,” says Pamela. “We started to see a consolidation of this move into adjacent platforms, contact centers, unified comms, customer engagement and customer data platforms. That’s when you noticed the differentiation and innovation starting to come in.”

By then, the CPaaS market had become quite crowded. From SMS aggregators to connectivity service providers, many of these companies started to identify themselves as CPaaS players. Even enterprise software vendors would sometimes partner with external organizations or occasionally develop their own CPaaS capabilities so they could offer them as well. All of which has created a very competitive market, which drives innovation levels through the roof.

“That desire to innovate, to add value, has become what it’s all about,” she says. “It’s gone beyond merely enabling communications for enterprises. It’s about supporting the whole customer experience for enterprise customers.”

The CPaaS-fication of comms: Trends that ring true

The discussion moved on to current trends and developments within the CPaaS market. From Pamela’s perspective, there are five key trends driving CPaaS and its providers:

- AI and GenAI will play an increasingly important role in customer engagement

CPaaS vendors are partnering with AI engines and vendors to integrate AI/GenAI technologies into their platforms, allowing most organizations, regardless of size, to access AI-based customer engagement capabilities.

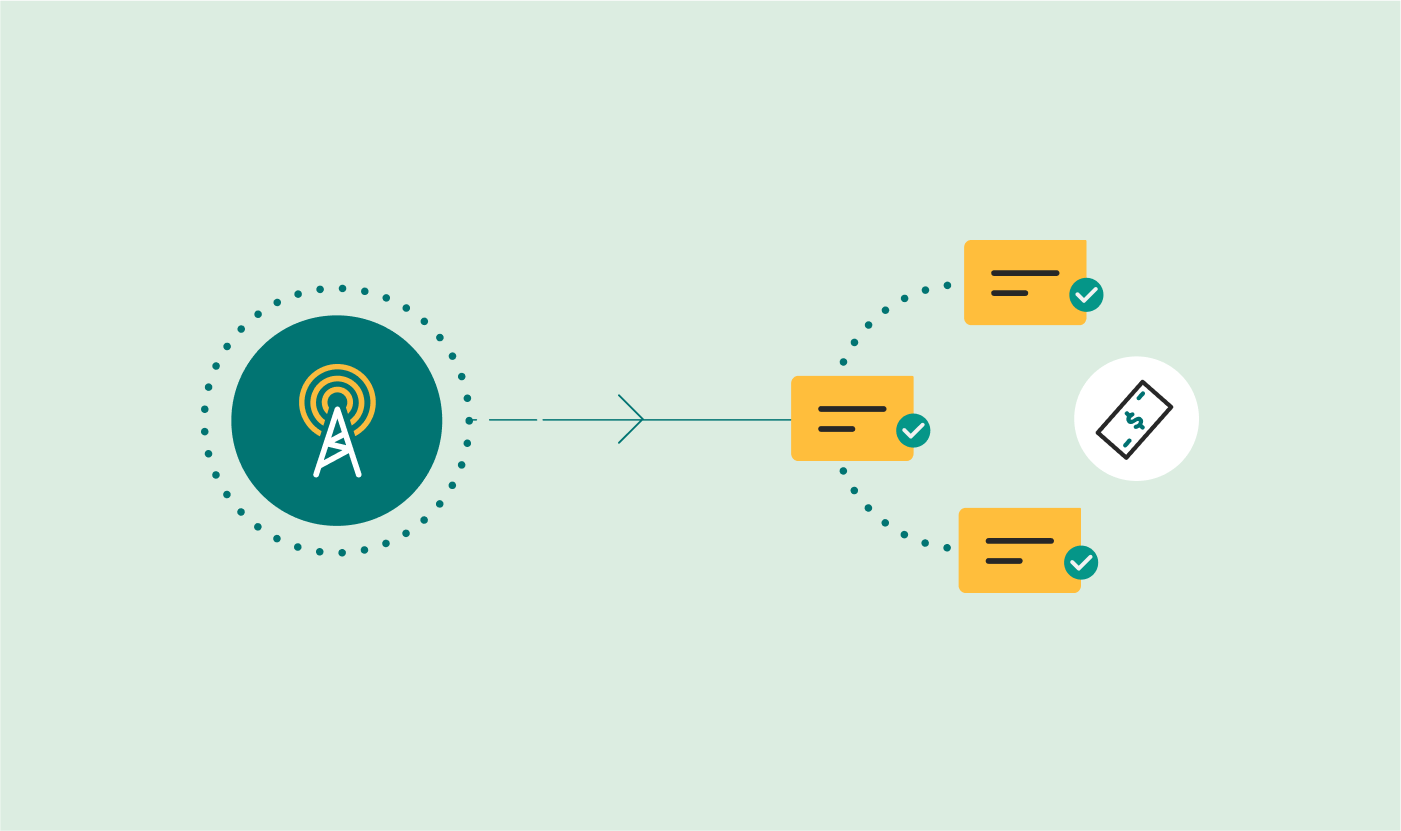

- SMS will remain resilient as a customer communications channel

SMS is the second most preferred communications channel that consumers use to interact with an organization’s customer care team. This suggests that it will remain a key customer engagement channel into 2024 and beyond, even with the development of the RCS market. CPaaS providers will need to continue to offer messaging APIs.

- Enterprise use of messaging apps for customer interactions will rise

The continued efforts of messaging apps to enable business-to-consumer interactions means that more online consumers than ever are engaging with organizations in this way. In 2024 more CPaaS vendors will expand support for messaging apps in their APIs.

- Intelligently executed customer data strategies come to the forefront

As CPaaS vendors move up the product stack from communications to customer engagement, the logical next step is to add a customer data platform (CDP). These platforms will help enterprises to more quickly and effectively create and distribute targeted market campaigns, for example.

- Mergers and acquisitions continue to build up CPaaS providers

Since 2016, more than $18bn has been laid out on M&A by Twilio, Ericsson, Sinch, and Infobip. In 2023, TATA Communications, Tanla Platforms, and Proximus Opal collectively outlaid another $850 million to, respectively, acquire Kaleyra, ValueFirst India (from Twilio), and a majority stake in Route Mobile.

Omnichannel opportunities – A must-have capability

Next, Pamela dove into the importance of omnichannel in CPaaS for enterprises. She pointed out that most customers want to be engaged in different ways depending on context and their preferred communication channel.

“For instance,” she says, “a conversation with a customer might start out online with web chat and then, depending on how the conversation goes, there may be a verification code sent via SMS, after which there’s a contract sent via email. Being able to communicate via SMS, voice, video, at the drop of a hat is essential nowadays.

“And, importantly, because WhatsApp or Facebook Messenger really matter for a younger cohort,” Pamela continues, “it’s incredibly important for CPaaS providers to offer their customers the ability to tap into all of those communication channels seamlessly.”

RCS and CPaaS – redefining rich communications

The conversation naturally led to RCS, and how it got to over a billion users thanks to Android (Google) messages. Pamela also touched on the eventual adoption of RCS by Apple and how it might do the same for iMessage users.

“Earlier I mentioned that SMS is resilient, but RCS is being positioned as its much richer messaging successor with a lot of specific applications,” says Pamela. “We’re already seeing that RCS is returning higher engagement and clickthrough rates than SMS. With its messaging app-like experiences, it can certainly offer consumers and enterprises a lot more in terms of engagement. And with Apple coming on board, you’ve suddenly got an addressable market for RCS of about 2 billion, which is getting up into WhatsApp territory.”

And with the branded messaging, verified sender, increased analytics and elevated customer engagement RCS offers, it’s hard not to think it is the evolution of messaging. It can maximize customer trust, engagement, experience and ROI for business.

“Still, I don’t think it will make SMS obsolete in the short to medium term,” she says. “I think there will be a process of migration for enterprises, but I also think that SMS has use cases for which it is better suited than RCS. So, yeah, I wouldn’t write SMS off just yet, either in the consumer or business messaging space.”

Hey Siri, how is CPaaS leveraging AI?

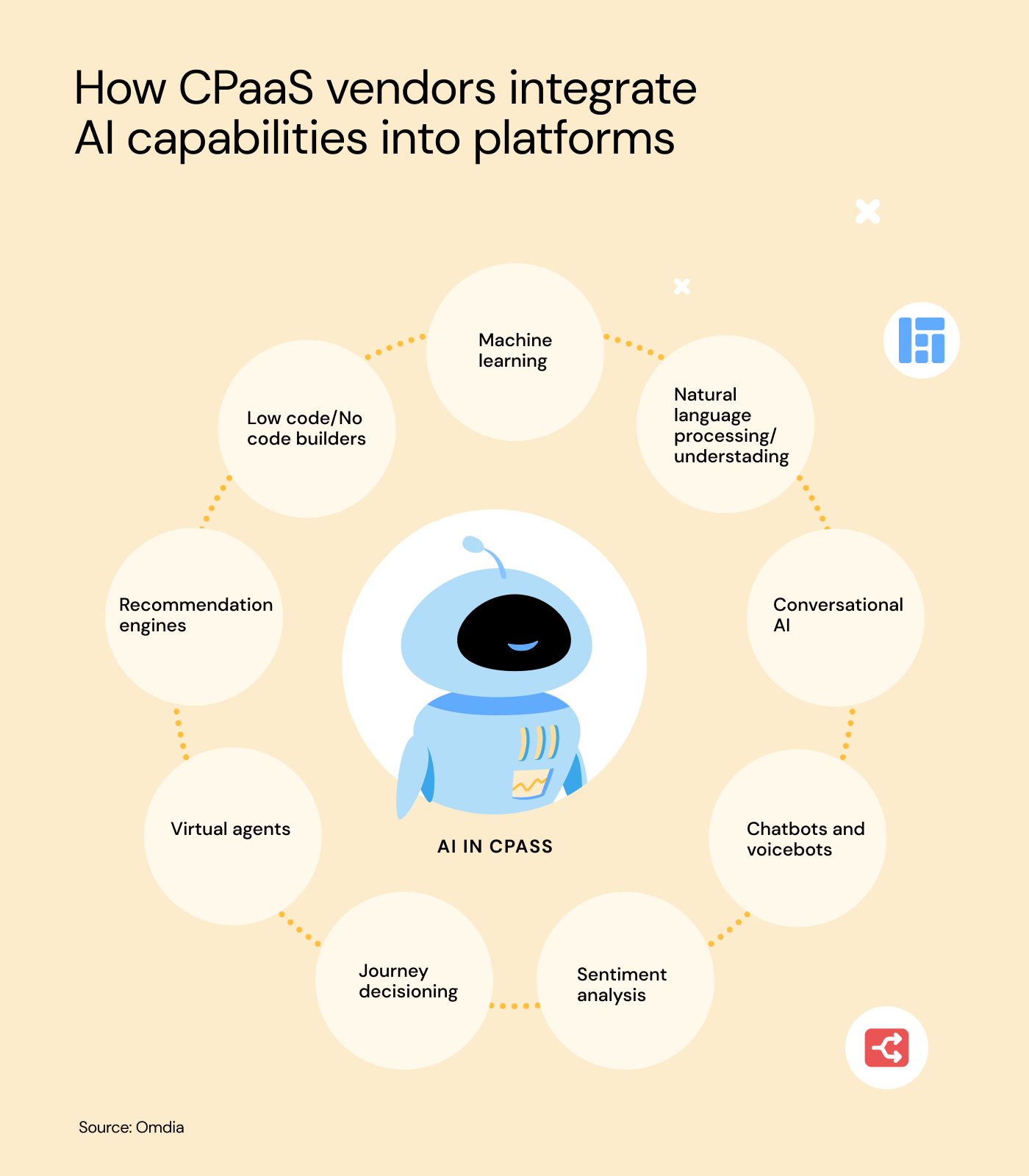

The discussion finally made its way to AI and how its integration has affected the CPaaS market and providers. Pamela was quick to point out that CPaaS vendors have been integrating AI capabilities for quite some time.

“Machine learning, natural language processing and sentiment analysis are not only being used in a customer facing perspective by providers, like with chatbots, but also in an underlying platform perspective,” says Pamela. “So being able to use machine learning to help direct or route traffic is huge, but so is using different AI capabilities to enhance customer experience.

“With a contact center, for instance, I think it takes the frustration out of the equation for consumers to work with self-serve AI to find answers to a query,” she continues. “It reduces the cost for an enterprise while at the same time safeguarding against a negative customer experience.

“So, it’s already being used extensively, but what is exciting is what can happen with generative AI and using these large language models,” says Pamela. “And again, it’s still fairly early stages here, but we’ll have more intelligent automation, we’ll see generative omnichannel engagements, generative agents helping on the customer engagement platforms. And this is where we’ll start to see some hyper-personalization boosting the value of the customer data platform with customer engagement platform to send out uniquely targeted content to an individual or small group based on the data.”

State of the CPaaS universe

CPaaS has skyrocketed from simple SMS and voice APIs in the early 2000s to a robust platform with video, messaging apps, email, and more. Key trends like AI integration, RCS emerging as a richer alternative to SMS, and the popularity of messaging apps are driving the future of the industry. And as AI and CPaaS continue to evolve together, they will deliver even more value-laden applications.

Now that you’re caught up on the state of the CPaaS universe, learn more about how Sinch’s industry-leading CPaaS solutions can help you start delivering better, more meaningful engagements at every touchpoint for your customers. Talk to us today! And if you’d like to check out the on-demand version of the LinkedIn Live event, click here.