Fraud and security, Products

Reach your customers despite data privacy concerns

Fraud and security, Products

New research shows that despite consumers’ wariness about sharing personal data, they are open to some types of personalized messaging

Protecting consumer data privacy has been in the spotlight for the last two years—first with the adoption of GDPR in 2018, but more recently with troubling news about how giants like Google and Facebook leverage and share user data. The interest isn’t likely to fade anytime soon: Data privacy legislation is in the works across the globe, from California’s imminent rollout of CCPA, to new initiatives in Brazil, India, Singapore and New Zealand.

For businesses that rely on consumer data to engage, promote and transact, it’s a time of uncertainty … yet the fundamentals aren’t likely to change. Yes, regulation over consumer data privacy is on the rise, and with it a growing sophistication among consumers about how to protect their own data. But new research from Sinch shows that most consumers don’t view privacy as a black and white issue (i.e. businesses necessarily have bad motives when they collect user data). Rather, they understand that by sharing data sensibly with brands they trust, they can reap the benefits of personalization.

If you want the entire Sinch report (MobileConsumer Engagement 2020), which includes a much broader set of summary data, you can download a copy here.

Before unpacking the research, let’s first understand the exact nature of consumers’ fears over granting access to their data.

A recent study from the highly respected US research organization, Pew Research Center, finds Americans feel out of control when it comes to protecting their data. 63% report they understand very little or nothing at all about regulations and laws intended to protect their data. And 8 in 10 believe they have little-to-no control over the data companies collect about them. (These concerns aren’t only true of Americans, of course, but tend to be higher where widespread legislation isn’t in place to allay fears. In India, where lawmakers are weighing ambitious new data privacy rules, a study found that 60% of Indians worry about the unauthorized collection of their data.)

For many consumers, fears about data privacy are often closely connected to hacking, fraud and identity theft. A study of over 1,000 smartphone users by Factual found the top concern by a large margin was “identify theft and fraud” (72%).

Of all the smartphone-using generations (Gen Z, Gen Y, Gen X and Boomers), Baby Boomers are significantly more likely to worry about privacy when compared to younger cohorts. Boomers are 70% more likely to be “very concerned” about data privacy compared to Gen Z and millennials, according to the Factual study.

Research from Sinch, which surveyed 2,300 mobile phone users globally, supports many of these ideas. Sinch’s Mobile Consumer Engagement 2020 study found the majority of consumers (72%) say they are concerned about mobile apps tracking their movements, and 60% avoid putting apps on their phones because they don’t trust how companies use their data.

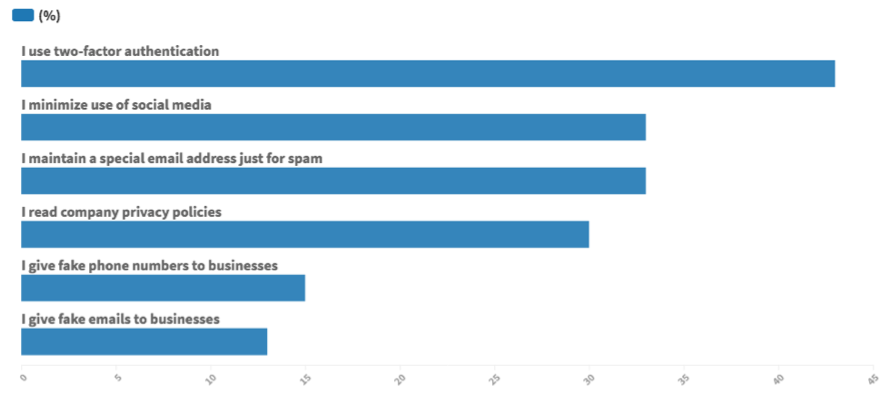

When asked what steps they take to protect their privacy online, 1 in 3 say they minimize their use of social media to protect their privacy; similarly, 1 in 3 maintain a distinct email address to collect spam.

Consumers are also wary about sharing their email and phone numbers with businesses, particularly those they don’t know/trust. A surprisingly high number are at least “somewhat comfortable” sharing their contact information. While only 32% would share their phone number with an unfamiliar brand, that number jumps to 68% when asked to share a phone number with a brand they use. (Social media companies are trusted roughly on par with “unfamiliar brands”; just 35% are at least somewhat comfortable sharing their mobile number with social media companies.)

Even more interesting: younger generations are much more willing to share personal contact information. Nearly 80% of the Gen Zers Sinch polled says they are at least somewhat comfortable sharing their phone number with brands they use, and 71% of Gen Y say the same. And this makes sense: many businesses’ product/service offerings are intricately linked to the mobile phone experience—a ridesharing app that sends a message when a driver is arriving, a dining reservation platform that reminds you of your upcoming meal through SMS text messages, or a retail promotion that announces a holiday sale for insiders when geolocation shows a customer is nearby. Younger people understand this data exchange more intimately than those over 55 years old do simply by virtue of the ways they use their phones.

In an earlier blog post, we looked broadly at consumers’ willingness to receive messages from businesses, examining scenarios across industries—from travel and banking to healthcare and retail.

But what of those consumers that have a higher level of distrust for how businesses use their personal data? Would they be similarly interested in engaging with businesses using their mobile phones?

We filtered the survey data, examining those who agreed they “avoid putting apps on my phone because I don’t trust how companies use my data.” Do these people find value in sharing their mobile phone numbers with business? And do they welcome different types of personalized interactions on their phones?

The majority of “data wary” consumers welcome the messaging scenarios we posed to them. (Note the least welcome were scenarios related to product or service promotions, but even those were deemed “welcome” by nearly half of respondents.) The overwhelming message is that even while consumers may be fearful about how companies use their data, their level of wariness is much lower for companies they do business with. Even more, data-wary consumers see value in the exchange of data for high-value, personalized interactions.

You can find a lengthy discussion of key takeaways for executives in the full report, but the following are some important considerations related to data privacy:

When companies are exposed in the media for data hacks or data misuse, the crisis is not only about the legal findings or financial penalties related to these breaches — it’s the breakdown of consumer trust. Customer experience — and in particular mobile experience — depends on the flow of data between consumers and the brands they trust. When a company loses consumers’ trust, they also lose a critical pathway to engage customers. Organizations must take bigger steps to safeguard data not only because regulations demand it, but because best-in-class consumer experience requires it.

Growing regulation of customer data is arguably long overdue due to abuses by bad actors in the tech industry. The change, however, means companies must double down on growing owned ecosystems. Rather than buying massive swaths of user data from third parties, companies will need to develop digital and mobile experiences that are worthy enough for customers to willingly share information in exchange for valuable experiences.

Our research shows that even while the majority of consumers welcome a wide range of messaging scenarios, in each scenario a sizeable share does not. Full stop. Today’s consumer experience must be tuned to individuals and their unique preferences, not target markets or personas. What does each of your customers want when they interact with your brand, and have you provided a rich ecosystem of choices to match each person’s unique profile and personalized needs?

While companies adapt to the growing raft of data privacy regulations, they must also keep their eyes on the preferences of millennials and Gen Z. Young people are more willing to share their data according to the Sinch research and many other studies. If you’re not convinced, Paypal’s announcement that it intends to purchase Honey for $4 billion should sway you. Honey collects users’ online shopping habits through an always-on browser plugin, and then offers them personalized coupons and promotions based on that data exchange. The platform is proof positive that young consumers are more relaxed about swapping personal data for value, and a sign that businesses must prepare for this rising tide of privacy-savvy consumers.

Want to find out more about how consumers like their messaging served, or how business can better meet their needs? Get all the insights in the full report here.