Insights, Products

3 reasons businesses are missing out on connecting with customers on mobile

Insights, Products

In this first part of a series of two blogs we’ll dive into our latest research report to take a look at how consumers are using messaging and what the future looks like.

As far back as 2015, pundits predicted the imminent rise of rich texting, or RCS. The new protocol would revolutionize how consumers and companies communicate via texting. Rather than sending a one-way, plain text (or using third-party messaging apps like Messenger or WhatsApp), businesses would be able to deliver an app-like, interactive experience through a mobile phone’s default texting function.

Here we are, nearly ready to ring in 2020, with pockets of successful campaigns around the world.

With so much hype about the possibilities of RCS, businesses (and the marketing automation ecosystem alike) have woken up to the many rich media mobile channels available today. Even more welcoming, consumers say they want to get messages from brands, particularly for brands they are already doing business with.

For CX and marketing leaders trying to make sense of this shifting landscape, new research from Sinch offers insights about (a) how customers use texting via SMS today, and (b) what they say they’ll find useful or welcome in the future. If you want the entire Sinch report (MobileConsumer Engagement 2020), which includes a much broader set of summary data, download a copy here.

Current messaging usage rates are robust … but with room to grow

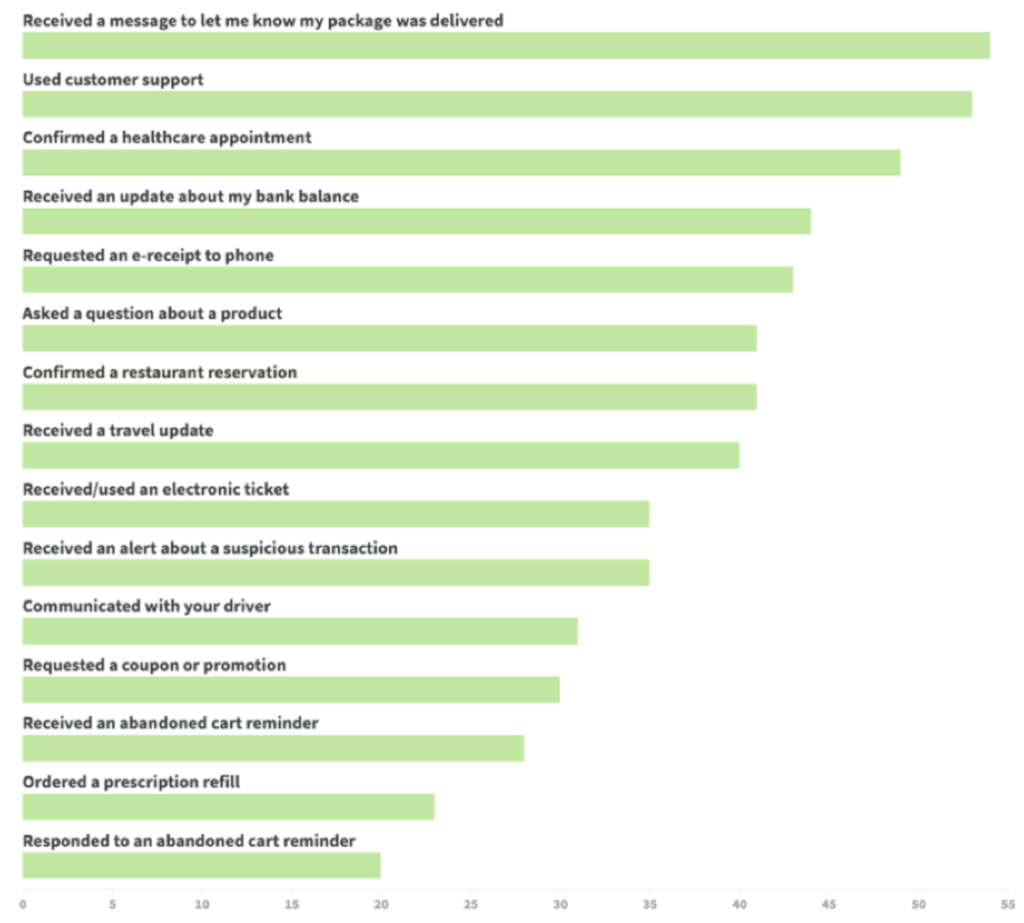

The Sinch research shows “imminent notifications” are among the most common use of messaging to interact with businesses (see chart below). Keep in mind the term “messaging” here includes both Text/SMS, as well as messaging inside dedicated messaging apps and inside brand apps.

Imminent notifications (sometimes referred to as transactional messaging) include receiving a notification of package delivery, confirming a healthcare appointment, or getting a bank balance update. Also popular: using customer support via messaging. Of those scenarios Sinch tested, the least common were “abandoned cart reminders” and “ordering a prescription refill.”

Notifications of “imminent events is more common. Receiving (and acting on) abandoned cart reminders less common.

Some may be inclined to think that usage rates are artificially low due to Baby Boomers using their mobile phones less adeptly than younger generations — but the data does not bear this out. For many of the usage types, differences between generations were negligible. Below find some of the more interesting generational differences. Setting up banking alerts is much more common among younger generations than Boomers (not surprising). Boomers were much more likely to have used mobile electronic tickets, and more likely to use their mobile phones to order prescription refills. Both are proof that Boomers have the desire to use their mobile phones to engage via messaging, but are not in the habit of doing so for many scenarios.

Younger people are more likely to use messaging for personal banking and transportation, while older consumers use messaging for events and prescriptions.

For most categories, fewer than half of consumers surveyed have experience with those message types. Given the near-ubiquity of mobile phones, why aren’t these numbers higher? It’s complicated, of course.

If you consider two-thirds of Americans have purchased something on Amazon, then the fact that 61% of all US consumers report they get notifications of package deliveries is reasonable and expected (using Amazon shopping as a proxy for online shopping).

But only 1 in 3 are currently getting notifications of suspicious activity in their bank account — a low number considering the rate of identity theft and hacked credit card numbers. And just 23% globally have ordered a prescription refill via mobile messaging.

The modest uptake of these basic messaging types is likely due to three key issues:

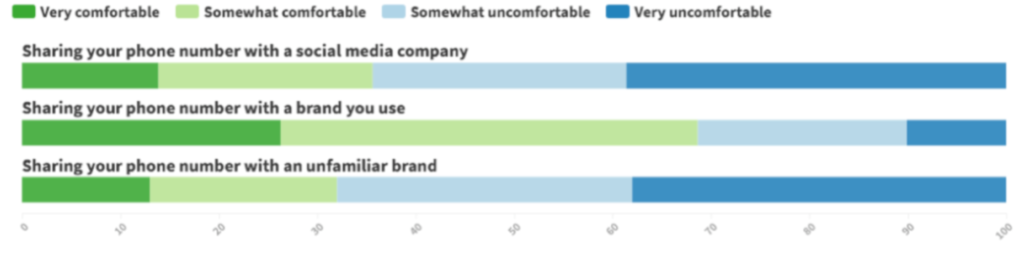

Consumers savvy about data privacy: Consumers are sensitive about whether they want to share their mobile phone numbers with business, and for good reason: 58% of consumers say their phones send them too many notifications according to Sinch’s research. Considering that mobile phones are typically just a few feet away from their owners, consumers guard their phone numbers and mobile access much more closely than they guard other channels like social media and email.

Just 13% say they are “very comfortable” sharing their phone number with an unfamiliar brand, and that rate rises to 26% for a known brand. (Social media companies are trusted as much as “unfamiliar brands” according to the Sinch research.) While consumers may trust Amazon or Uber to send them notifications (in those cases messaging is part of the product offer), they may be more likely to reject notifications from lesser-used brands.

How comfortable are consumers when it comes to sharing their mobile numbers with brands?

Access/permission: Even with access to a mobile phone number, many consumers don’t allow or “turn on” notifications. In the US, for example, where banking notifications are widely available to consumers, fewer than half (42%) have set up mobile bill pay alerts.

Awareness: In some cases, consumers simply aren’t aware that a messaging feature is available, despite clear indications they are open to the idea. This is something we’ll review in much more detail in part two of this series of blogs in a post entitled Analyzing the mobile messaging opportunity gap – 3 key takeaways.

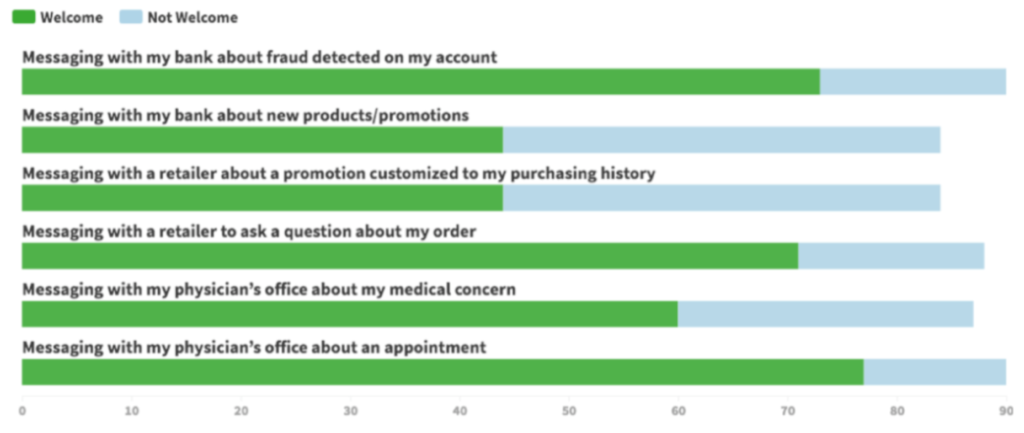

Despite today’s usage rates, consumers are clearly open and willing to most conversations with a business via messaging. (See chart below.)

Overall the mobile messaging types consumers are most enthusiastic about are interactions directly related to existing purchases/transactions. In banking, 73% say they welcome notifications about fraud detected on their accounts. In retail, 71% of consumers welcome the chance to message retailers about an order. And 77% of consumers worldwide say they’d like to message their doctor’s office about making an appointment. None of these are “cold outreach”-types interactions; rather these are problem-solving scenarios for existing relationships.

To what extent do consumers welcome (and not welcome) messaging from businesses?

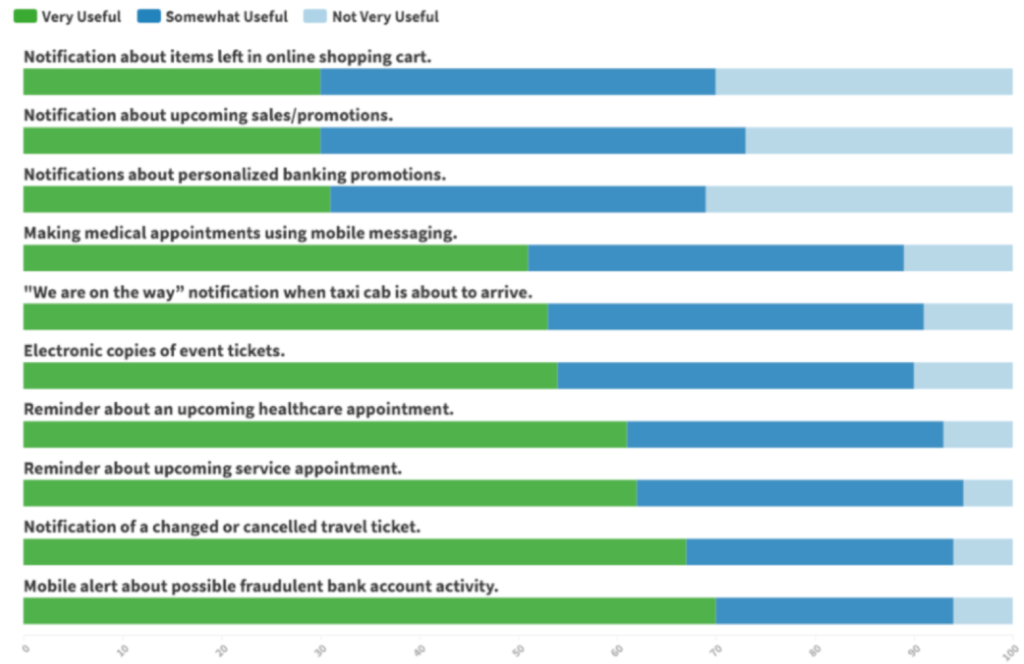

The survey also asked consumers to share how useful (or not) certain messaging features would be. (See chart below.) Across all categories, consumers say messaging scenarios are at least “somewhat useful,” and in many cases “very useful.” Again, imminent notifications are most useful (e.g. banking alerts, travel alerts, and upcoming service appointment and medical appointment reminders).

Slightly less useful — but still surprisingly high in value — are notifications about items left in a shopping cart, and notifications of upcoming sales/promotions.

To what extent do consumers find value in these industry-specific messaging types?

Want to find out more about how consumers like their messaging served, or how business can better meet their needs? Get all the insights in the full report here or check out part two in this short series of blogs: Analyzing mobile messaging the opportunity gap – 3 key takeaways.