Fraud and security

How to use machine learning for fraud detection

There’s a lot of talk about how artificial intelligence (AI) can be abused to run scams and sophisticated fraud schemes. But can AI also be used to combat fraud? Spoiler alert… yes, it can! In fact, machine learning can be a powerful tool in detecting fraud, protecting customers, and saving businesses a lot of money.

It’s therefore not surprising that some enterprises have already started to use AI-based technologies to prevent fraudulent activities. The 2024 anti-fraud benchmarking report by the Association of Fraud Examiners has found that 18% of organizations already use AI and machine learning for fraud detection. This number is expected to triple over the next two years, as almost 60% of enterprises are looking to increase their budget for anti-fraud technology.

Keep in mind that fraud happens on all communication channels and is targeted at all age groups. However, as a 2024 report from the Mobile Ecosystem Forum (MEF) shows, hackers tend to focus on the most popular communication channels.

While in the U.S. this might be email and SMS, in Europe fraudsters have increasingly moved to messaging channels. WhatsApp, for example, showed a 4-point rise in reported attacks simply because its user base has grown.

So, let’s take a closer look at possibilities, benefits, and practical scenarios for machine learning in fraud detection.

What is machine learning?

Machine learning (ML) is a specialized field within AI focused on creating algorithms and models that enable computers to analyze large datasets, learn from them, detect patterns, and make informed predictions based on that data.

There are three main types of machine learning techniques: supervised learning, unsupervised learning, and reinforced learning.

Supervised learning

In supervised learning, a computer is taught to make predictions based on examples it has been trained on. For this, computers are given an input (a problem) and an output (solution or answer to the problem). The computer then studies these and learns the relationship between input and output. Once it understands the underlying pattern, it’ll be able to make predictions and decisions for unknown issues.

Unsupervised learning

With unsupervised machine learning, computers are only given input data, but no output. The idea is for the computer to analyze the information and uncover patterns on its own.

Reinforced learning

In a reinforced learning situation, a computer interacts with an environment and makes decisions, for which it receives feedback in the form of punishments or rewards. The goal is for the computer to find the approach that gets it the most rewards.

How is machine learning used in fraud detection?

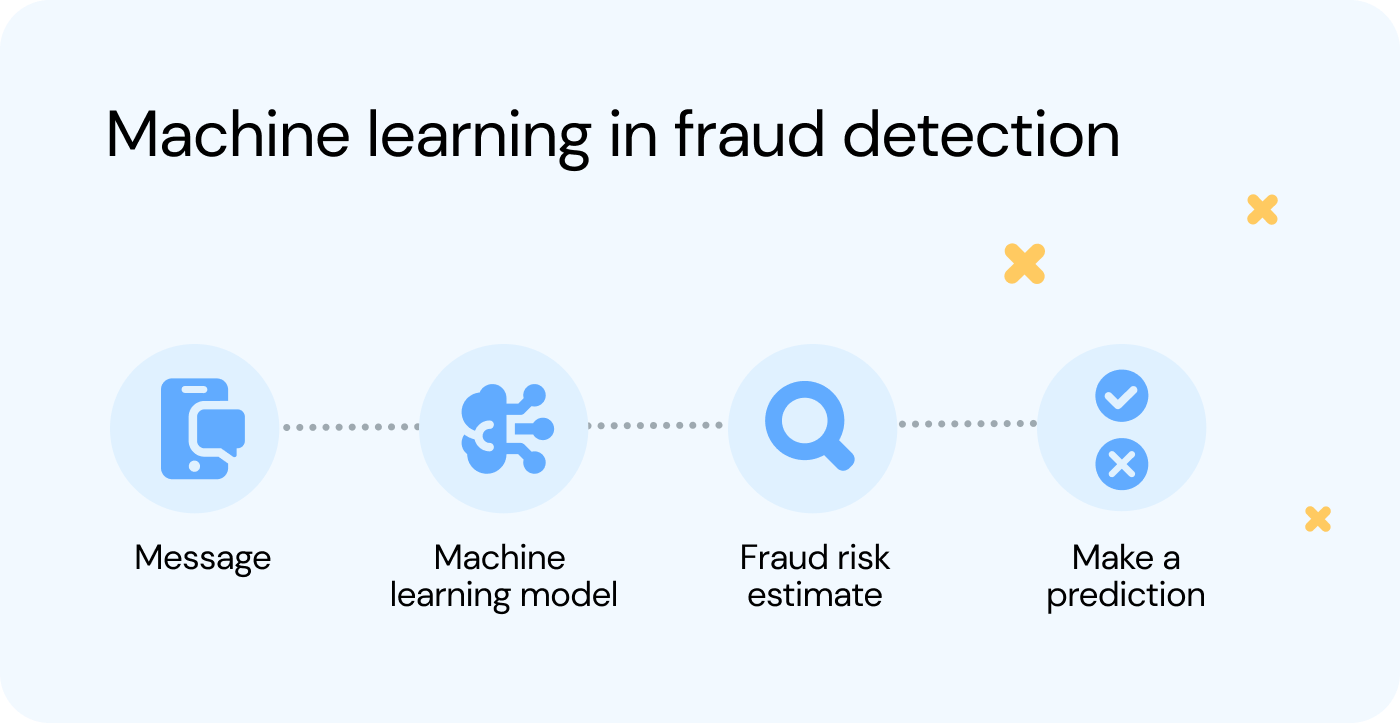

All three approaches of machine learning models focus on a computer’s ability to analyze large datasets, recognize patterns, and be able to adapt to new information and make reasonable predictions based on its training.

That’s why this subset of AI is so valuable to fraud detection.

Typically, a machine learning model intercepts incoming traffic before it reaches the recipient. Then the ML model analyzes if anything looks suspicious based on what it has been trained to recognize as “suspicious.”

Then, it takes an action. The action also depends on the programming and could be to simply flag messages as suspicious or block them from going through.

There are several ways in which machine learning can be used in fraud prevention.

Finding anomalies

You can train a computer on historical datasets to teach it to recognize “normal” vs. “abnormal” behavior. An example would be to learn that taking out an amount of $500 per day from a private bank account is “normal,” but taking out $500 every two hours isn’t. It’s also possible to teach computers each user’s singular behavioral pattern and, based on these, identify individual deviations. That enables quick anomaly detection that’s likely to indicate fraud.

Scoring risks

Aside from identifying a possible fraud, machine learning can also be used to assign risk scores to anomalous patterns. A high-risk score could indicate a higher likelihood of fraud or that the scam presents a bigger threat to the company. This risk management approach can help teams prioritize when they look at flagged situations.

Analyzing networks

Bad actors often operate through a shared network. Identifying network patterns like suspicious activities that come from the same location or device can therefore be another way to use machine learning for fraud detection.

Analyzing content

Another way of using ML algorithms for fraud detection systems is to train them on text or image data. This could include online reviews, text messages, and QR codes. The AI would then look through this content for patterns or indicators of fraud (spammy links, wordings like “get rich quick”, etc.).

As machine learning is adaptive, computers can also be retrained on new data. So if bad actors change their behavior, computers will be able to study and learn these new fraud patterns and adapt their approach as well.

Do I have to use machine learning for fraud detection?

Even though machine learning is powerful, it’s not the only option companies have to detect fraud. You can base your fraud detection on manual processes only. While this can be successful, it requires more personnel.

Aside from machine learning, there are also other technologies that you can use for fraud detection like biometrics or big data analysis. These become especially successful when you combine them with ML as you can easily scale them and fine-tune them even more.

Benefits of machine learning for fraud detection

Machine learning algorithms are very powerful in preventing fraud at scale. This means that you can increase the benefits of any type of fraud detection exponentially by using machine learning. Here are some ways in which ML for fraud detection scales particularly well.

Improves efficiency

For one, machine learning is very efficient as it can identify fraudulent user behavior faster and do this consistently with very large volumes of data. This optimizes the process, reduces the workload for your teams, and cuts down on manual reviews while being able to react to possible threats faster.

Prevents more financial losses

From artificial inflation of traffic to payment frauds, many frauds can be very costly for enterprises if carried out successfully. You can obviously detect those without machine learning, but as machine learning can flag bad actors faster, enterprises will be able to recognize and even prevent fraud sooner as well, which can save companies millions of dollars. This also makes ML very cost-effective and therefore renders a good ROI, which is important to consider when deciding in which fraud detection methods you should invest.

Prevents possible lawsuits

As examples from Citibank or Wells Fargo have shown: Even if a company is not directly at fault, if fraud affects customers, enterprises are at risk of being sued. That’s both costly and a reputation killer, so being able to use machine learning to make effective fraud prevention even more effective is a huge advantage.

Builds trust with customers

Data from the Federal Trade Commission shows that consumers lose a lot of money to fraud. In 2023, fraud-based losses from consumers added up to $10 billion – a new record. That makes it even more important for companies to protect their customers. Businesses that prioritize fraud prevention at scale through machine learning will be more successful in earning their customers’ trust, ensure long-term retention, and reduce churn.

Improves brand reputation

Being seen as a brand that actively combats fraud and protects customers not only grows trust with existing customers, but it’ll also improve a brand’s reputation overall. That’s now more relevant than ever! As our 2024 research on customer expectations shows, safe communication is one of the top priorities for customers when interacting for the first time with a new brand.

Gets better over time

Machine learning is not a one and done process. You can retrain computers or teach them to understand changed user behavior. If hackers or spammers switch up their approach, the AI is flexible enough to adapt to these changes.

This means that the AI improves over time and will be able to cover more unwanted scenarios.

What are the limitations of AI in fraud detection?

When looking into machine learning for fraud detection, it’s also crucial to understand its limitations.

Incorrect predictions or decisions

Using AI in fraud detection can lead to false positives (real customers that get blocked) and false negatives (fraudsters that go undetected). Of course, this issue isn’t unique to AI. However, overconfidence in AI – where people trust AI too much – could increase the rate of incorrect outcomes.

It’s therefore important to mitigate the risk of incorrect predictions or decisions by tracking them and setting a risk threshold. In other words: what traffic is considered fraud and should therefore be blocked. This means that operators or companies have to define at which point they estimate the fraud risk to be high enough to block a message or user.

For example, is a user who requests three one-time passwords in a short period of time a sign of a hacking attempt and should be blocked – or is it a customer with login issues?

Finding the right threshold for which messages to accept and which ones to reject can be tricky. After all, you don’t want to block legitimate customers, but you also don’t want to make it too easy for fraudsters.

Typically, your message acceptance rate should be close to 100%. Most companies set their risk thresholds above 98% or even 99%, but that also depends on your individual use case.

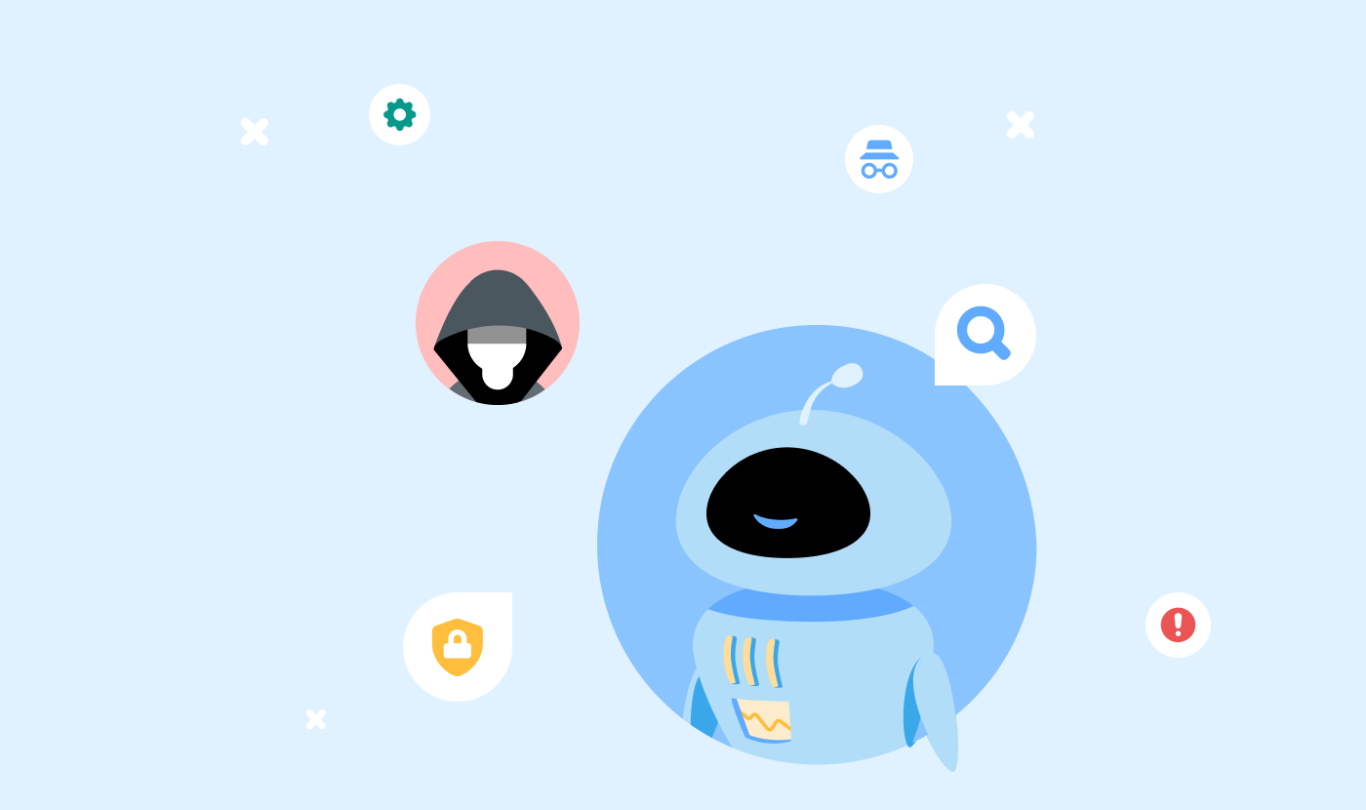

Missing scams that play on human psychology

As machine learning focuses on pattern recognition, it might be hard for any AI to detect tricks that play on human psychology like social engineering attacks – especially if it’s a new type of attack and the AI hasn’t been trained to discern it yet.

If, for example, a user is on the phone with a hacker that they think is the IT department of a bank, they might use their own login information and perform a legitimate transaction. To the untrained AI, this might look like normal behavior, but in the background, the hacker just stole the user’s password and account information.

Of course, it’s always possible and definitely recommended to re-train the AI and school it to recognize new patterns, but you should also be aware that there might always be new scams that slip through the cracks.

That’s why, in addition to leaning on ML, it’s vital for companies to train employees and customers thoroughly on as many types of scams as possible. AI can still help detect suspicious patterns, but it shouldn’t be the only prevention mechanism a company relies on.

Fraud scenarios where machine learning can help

The following scenarios show where ML can help detect and prevent fraud.

Phishing and smishing

One of the most common social engineering scams is when consumers are manipulated into revealing their private information that’s then used for illicit purposes. When this happens over email, it’s called “phishing,” and SMS phishing is known as “smishing.”

Machine learning can deal with this type of fraud by analyzing user habits and typical transaction behavior. Anything that seems out of the ordinary can then immediately be flagged and reviewed.

AIT

Artificial Inflation of Traffic (AIT) is a type of SMS fraud that involves high –volumes of application-to-person (A2P) traffic. Usually, scammers use bots that request numerous one-time passwords (OTPs) that they want sent as text messages to a mobile number. However, there are no end users receiving these OTPs. Instead, application owners are left to pay for the SMS.

Robert Gerstmann, Chief Evangelist and co-founder at Sinch, defines AIT and how it works for an enterprise.

With machine learning, enterprises can identify and stop this type of fraudulent traffic faster. ML-based AI can detect this type of suspicious activity, for instance by tracking a common network where these requests come from or identifying an unusually large number of OTP requests.

This enables companies to prevent malicious attacks in real time.

Payment fraud

Machine learning can also be an asset for preventing payment fraud. From detecting unusual device locations to multiple failed login attempts, algorithms can easily spot suspicious activities that could indicate a hostile account takeover. This helps teams identify payment frauds faster and prevent them as they’re happening.

Go beyond fraud detection

While it’s crucial to prevent fraudulent transactions to keep your business and customers safe, it’s not the only type of unwanted traffic you should keep an eye on. It’s also important to consider potential compliance violations or any type of messaging that can lead to customer complaints. Machine learning can help with both: It can help you stay compliant in your messaging and making sure your customers don’t perceive your communication as spammy.

In the case of staying compliant, you could train an AI on existing regulations and have it flag potential violations – possibly even for different industries or countries. That could be a huge help in keeping your messaging above board and even prevent legal issues.

Another clever use of machine learning could be to let it help you improve the quality of your customer communication. Why not have an AI monitor customer behavior metrics, like an unusual increase in opt-outs or complaints. This could help businesses identify potential issues faster, stop problems earlier, and ultimately improve customer communication.

Promising industries for using AI in fraud detection

Financial institutions, e-commerce businesses, and gaming companies are at the forefront of using AI for fraud detection.

Fintech / finance

As fintechs and financial institutions handle large sums of money, they often get targeted by fraudsters. Machine learning can be a big help in detecting offline and online fraud.

- Watch for unusual traffic (AIT, large volumes of messages coming from a particular region or IP address) to detect suspicious activities.

- Analyze transaction data (time, location, amount) for credit card fraud detection.

E-commerce

Global online payment frauds in e-commerce reached almost $50 billion by the end of 2023. That’s why many e-commerce companies invest in machine learning for fraud prevention. Some interesting applications could be:

- Monitor user patterns that could indicate an account takeover (unusual amount of failed logins, switching login devices in a short period of time, etc.).

- Behavioral biometrics where unusual behavior (typing speed, swiping behavior) is analyzed to identify financial fraud.

Healthcare and insurance

Healthcare and insurance companies could also benefit from AI-based fraud detection, especially when it comes to identifying false claims. ML algorithms can be trained to recognize data discrepancies or false information that point towards insurance fraud.

Gaming

Gaming, and especially online gaming, is one of the fastest growing industries globally. At the same time, it’s challenging for companies to stay compliant with communication regulations that vary by country and even region. In some markets, sending marketing messages around gambling is prohibited, in others it’s allowed, and yet in others, it’s only possible in certain circumstances.

This is another scenario where machine learning can help. By training algorithms to understand compliance rules by region, they can immediately flag if a certain type of message doesn’t meet the local legal requirements. That can help companies stay agile and compliant in their communication and improve the customer experience.

The potential of machine learning for fraud prevention

With its ability to analyze large amounts of data, learn patterns, and make decisions and predictions based on this information, machine learning systems can be a big asset in fraud detection and prevention.

While it’s important not to solely rely on AI to identify fraud, implementing machine learning can be an extremely effective tool for companies in recognizing and stopping unwanted traffic and even help avoid spam and non-compliant communication.

When working with AI tools, you should also make sure that you implement AI responsibly by following best practices, such as establishing ethical guidelines, always informing customers that they’re interacting with AI, following compliance and rules and legal regulations across markets, and using an AI infrastructure that’s safe and secure by design. In the end, that makes fraud prevention more efficient, saves resources, and increases trust in your brand.

Reach out to our AI team to find out more about using machine learning for fraud detection.