5 scalable solutions to elevate customer experience in banking

How to enhance the banking customer experience

Mobile messaging has become one of the most critical channels for banks to reach customers and a fundamental way to futureproof customer relationships and build truly scalable solutions.

As part of our latest consumer research for banking and financial services, we asked 3,000 customers worldwide what kind of banking experiences they value most, what earns their trust and loyalty, and how they want to engage with financial partners. Here’s one of the main takeaways:

Creating a great customer experience in banking is about empowering your customers and delivering value across their entire journey, all while reducing friction. This means meeting your customers in the places and moments they find most convenient.

Our research clearly shows banking customers find value in messaging-based experiences, and best-in-class banks have already embraced this type of solutions to better connect with customers and provide education, insights, and real-time solutions to problems — and, in turn, build deeper relationships and trust.

Let’s dive into some innovative messaging use cases that’ll help you enhance your customer journey and deepen customer relationships in a fast-changing digital world.

1. Prevent fraud and build trust with transaction verification and messaging-based “badges”

When fraud is suspected in a customer’s account, time is of the essence. Messaging is the fastest, most frictionless way to verify transactions and protect customer accounts.

Take Nets, for instance — a leading payment processor in Europe. The company handles millions of daily card transactions and needed a two-way SMS solution that could alert customers of possible fraud in a conversational, frictionless format. Nets hired Sinch to deploy a real-time, scalable messaging solution that verifies transactions in a matter of seconds, instantly approving legitimate customer transactions and stopping fraudulent ones dead in their tracks.

Another critical issue in fraud prevention is ensuring banking customers trust that an incoming message or phone call is in fact coming from their bank.

Financial institutions can give customers visual confirmation that their data is secure, by displaying digital badges to confirm their identity on calls and in messages. They can also encrypt conversations inside a messaging app. Not only does this help protect customers against spammers and phishing attempts, but it also reduces friction by giving customers the peace of mind they need to engage in sensitive conversations with their bank.

2. Deliver critical information and enable meaningful conversations

Instead of using messaging to send one-way banking alerts, give banking customers the chance to reply! Our research clearly shows the importance of two-way messaging conversations in banking:

53% of banking consumers say they’re frustrated when they can’t reply to a mobile message.

“I received a fraud alert about unusual banking activity, but I’m traveling this week. Please don’t flag charges from Scotland.” Helpful and simple!

Now let’s look at another scenario. When customers miss a loan payment or run out of money in their checking account, customer normally get the news via a warning. Increasingly, banks are taking a more proactive and responsive approach to customer hardship to understand (a) what’s driving the issue and (b) how the bank can help customers get back on track.

Rather than sending a one-way “your loan payment is late” notice, banks can use the messaging channel to learn when the customer might be able to make a payment, identify whether the missed payment is part of a bigger problem, and even set up a repayment schedule. This type of scalable solution saves money by reducing customer service calls and provides anonymity for customers when discussing sensitive financial topics — a true win-win.

Nationwide Building Society is a British bank that decided to deploy an expanded messaging-based service to proactively support customers during the COVID-19 pandemic. The company granted a payment holiday to bank customers in the early stages of the pandemic, as so many were hard-hit by the economic fallout. When that period ended, the bank used Rich SMS to provide personalized information about next steps.

The results? Quadrupled engagement and click-through rates compared to industry average.

3. Let customers perform banking tasks and seek support on their own terms

Bank customers who need to perform simple tasks typically still open their mobile app or log in on a computer to get these tasks done. Smart banks are making these simple tasks even easier, for instance by letting customers authorize transactions or pay their bills via messaging.

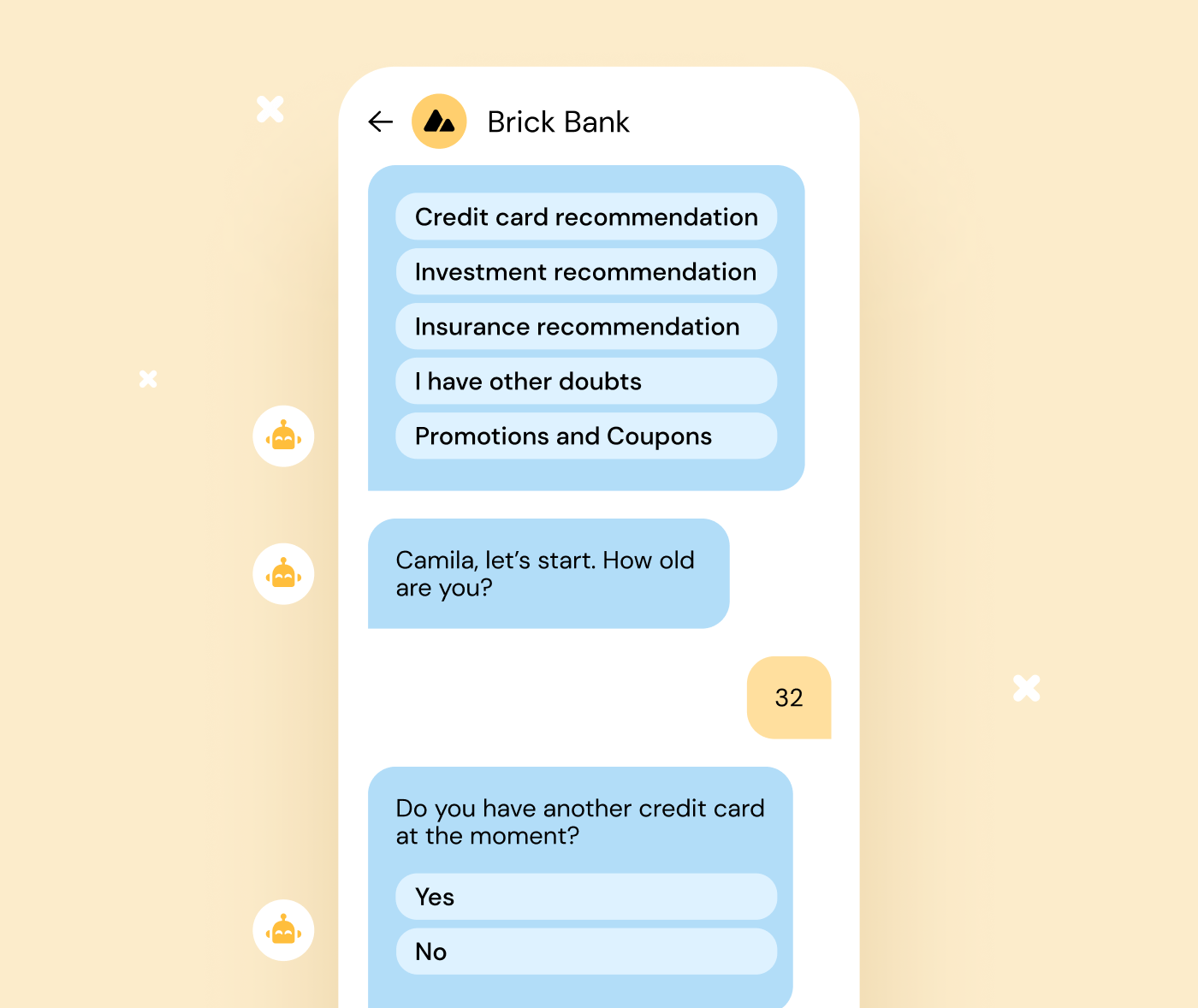

Messaging chatbots can also help banks boost digital sales, for instance by providing customers with a fast and easy way to apply for loans or new accounts, like in the example below.

With the right tools, supporting banking customers when and where it matters is also much easier than it seems.

Conversational AI applications allow banks can create helpful, interactive FAQs and provide instant answers to basic banking questions 24/7 on messaging channels like WhatsApp, Instagram, and more. Not only does it reduce friction, but it also helps increase conversions.

And of course, it integrates seamlessly with other customer engagement solutions like Contact Pro, our omnichannel cloud contact center.

4. Step up customer onboarding with interactive guides and tutorials

Today’s customers expect financial partners to make their life easier. Rich-media, educational content is a perfect way to do just that. Research shows this type of experiences earn high marks from customers:

- 76% would like a buying guide based on previous purchases and activity

- 81% would like a personalized video tour

- 83% would like a video tutorial based on a recent purchase

What would this look like in real life? Offer a personalized video tutorial to banking customers about how to boost their credit score, send a video tour to new credit card customers with details on what to expect on the first bill, or distribute an interactive buying guide for new home buyers applying for mortgage loans based on their financial maturity.

Sending out promotional mobile messages can be challenging if a customer isn’t willing to receive this type of notification. Banks can use messaging channels to find out what types of offers customers are interested in, or funnel them to their online settings to set up the types and tempo of notifications they want to receive.

Developing personalized messaging is a great way for banks to futureproof their customer relationships and deliver more value to the people they serve, all while increasing conversions with relevant product recommendations based on their financial history and needs, like loan or credit card offers. And with rich messaging channels like WhatsApp, Instagram, Facebook Messenger, RCS, or Apple Business Chat, it’s easy to create compelling campaigns that instantly grab attention.

And what if you could offer a personalized financial assessment to your customers or show them their monthly spending patterns to help them meet personal finance goals?

Nearly 90% of the consumers we surveyed said they’d like to receive personalized financial advice from their bank, but fewer than 3 in 10 get this today.

Many banking apps now incorporate spending insights into customers’ dashboards to help them manage their finances, but these insights are only visible if you log in.

Using messaging, banks can build deeper connections with customers, for instance, by giving them real-time updates about how they’re tracking relative to spending (“Tony, you’ve spent 80% of your dining-out budget for December!”).

Customers can set preferences using the app but get in-the-moment notifications over messaging. They can even query a chatbot to see how much they’ve spent before making a purchase — like asking a slightly more responsible but appreciated friend to help them make wise choices.

And for those who respond better to the carrot than the stick, messaging is also a great way to encourage savings. Using the app, banking customers can set monthly savings goals and activate savings features such as rounding up on purchases and depositing the difference to a savings account. Then, using the messaging channel, banks let customers know how they’re doing each month, send out badges for hitting milestones, and even reward customers with loyalty points.

Build a futureproof banking customer experience with smart digital solutions

With more and more banking being done digitally, mobile messaging offers banks the opportunity to forge a new kind of online customer relationship — one that’s more conversational and customer-centric.

Using AI-powered chatbots, conversational channels, and video, banks can deliver scalable solutions, reaching customers with the information they need, where and when they need it.

Whether it’s sending personalized offers, answering simple inquiries, securing accounts, or providing guidance toward financial goals or a safe ecosystem for conversations, smart technology helps banks become a financial partner customers can turn to for fast, convenient, individualized service, all while optimizing conversions and costs.

“Technology enables a superior customer experience. Mobile messaging is integral in the mix…vital in delivering not just messages, but on our promise of meeting customers where they want to be met.” — Kelly Kaminskas Digital and Retail President, FirstBank.

Want more tips on how to create personalized banking experiences that foster lasting customer relationships? Take a look at our report, Bank to the Future, to explore all the findings from our global consumer research, or download our complete guide to financial services communications below.