Customer Story

How Argenta banked a 95% CSAT score with an AI chatbot

Overview

Challenge: Help overworked agents focus on more complex customer service tasks

Solution: A chatbot called Charlie to handle FAQs and help ease the load

Results: Significant improvements in CSAT scores due to improved customer support

“Our new colleague Charlie is doing very well. Because of its quick reaction to simple questions, we can focus on the real work.“

As Belgium’s fifth-largest banking institution, the Argenta Group is famous for its excellent customer service. In an industry where, on the one hand, high-quality service is one of the most important aspects for customers and, on the other hand, hard to achieve, the Argenta Group really stands out.

According to global data, Belgium has one of the lowest customer satisfaction (CSAT) rates for banking. Argenta proved, however, that it’s possible to go against the grain. By introducing an AI-based chatbot, Argenta increased their ratings and reached a CSAT score of 95% in their contact center!

Challenge: Helping overworked agents

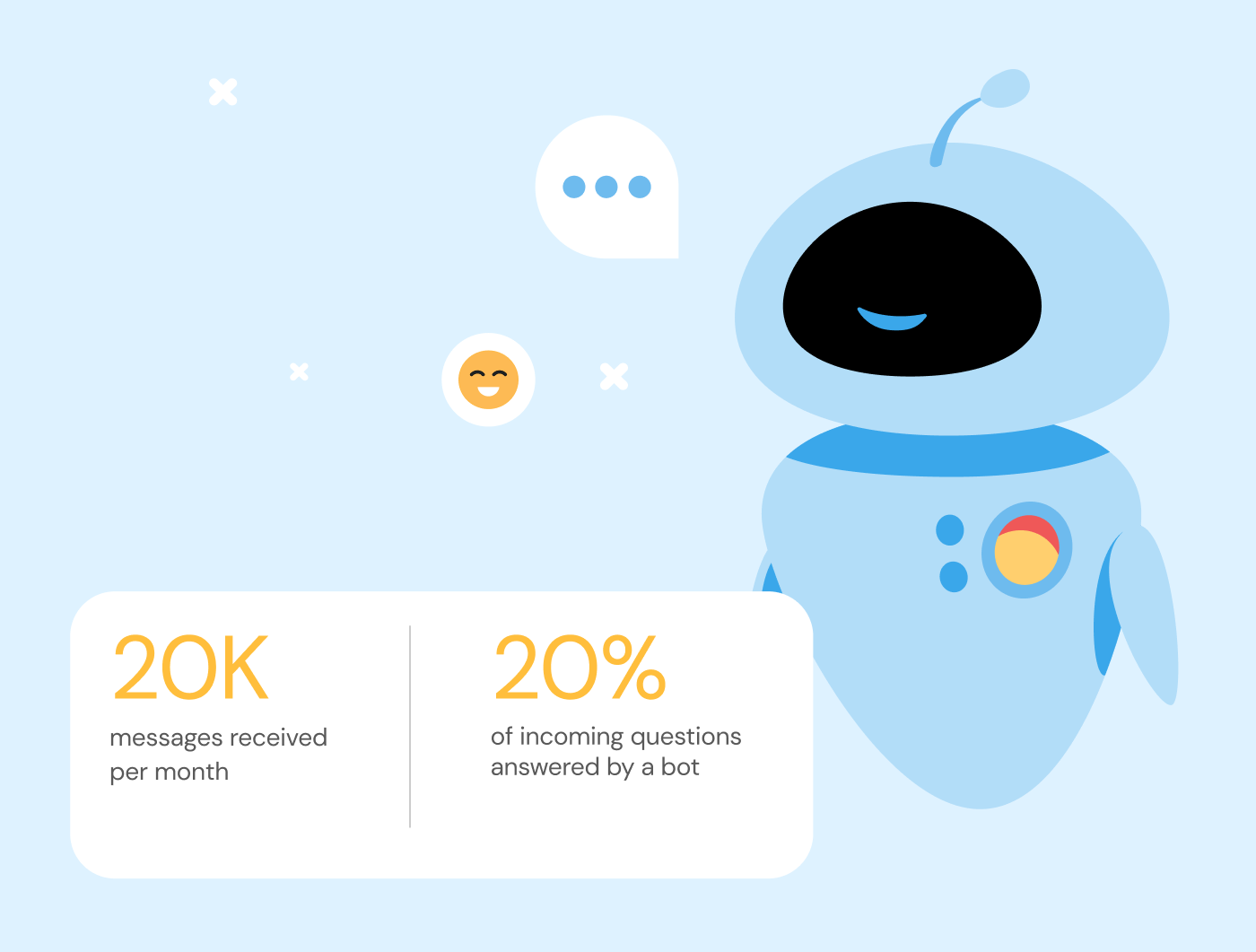

Argenta’s customer support team gets more than 20,000 messages per month. Answering requests quickly and ensuring high-quality service levels became a challenge for the team of 23 agents. Not only were they overloaded, but they were wasting valuable time answering basic and repetitive questions.

The three main areas where agents lost the most time were:

- Basic FAQs

- Basic intent detection and data capture for specific transactional flows

- Conditional data detection and capture for increasing daily limits

Argenta needed a smart solution. Together with Chatlayer by Sinch and their implementation partner Campfire AI, they introduced a new team member: the Conversational AI chatbot, Charlie.

Solution: Helping agents and customers with smart technology

Charlie is Argenta’s virtual assistant. He lives inside the Argenta mobile banking app to help answer some of the most common customer questions and complete transactions. Charlie covers around 20% of all incoming questions.

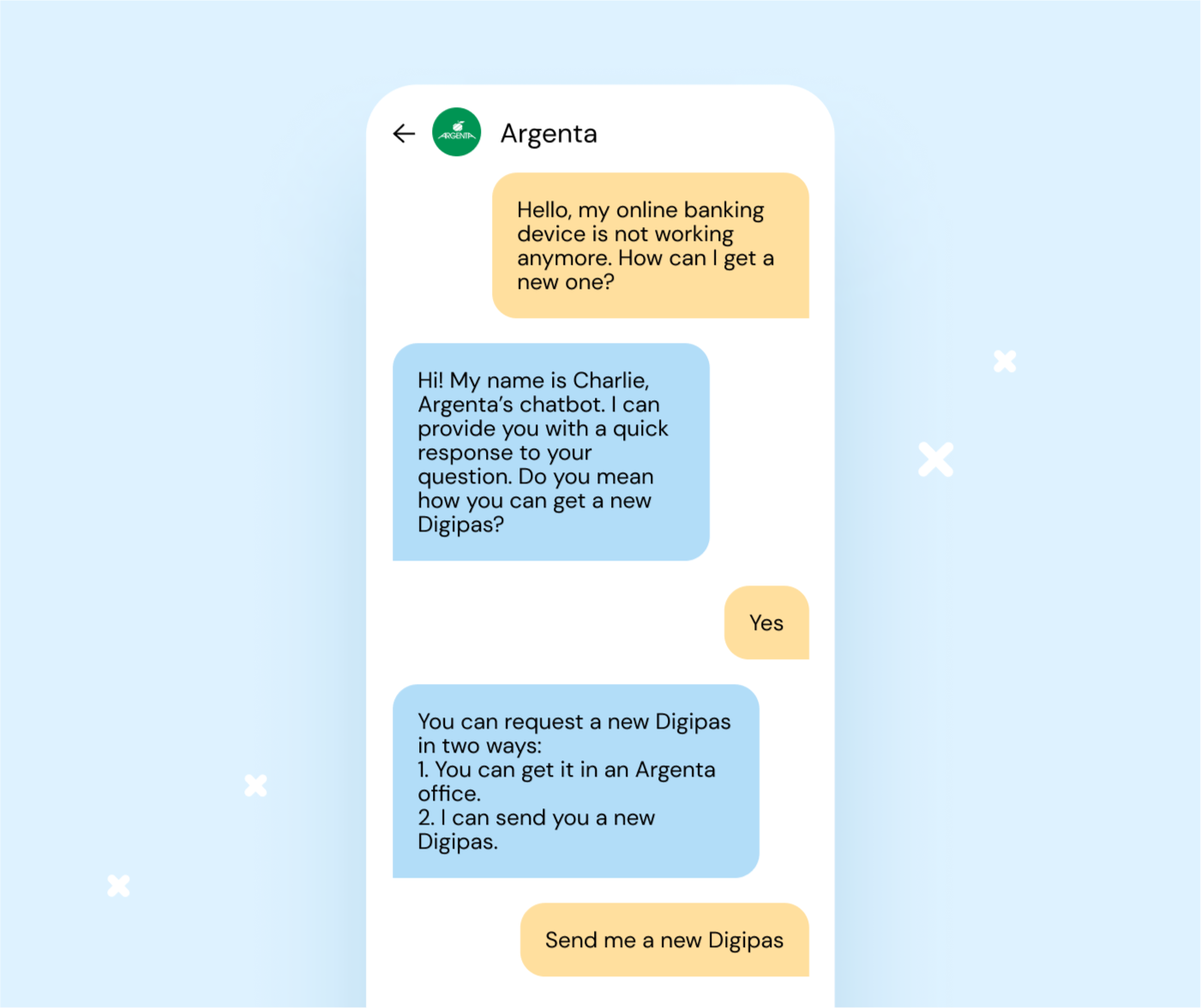

The most often asked question and requested item is a new card reader. The batteries expire, so customers need a replacement. This question is easy for a bot like Charlie to deal with. So, instead of bothering a live agent with this simple request, Charlie detects when a user asks for a new card reader and responds with a data capture flow that collects the user’s name, address, email, and other important information. Charlie then sends the information and the new card reader request to a specific team within Argenta, who check the request and prep the card reader for dispatch.

Successful partnerships for the win

The smart technology behind Charlie is the key to such smooth support. Aside from Chatlayer’s conversational AI technology, Argenta’s agents also use Hootsuite’s live chat platform Sparkcentral, which allows a seamless hybrid fall-back set-up between agent and bot.

Bringing these two technologies together with the help of Campfire AI makes Charlie successful. It also shows the added value that successful tech partnerships can bring to a company.

Results: Higher customer satisfaction with Argenta’s chatbot

The new team member, Charlie, solved not only one but two problems for Argenta: reducing the workload for agents and meeting Argenta’s high standards for customer support.

For one, Charlie handled 20% of incoming conversations, which saved 24 hours of work for agents in the first one and a half months alone! It’s important to note that if Charlie doesn’t know an answer, the conversation gets routed to a live agent, so the same high-quality conversation is supported. This is a win-win for the customer and the support team!

Secondly, thanks to Charlie’s great work, Argenta increased their CSAT score. As clients were getting help faster and more efficiently, Charlie’s CSAT score shot up to 80% in messaging channels and 95% in the contact center.