Insights, Operators

The recipe for business messaging adoption

By Robert Gerstmann, Chief Evangelist and co-founder at Sinch

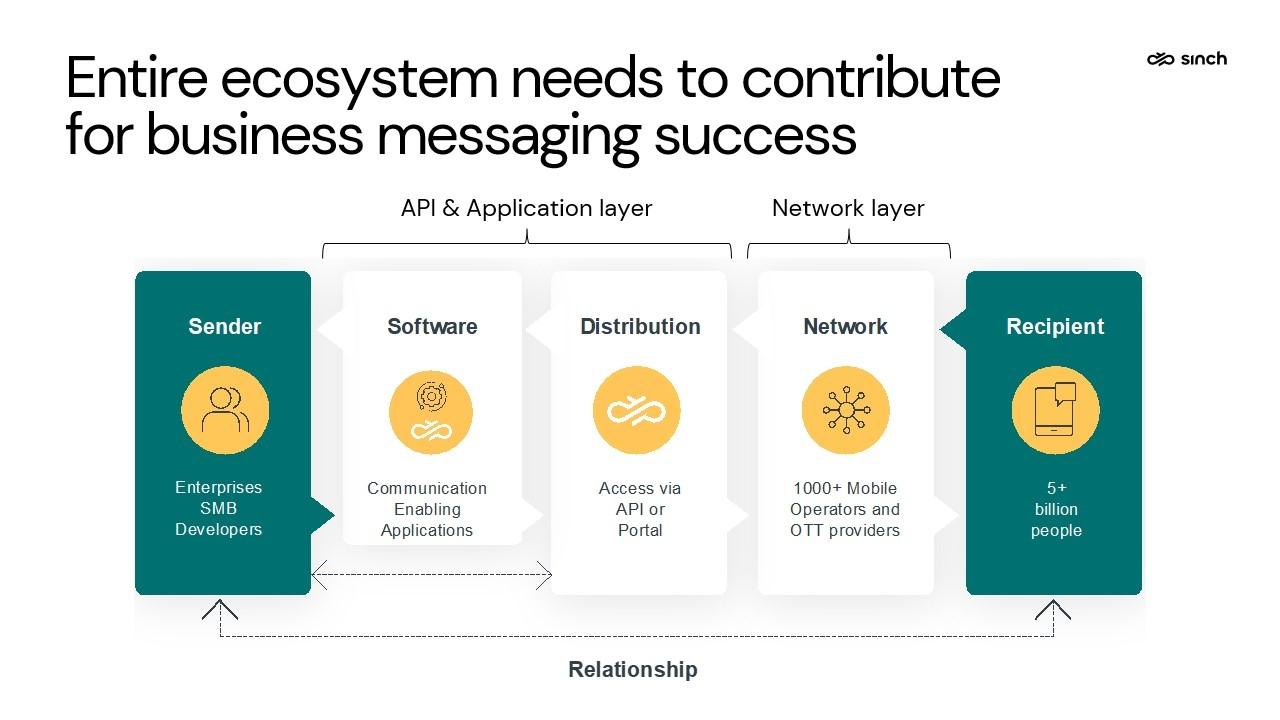

Gone are the days when business messaging was one-sided and focused only on notifications, one-time passwords or basic marketing. Today, consumers are coming to expect nothing less than immediate, interactive, two-way communication with businesses. This shift affects not only those businesses themselves, but also mobile operators, Over-The-Top providers (OTTs) and CPaaS providers who are integral parts of the messaging ecosystem.

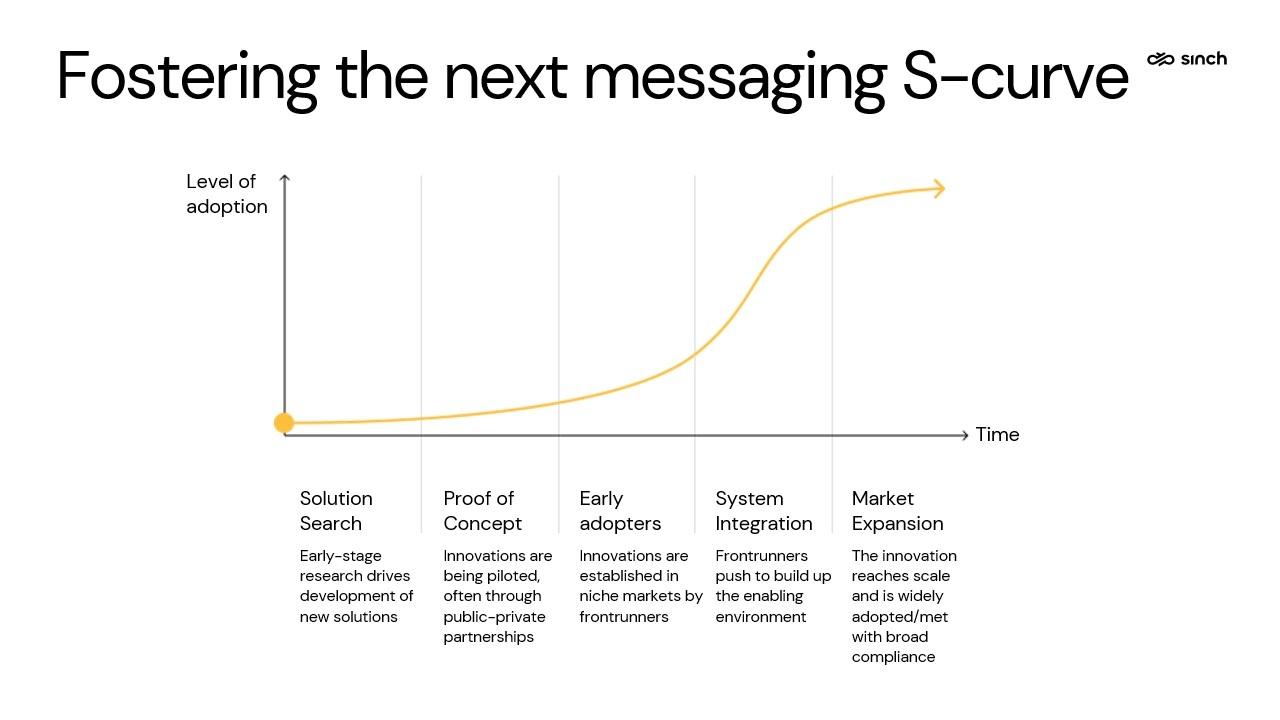

I see a need to nurture the next phase of business messaging to achieve the next messaging S-curve. While SMS has had a fantastic run over the past 20 years, we see its growth tapering off. As SMS growth reaches a plateau, conversational channels like WhatsApp and Rich Conversational Services (RCS) are on the rise, offering great promise for the future. I believe these two channels will be dominating the next generation of messaging, outside some specific Asian markets where other OTTs dominate.

With WhatsApp already demonstrating significant potential and early signs of meaningful growth for RCS, particularly following Apple’s announcement that they’ll support RCS in 2024, we’re witnessing a market shift towards delivering richer, interactive experiences to consumers.

But how can the industry make the next era of business messaging even more effective for customer engagement?

In this article, I’ll cover how businesses can adapt to the changing world of messaging, and why collaboration across the industry, from brands, to mobile operators and OTTs, from cloud platforms and Application Service Providers (ASPs), to CPaaS providers, is crucial to making this happen.

How brands are currently using messaging

Brands face and will continue to face very different challenges, influenced by their specific use cases, geographic focus, and target demographics. Let’s dive into the primary four use cases where brands leverage messaging and CPaaS solutions:

- Marketing: Brands use messaging to promote products or services.

- Utility messages: Providing practical information like reminders, delivery notifications, or appointment confirmations fall under this category.

- Authentication: Sending passcodes that serve a critical security function, like ensuring the legitimacy of online transactions or account access. Two-factor authentication (TFA) is a common example.

- Customer care: Involves sending two-way messages, typically user-initiated messages to a brand. This is less common in SMS as care is mainly handled via calls to contact centers or webchat, but there’s considerable growth potential as messaging becomes more conversational.

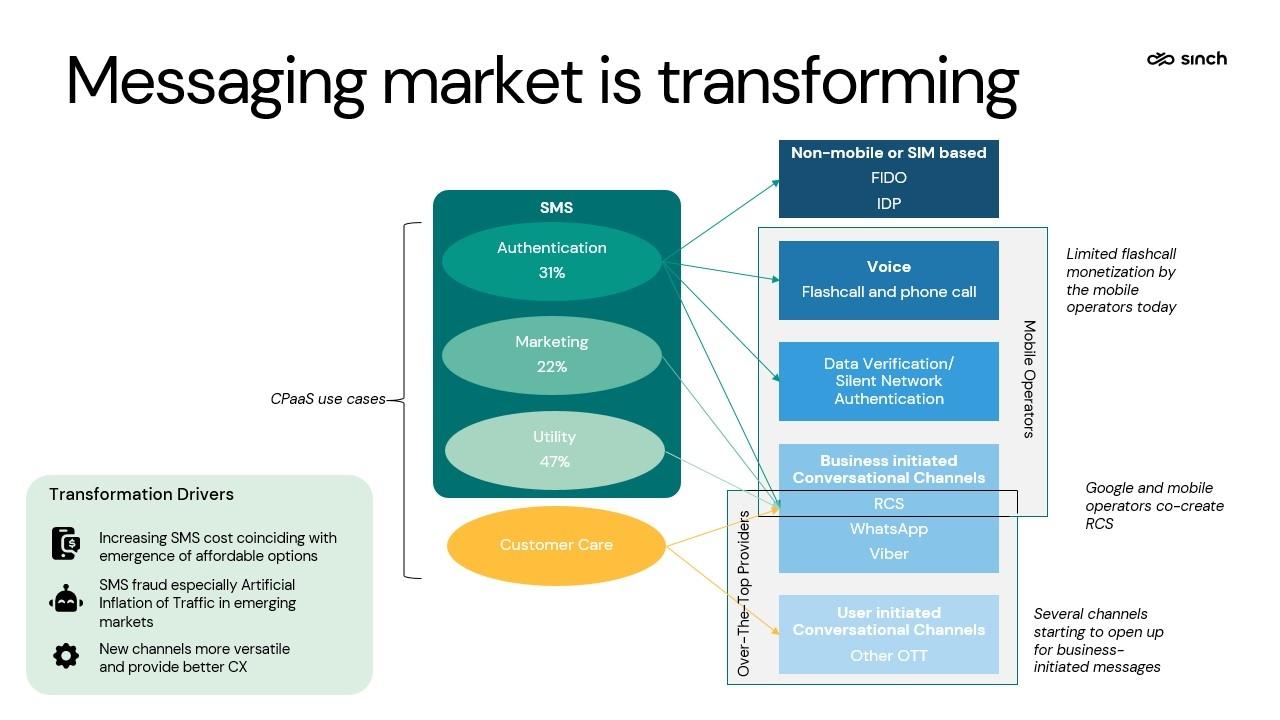

Currently, global SMS traffic is dominated by the first three use cases above. However, as time goes on, brands will increasingly adopt a variety of channels and solutions to address each specific use case differently.

Knowing how brands use messaging today helps us understand the changing market – and what the industry needs to do to help businesses into the new era.

The messaging market is transforming

The messaging market will undergo a significant transformation as the use cases above continue to move to channels other than SMS. For example, some authentication use cases will move off the SIM card all together to FIDO and identity provider (IDP) authentication. Moreover, a portion of authentication services are migrating towards voice-based solutions, whereas yet another portion will be leveraging number verify authentication facilitated by dedicated APIs that the mobile operators provide.

In tandem, the remaining part of authentication together with marketing and utility use cases are increasingly embracing conversational channels like WhatsApp, RCS, and Viber, signaling a departure from traditional SMS. This shift is not only driven by the rising cost of SMS (mainly a phenomena in some emerging markets) but also underscores the opportunity for enriching customer experiences through rich-media infused conversations with brands.

Finally, businesses will start using messaging for customer care as conversational channels allow for cost savings through automation leveraging bots while providing better customer experience at the same time.

In parallel with these changes on use case level, brands will need to continue to navigate the other factors I mentioned above – geography, and customer demographics – and keep an eye on the cost/benefits of their customer communications to ensure they’re choosing messaging channels that both resonate with their audience and deliver a good ROI.

1. Changing industry dynamics due to the rising cost of SMS

As SMS costs rise in some emerging markets for international traffic, multinational businesses are actively transitioning their traffic from SMS to other channels. The vast majority of this traffic is related to authentication use cases. This trend is compounded by high levels of Artificial Inflation of Traffic (AIT) fraud in many of these markets making the cost for businesses even higher.

OTT providers are establishing themselves as key players in business messaging, many times offering more cost-effective messaging alternatives. For instance, in many emerging markets that already show high penetration rates, WhatsApp is driving conversational messaging adoption via price.

In markets like Germany, where high SMS cost has hampered the market for non-critical messaging cases, RCS could pose the opportunity to grow messaging penetration beyond the most critical use cases by providing more value to both brands and consumers at the same price level as SMS.

2. Every market has different paths for business messaging adoption

Every market has its own challenges and opportunities that businesses need to consider, from Brazil’s near ubiquitous WhatsApp penetration making it a preferred channel for businesses to Germany where the data privacy concerns of big businesses are hampering WhatsApp usage.

In the U.S., affordable pricing has already driven conversational use cases on SMS, and combined with the widespread sending of rich content through MMS means that businesses are more than ready to leverage conversational messaging once channels reach critical penetration, something for which I have high hopes.

Ultimately, success will depend on how effectively the industry and businesses navigate these unique market challenges, while also leaning into the opportunities presented by new messaging technologies.

3. Every customer is different – and they expect to be treated that way

Customers have different communication preferences, and they expect brands to recognize and adapt to them individually.

For multinational businesses, this becomes more difficult when demographics vary so much between regions. For example, the median age in Japan is 32 years higher than the median age in Nigeria. That’s huge – we know that what works in Japan won’t work in Nigeria, and vice versa.

And in countries like the U.S., there are big splits in demographics. For example, in the U.S., where WhatsApp use is just starting to rise, Hispanic Americans are already using WhatsApp at high rates due to their ties to Latin America.

The takeaway? To succeed in business messaging, brands need to know their customers well. As an industry, we need to help them navigate this effectively.

Building the foundation

What can we do as an industry for successful business messaging adoption? We all have parts to play here, from operators and OTTs, from CPaaS providers, to Cloud Platforms, ASPs and brands. Let’s look at some of the key factors we need to build this foundation.

Watch the video to learn how Sinch is preparing for a new era of rich business messaging that empowers businesses to deliver more value.

What mobile networks, Google, Meta, and other OTTs need to do

Mobile network operators, Google, Meta and other OTTs, i.e. the network providers, play a crucial role in the future of business messaging adoption.

First, they’ll need to ensure adequate coverage. This is the single most important factor for adoption, and one of the key reasons why SMS has been so successful, with 5.1 billion people using with a single channel. This will mean ensuring that a critical mass of people adopt a certain channel.

WhatsApp already has over 2 billion monthly active users worldwide and are doubling down especially in America to grow its user base. For RCS achieving critical mass will be made easier with Apple’s support. Although not explicitly stated by Apple, I believe Apple will start supporting RCS business messaging through a staggered geo roll-out starting with the release of iOS18 in September 2024. Adding the iOS user base to the existing RCS base will create an even bigger footprint than what WhatsApp has today.

Second, they’ll need to address cost concerns. Brands need predictability and affordability in messaging services to justify their investment and ensure positive ROI compared to other communications channels. Network providers will need to strategize pricing models to incentivize adoption and maximize revenue potential.

Third, they’ll need to prioritize ease of use. How easy is it for an enterprise to leverage messaging over a specific channel? This will be part of an enterprise’s business case, so it needs to be as smooth as possible. Implementing features like national Sender ID verification and possibly onboarding coordination would help RCS close some of the gap to WhatsApp, as RCS is more fragmented in nature as split between multiple mobile operators per market.

Additionally, engagement analytics in the form of read receipts are a great improvement over SMS, and advancements in user experiences like integrated payment capabilities being launched in WhatsApp offer a significant potential for growth. Leaning into these advancements can enhance the appeal of messaging channels to marketers and streamline communication processes for businesses.

Last but not least, building trust in messaging platforms is fundamental. While challenges exist regarding privacy with platforms like Meta, and encryption questions about RCS, both channels offer improvements in security over SMS especially when it comes to combatting smishing.

By focusing on these aspects, the network providers can lay the groundwork for the continued growth of and success of mobile messaging. But they’re not the only ones with work to do in the ecosystem.

What CPaaS providers, ASPs, and cloud platforms need to do

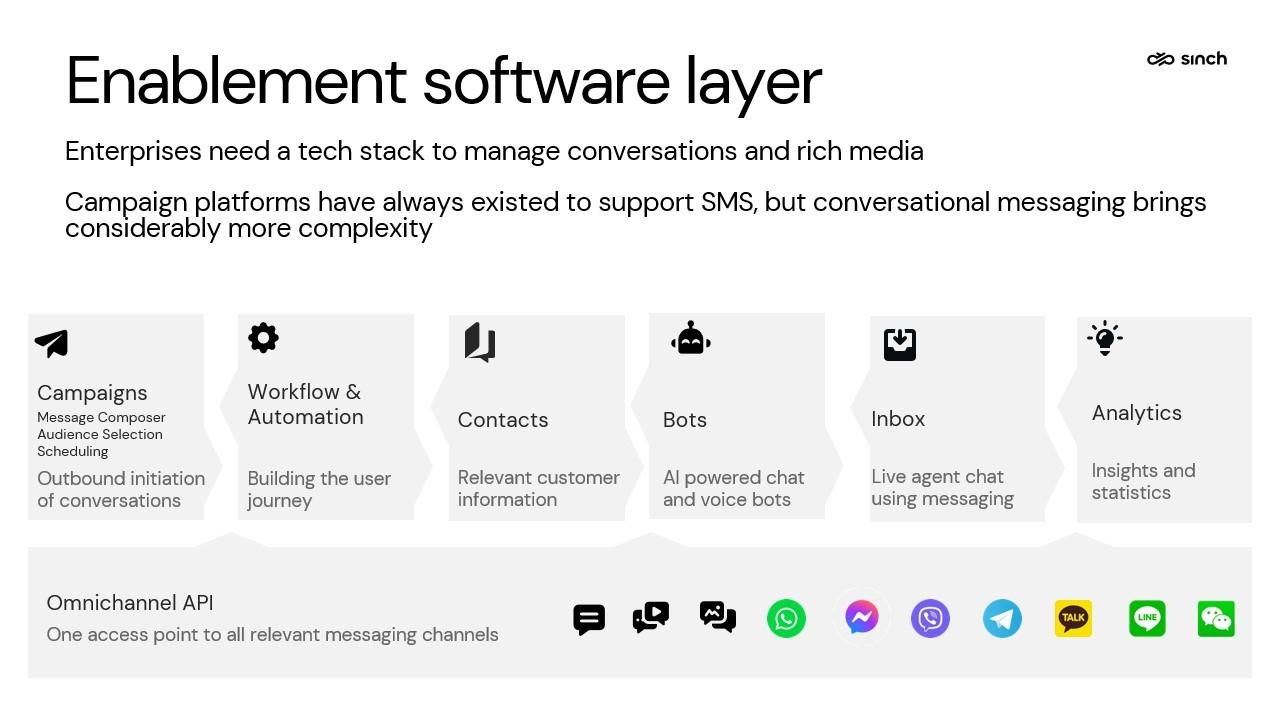

To ensure business messaging adoption, CPaaS providers will need to focus on two key elements: providing a versatile conversational messaging enabling software layer and fostering a vibrant software ecosystem via their ASP, and cloud platform partners.

Let’s start with the enablement software piece. Enterprises need a tech stack that manages conversations and rich media effectively. This entails different things, like developing AI-powered bots that can automate various tasks to free up human resources and enhance efficiency while improving customer experience.

Additionally, seamless integration of these bots with contact centers is essential for smooth customer support when bots encounter complex issues.

And there’s a need for an omnichannel API to support this software layer, allowing businesses to access messaging channels matching their specific market needs. Whether you’re operating domestically or internationally, meeting the different consumer preferences will require businesses to leverage each individual consumer’s channel of choice.

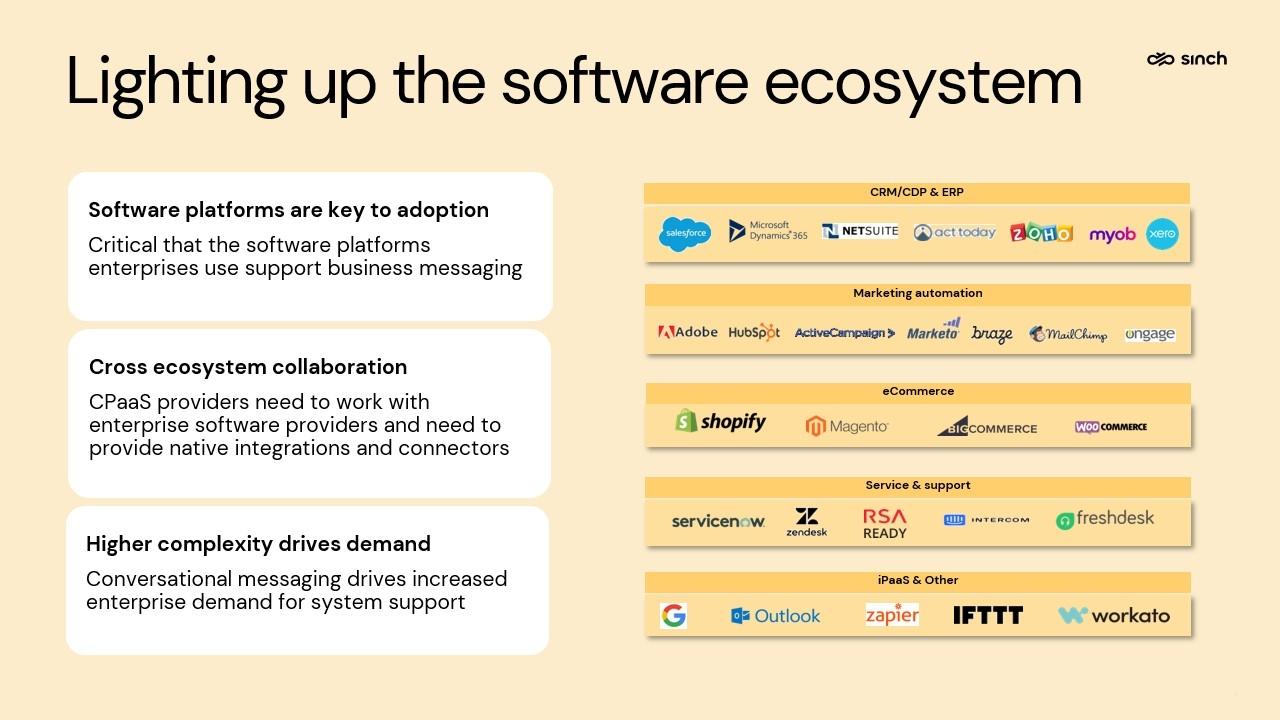

Next, let’s talk about the software ecosystem. Enterprises currently use various software solutions for different aspects of their operations, and the effective adoption of conversational messaging hinges on these systems being integrated with the relevant channels. A lot of SMS traffic already comes through these types of systems – so with conversational and rich messaging, the complexities of what needs to happen will grow.

CPaaS providers, with their channel expertise, will have to collaborate with cloud platforms and ASPs to ensure smooth integration processes, either by developing native integrations to cloud platforms or by providing simple connectors that enable businesses and ASPs to use messaging channels with their existing software infrastructure.

Business messaging is changing rapidly, driven by evolving consumer expectations and technological advancements.

The businesses that ultimately are successful in leveraging the next generation of business messaging to provide their customers with superior experiences will be the winners in their respective markets.

The shift from SMS to conversational channels like WhatsApp and RCS is happening now, and marks a pivotal moment for businesses, mobile operators, OTTs, and CPaaS providers alike.

We need APIs, purpose-built software, and solid support from mobile operators, Meta, Google, and other OTTs to really unlock conversational messaging and see meaningful growth for the benefit of everyone. Embracing innovation, addressing costs, prioritizing user-friendliness, and building trust are keys to laying a strong foundation for continued growth and success in the next generation messaging era.

By collaborating across the industry and staying responsive to consumer preferences, we can navigate this transformative period with confidence, together.

This article is adapted from a presentation given at Mobile Ecosystem Forum (MEF) Global Forum in February 2024. Watch the full video presentation.