Insights

The RCS advantage: Transforming messaging in financial services

With new opportunities and challenges shaping the financial industry, keeping customers engaged is the foundation for success. As consumer expectations and security threats rise, financial institutions must deliver the trust, security, and interactivity today’s banking customers expect.

And while traditional SMS has been the cornerstone for mobile communication, the growing adoption of Rich Communication Services (RCS) is reshaping the messaging landscape, ushering in a new era of engagement.

Let’s dive into how financial institutions can use this next-generation messaging to deepen trust and build lifelong customer relationships.

The growing demand for secure, interactive messaging in financial services

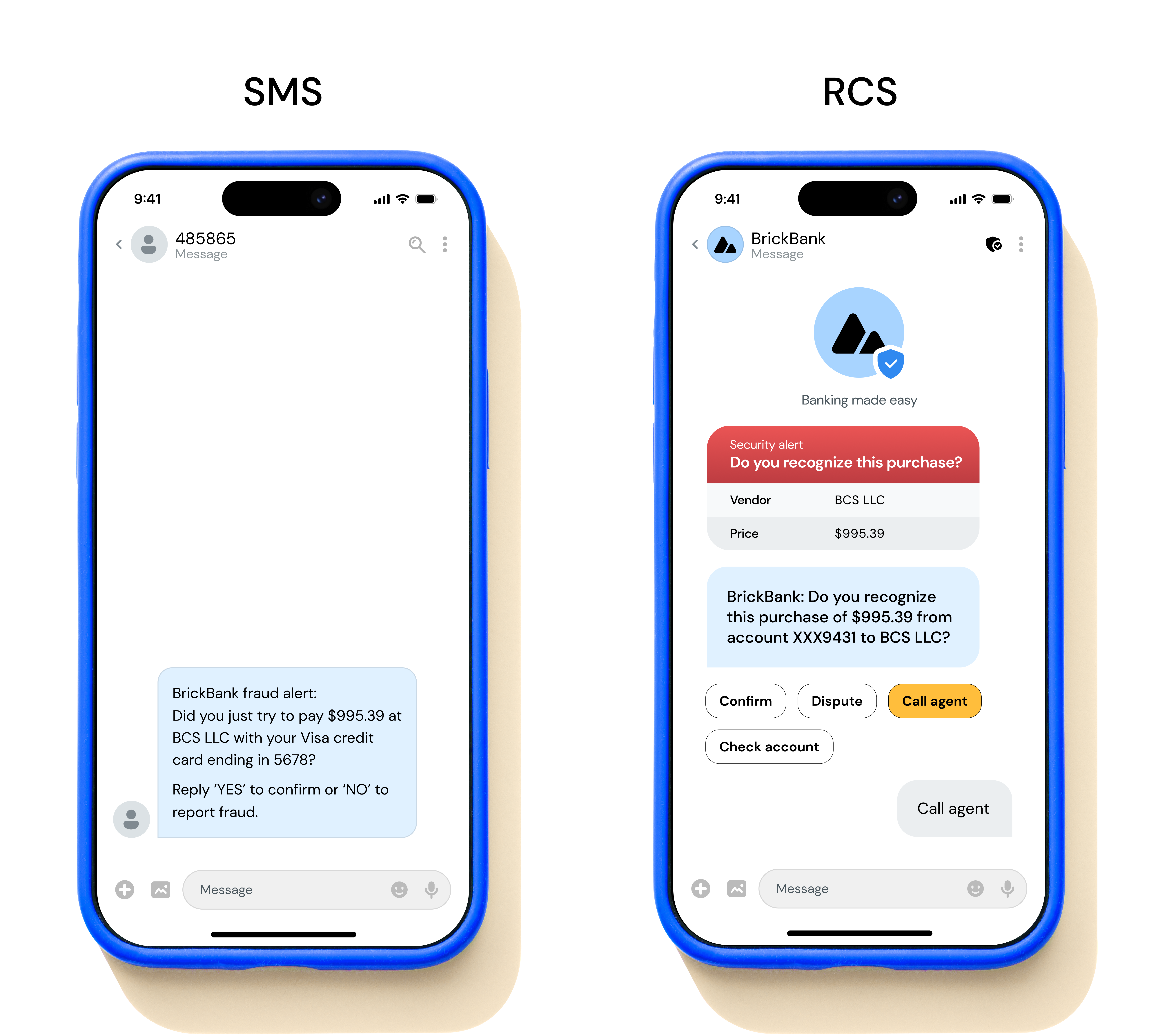

In the first half of 2023 alone, Americans received approximately 78 billion spam texts, causing around $13 billion in losses. That’s more than just a nuisance – it’s a major security threat. As fraudsters hone their tactics, financial institutions must remain vigilant to protect their customers. RCS offers a more secure and trusted messaging experience, perfectly suited for the financial sector’s needs.

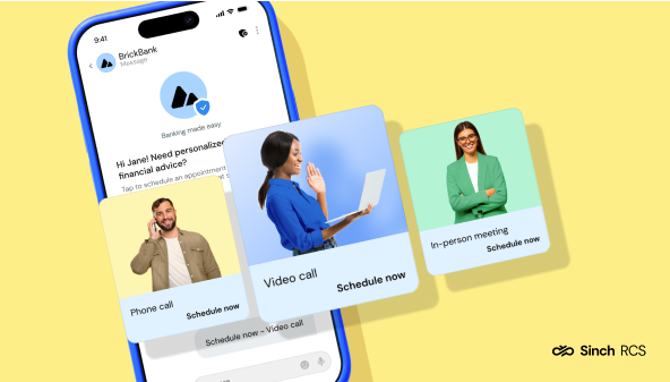

But RCS isn’t just about security. It supports multimedia — like images and videos, cards, carousels, and suggested replies and actions — making it a more interactive and immersive channel. It’s the next step for financial organizations looking to level-up their customer engagement.

6 key RCS features for financial services

RCS empowers financial institutions to build stronger connections with customers, offering experiences that go beyond plain text. Here are some of the top features that RCS has to offer:

- Verified sender agents: RCS business messaging requires brand vetting and verification, making it nearly impossible for fraudsters to impersonate legitimate brands. Every message comes from a verified sender profile with the business’s name and logo, so recipients know it’s really their bank.

- Branded messaging: RCS helps financial institutions to keep their brand front and center with company colors, logos, and business profiles for instant recognition.

- Encryption: RCS protects sensitive information as it moves between users with encryption in transit and, in some cases, end-to-end encryption. It’s the level of security financial institutions – and their customers – expect.

- Rich media: RCS transforms plain text messaging into dynamic conversations with high-quality personalized images, videos, and suggested replies.

- Read receipts: One key difference between RCS and SMS is better analytics. With RCS, banks can get real-time feedback on how messages perform, with read receipts and detailed analytics to improve future communications.

The benefits of RCS for financial services

RCS offers endless opportunities for financial services organizations to truly transform how they engage with customers. Here’s how:

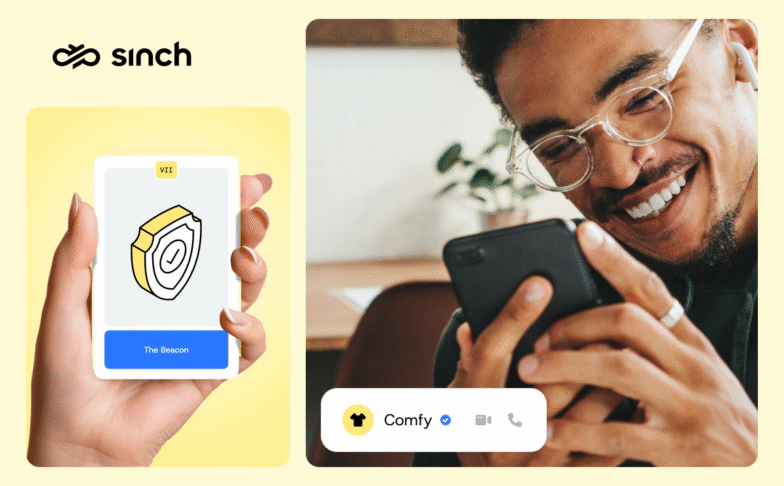

1. Security and trust

Trust is everything in finance – lose it and the relationship crumbles. In fact, 73% of customers equate security with trust in their bank. RCS provides the tools to safeguard that trust.

Let’s say a customer receives an RCS message alerting them to unusual account activity. Not only is the message branded, but they also see it’s been sent from a verified sender: clear proof this is an official alert, not a phishing attempt.

2. Interactivity

Effective communication drives customer satisfaction, and in today’s competitive financial services landscape it’s no longer optional – it’s essential. One in three customers has switched banks simply because they wanted better communication. RCS delivers, allowing financial organizations to create real-time, interactive experiences that foster loyalty.

Imagine sending real-time notifications for deposits, withdrawals, transfers, and payments – with suggested actions and replies right in the message inbox, leading to a seamless user experience that increases conversion rates.

3. Actionable insights

With read receipts and enhanced analytics, banks and financial organizations can gain critical insights into how well their messaging and customer engagement strategies are working.

Imagine a bank sends a marketing promotion. With RCS read receipts and analytics, the bank can track which messages got the most engagement, click-through rates, and how long customers spent viewing messages. These insights enable financial institutions to fine tune their campaigns for even better results.

Driving business impact through rich communication

The numbers speak for themselves: RCS delivers results that other messaging channels can’t match. Businesses using RCS have seen an 80% conversion rate in their campaigns and three to seven times higher click-through rates than with Rich SMS. In fact, French Insurance company Macif saw a 200% increase in click rates with RCS compared to their email campaigns.

With RCS, banks and financial organizations can level-up their messaging to meet today’s customer expectations. And when you fold RCS messaging into an omnichannel communication strategy, you ensure you’re driving deeper engagement throughout every step of the customer journey.

Going beyond messaging: The full suite of Sinch solutions

RCS is a game-changer, but it’s just one piece to the puzzle. Sinch’s omnichannel approach combines RCS with voice, email, and verification services, offering a holistic solution for financial institutions looking to create a seamless, secure communication experience across every channel. With 51 billion interactions annually for hundreds of financial services clients, we have the experience, innovation, direct carrier relationships, and tier 1 global Super Network to connect you with your customers.

Conclusion

RCS is set to transform how financial services institutions communicate with their customers. By embracing RCS, financial institutions can build trust and loyalty, deepen customer relationships, and drive meaningful interactions. The future of messaging is here – and it’s powered by RCS.

Ready to take your financial communication to the next level? Request to register your brand, or contact a Sinch expert today to explore how RCS can revolutionize your customer communications.