Insights

Know your Customer: The importance of KYC when it comes to international numbers

Service providers are working harder than ever to verify a customer’s identity and business operations to identify entities that might send unlawful robocalls. This process is known as “Know Your Customer” and is commonly referred to by its acronym KYC. In addition to KYC, service providers also work (or should be working) to know the traffic being sent by their upstream providers (i.e., your customers), and in some cases your customer’s customer.

While the Internet makes remote communication easier and more accessible, it also complicates interactions, especially for businesses. It’s now easier than ever to impersonate someone else or create a false identity.

The risk associated with impersonations is a challenge businesses face when interacting with customers. If your business operates with global or international communication providers, making sure you’re talking with the right people is vital to maintaining effective compliance.

What is KYC?

“Know Your Customer” encompasses all the tools businesses use to verify the identities of their customers. The acronym KYC carries legal weight, especially for banking and insurance agencies who must ensure the people they’re working with aren’t at risk of financial crimes like bribery or money laundering.

But KYC extends well beyond the financial sector. Any industry communicating with clients and partners all over the world should do their part to ensure legal compliance and to verify the identities of their customers. KYC protects your clientele from becoming victims of scams and robocall activity, network impacts, and more.

KYC first comes into play when you’re onboarding a new client. Are they a legitimate customer? Are they who they claim to be? Are they going to utilize your network and services for appropriate and legal reasons? It is critically important that your KYC efforts continue even after initial validation and onboarding, through the entire customer lifecycle (e.g., monitoring traffic, participating in tracebacks, and many other activities), in order to support compliance efforts.

Why it matters: The benefits of KYC

Implementing the rigorous checks required for KYC compliance seems like it takes extensive effort, so why should businesses prioritize it? KYC has many benefits.

Due Diligence

KYC essentially gives you due diligence procedures which will prevent your business from carrying illegal traffic, nuisance calls, Wangiri scheme (one ring and disconnect call), and more. An investment in KYC is ultimately an investment into your overall risk management system.

Better customer experiences

As competition in the communications sector ramps up, customers are expecting faster and more convenient service than ever before. The more you optimize the essential KYC process, the better the customer experiences you deliver while still maintaining high standards of compliance.

Improved data quality

Businesses must collect data, and analyze it, to make more informed business decisions and drive their corporate strategies. Making sure the data is accurate is a large part of the job. But, according to a study from Gartner research, poor data quality costs organizations as much as $15 million a year.

How KYC applies to international calling

If you’re an telecommunications provider, Know Your Customer comes into play whenever you work with international or global phone numbers.

Say, for instance, you’re serving countries in the European Union. Because of the unique data privacy laws of each region, identity verification is naturally required when collecting data on those customers.

You’ll also need authentication measures whenever customers perform sensitive activities, such as registering new wireless hotspots, accessing personal files, or making payments.

Another aspect to consider is inbound DID service. If, as part of your inbound calling service, you provide international or global telephone numbers to a corporation, make sure you know whether that company will use the numbers directly or act as a reseller and provide them to its own customers. If they intend to use the numbers for their customers, the diligence you perform is known as “Know Your Customer’s Customer” or KYCC. Moreover, in some cases, global phone numbers cannot be “passed down” too many times or at all.

Examples of government regulations dictating KYC responsibilities

It turns out KYC is a universal necessity, and countries across the world have dedicated legislation mandating it. While many laws mainly target the financial sector, KYC responsibilities are expected for many industries. A few examples of those laws include:

- The Patriot Act in the United States made KYC practices mandatory to prevent money laundering and terrorism funding.

- The Traced Act and the FCC Fourth Report and Order made it mandatory to properly vet customers and know your customers before providing them voice telecom services.

- FCC order 22-37 requires international gateway providers to “Know Your Upstream Provider” if you’re bringing traffic into the United States.

- Canada’s Know Your Customer/Anti-Money Laundering (KYC AML) regulations have been tweaked multiple times since their introduction in 2019, particularly to accelerate the verification process.

- Europe’s AML5 and eIDAS outline the digital identification methods used to secure communication between customers and remote banks and insurance agencies.

- Mexico’s Credit Institutions Law dictates the use of online video identification methods in the country.

We can generally categorize what the law requires businesses to cover into two categories: due diligence responsibilities to watch over their own KYC compliance and an obligation to let customers and business partners know about potential incidents.

Government sanctions for KYC-related non-compliance are notoriously stringent, sometimes costing significant amounts of money in fines and potentially damaging the reputation of the company itself. However, adopting the right KYC procedures into your organization can help you greatly mitigate the risk.

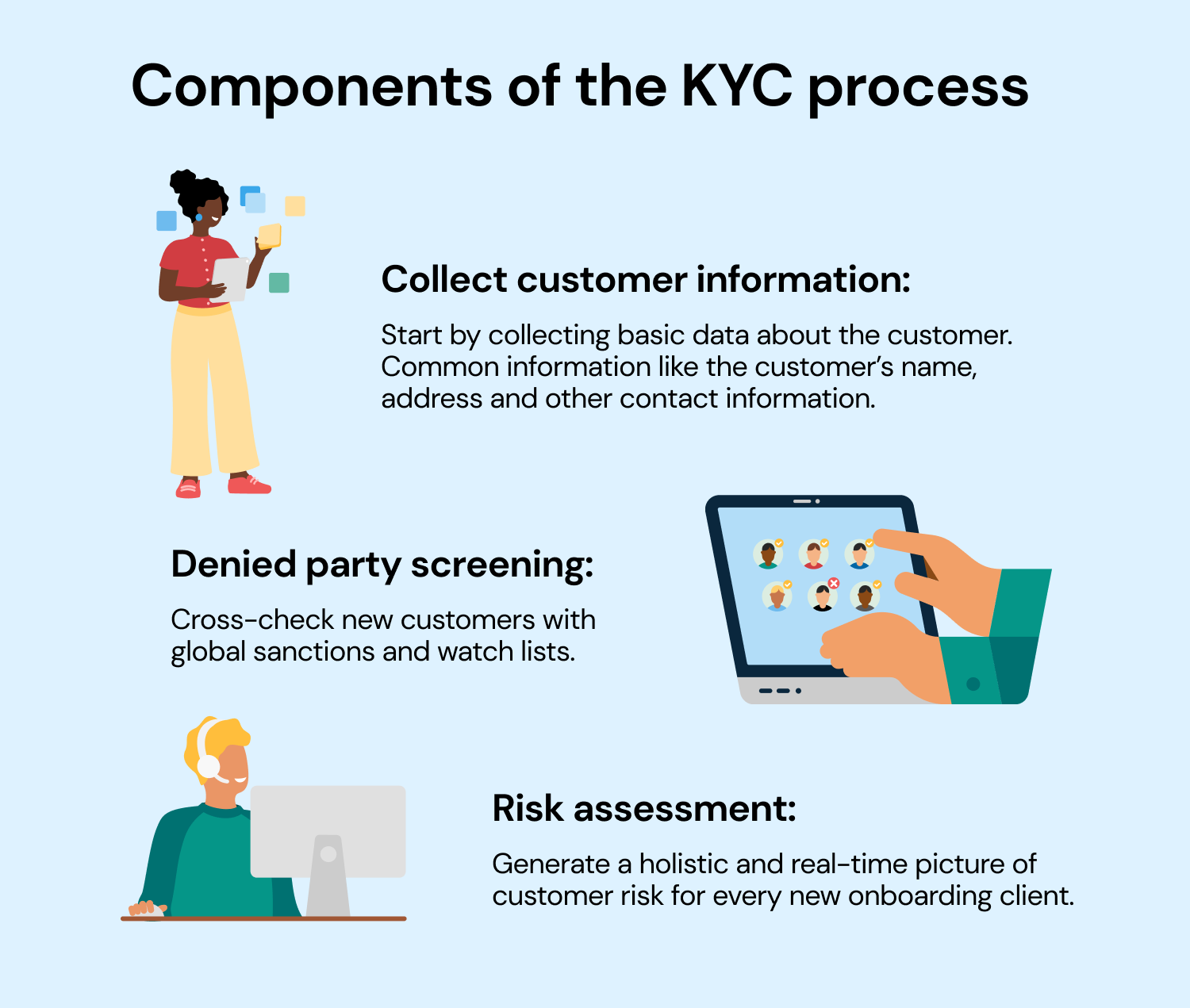

Components of the KYC process

Knowing your customer takes several steps to get right. Here’s a typical procedure for a KYC onboarding program.

- Collect customer information: The business starts by collecting basic data about the customer. In telecommunications, you’ll want to know the customer’s name, address, and contact info to start. Other points which may be useful are website, social media, traceback data, regulatory compliance confirmation (Robocall Mitigation Database, 499 Filer ID Number, etc.). You will also want to understand the customer’s business plan, among other data points.

- Denied party screening: Once you know whom you’re working with, it’s worth cross-checking new customers with global sanctions and watch lists. Anybody legally registered to be a risk is someone you don’t want to associate with.

- Risk assessment: Generate a holistic and real-time picture of customer risk for every new onboarding client. This way you can make better business decisions through risk analytics.

Choose Sinch for your cloud communication needs

If you’re worried about compliance and need help with KYC and other related procedures, talk to a communication service provider who understands your needs and pain points.

Sinch offers solutions for all types of cloud communication, from messaging to inbound calling (phone numbers) to offering toll-free calling to your clients. Talk to one of our experts today to learn more.