Insights

Key learnings from 25 years delivering exceptional customer service in banking

The business world has been talking about improving customer experience since the dawn of time, but the truth is, many banks are still stuck wondering how to make it happen.

We recently sat down with Josie Huelskamp, President of Retail and Digital Banking at FirstBank, to discuss this forever-hot topic.

We thought we could learn a thing or two from a company that’s been ranked highest in customer satisfaction in the Southwest region by JD Power and voted best bank six years in a row by Colorado Business Magazine — and who better than Josie to tell us how they got there?

Josie knows customer experience inside and out. Over her 25-year career at FirstBank, she’s worked with many facets of CX including contact centers, teller lines, customer support, and more. This experience now informs her work driving the bank’s customer service strategy.

So, what did the last 25 years teach Josie about customer service in banking? Keep reading to find out!

Lesson #1: Make employees central to your customer experience strategy

FirstBank is one of the largest privately held banks in the United States and has maintained its position as a leader in digital banking for many years. They were one of the first banks in the nation to launch Zelle, which now accounts for more than 30% of its customer base.

The company is also at the forefront of customer experience and has received many awards and recognitions over the years.

FirstBank’s mission is simple: it’s “banking for good”, which means they place their customers and community, but also their employees, at the heart of everything they do. This principle is the backbone of the company’s culture and identity:

“You have to really drive culture and make employees a big part of who your financial institution is to provide the best customer service,” says Josie Huelskamp.

The company is unique in that a large part of its stock is owned by management and employees. This privately held, employee-owned model means most employees have ownership at stake within the company. This has been key in maintaining the highest customer experience standards over the years.

While FirstBank’s commitment to innovation is a major part of the company’s success, its employees’ customer-centricity is what really sets it apart.

Lesson #2: Exceptional customer service in banking is about listening to your customers

According to Josie, one of the most important things businesses can do is listen to their customers. Sounds obvious, right? Knowing your customers and their banking needs is key in creating satisfying experiences, but many companies don’t have a proper customer listening process in place.

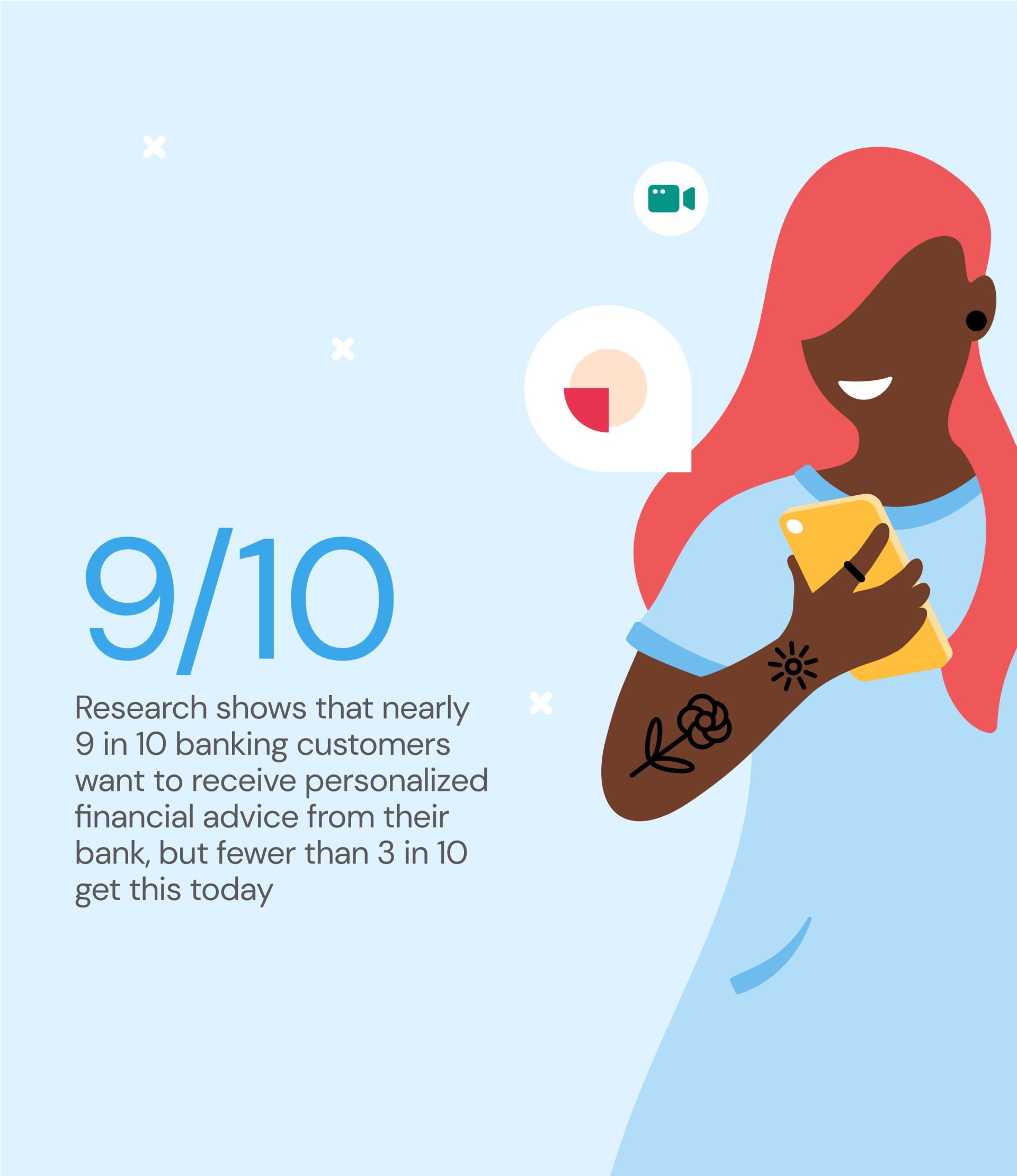

Let’s take an example. Our recent consumer research for banking and financial services shows that nearly 9 in 10 banking customers want to receive personalized financial advice from their bank, but fewer than 3 in 10 get this today. How can you fill the gap?

1. Ask your customers how they want to be helped

FirstBank continuously collects and analyzes feedback through surveys and studies to figure out what their customers need and how they want to interact and conduct daily banking activities.

Some customers may want a smart mobile app that helps them reach their financial goals, while others may be more interested in receiving alerts, for instance when they’re going to overdraw their account.

FirstBank also introduced a human touch into these surveys. Every customer receives a personalized email from a branch employee thanking them for their feedback with contact information so they can have a direct contact with that branch location. The bank also handles negative customer feedback by proactively informing unhappy customers that they take their comments seriously and investigate them. This approach has been a heavy lift but is becoming a little easier to manage over time.

2. Don’t just take their word for it

FirstBank is constantly increasing its technical capabilities to empower customers and enhance their experience. But how can you tell whether or not the technology you invest in is what your audience really wants? The truth is, in many situations, you won’t know until you give it a try.

After implementing new tools and channels, it’s essential to look back at how customers are actually using them.

“We need to pay attention to what customers tell us that they want, but also to what their real behaviors are,” Josie explains.

FirstBank implemented a money management tool that took over a year to develop. They spent significant marketing resources to promote this new product and it seemed like every customer wanted it. After seeing encouraging usage patterns the first couple of months following the launch, they saw a dramatic decline in usage, with less than 1% of customers actually making use of the new tool.

The lesson? Deploying new technology is a trial-and-error game and monitoring customer behavior continuously is the key to ensuring you’re making the most of your technology dollars.

“We are constantly in a position of making those difficult decisions of what technology we provide,” Josie explains. “If we had unlimited budget and resources, we could be all things to all people, but in reality, you really need to dial in your strategy to get the best impact for your buck.”

Lesson #3: Invest in technology that helps you meet customers where they want to be met

FirstBank strives to provide easy access to customer service, constantly re-assessing its network of branch locations and the technology on offer to customers.

“Many institutions out there have automated their customer service center as a cost-cutting measure. We currently have a 24-hour call center that’s operated by real people and always ready to assist,” Josie explains.

While AI and automation are great to reduce wait times and costs, human interactions should never be overlooked. As much as people love tech, in many situations, they still want to hear a human voice, no matter how digital-savvy they are.

That’s especially true in moments of frustration. Our research shows that despite people’s enthusiasm about automated chat options, 40% of banking customers want to speak to a human agent when frustrated.

Customer contact centers aren’t dead, and FirstBank is even investing in a new platform to better support its customers. In 2021, the bank had more than 3.5 million interactions with its customers through this channel.

“Between our call center, our branch locations, our robust mobile app, and our online banking platform, we’re really trying to do the best we can to meet customers where they want to be met, knowing that they have a lot of different ways they want to bank or interact with us,” Josie explains.

“Customers are dynamic and we have to pay attention to all channels, keeping an eye on what is coming, what the future looks like but still making sure that we’re maintaining those systems that we would consider to be somewhat antiquated.”

FirstBank has also partnered with Sinch to send personalized SMS notifications and emails to customers to keep them up to date on their finances and protect them against fraud. They send nearly 3.5 million text or email alerts each month and 60% of their customers have adopted this technology.

The company is also looking into bot solutions to provide quick answers to basic questions, like “What is my balance?” — one of the most common customer queries FirstBank’s support agents receive. Watch the video below to learn more about the benefits of FAQ bots in banking.

Banking experiences that truly revolve around customers

FirstBank has made customer experience and innovation central to its growth strategy, constantly striving to deliver more value and delight customers at every touchpoint. Looking at the ongoing positive feedback the company receives from its loyal customer base and the recognitions and awards it’s earned over the years, it’s safe to say this approach has paid off.

So, how can you deliver exceptional customer service in banking? Let’s recap:

- Build an organization that lives and breathes customer experience.

- Listen to your customers, but always keep an eye on usage and behavioral patterns.

- Be strategic about your technology investments and choose what helps you meet the most customers where they want to be met. And remember: track, track, track!

- Ideally, give customers the power to decide how to engage with your brand and choose between self-service or human assistance to meet their needs of the moment.

Need more tips on how to create satisfying experiences for today’s banking customers? Listen to the full discussion with Josie Huelskamp and our financial services experts Alejandro Murcia and Daniel Draper.

Next, check out our guide to financial services communications below to learn how you can enable meaningful and secure connections with your customers, simply and reliably.