Insights

Elevating customer experience in fintech: Expert insights

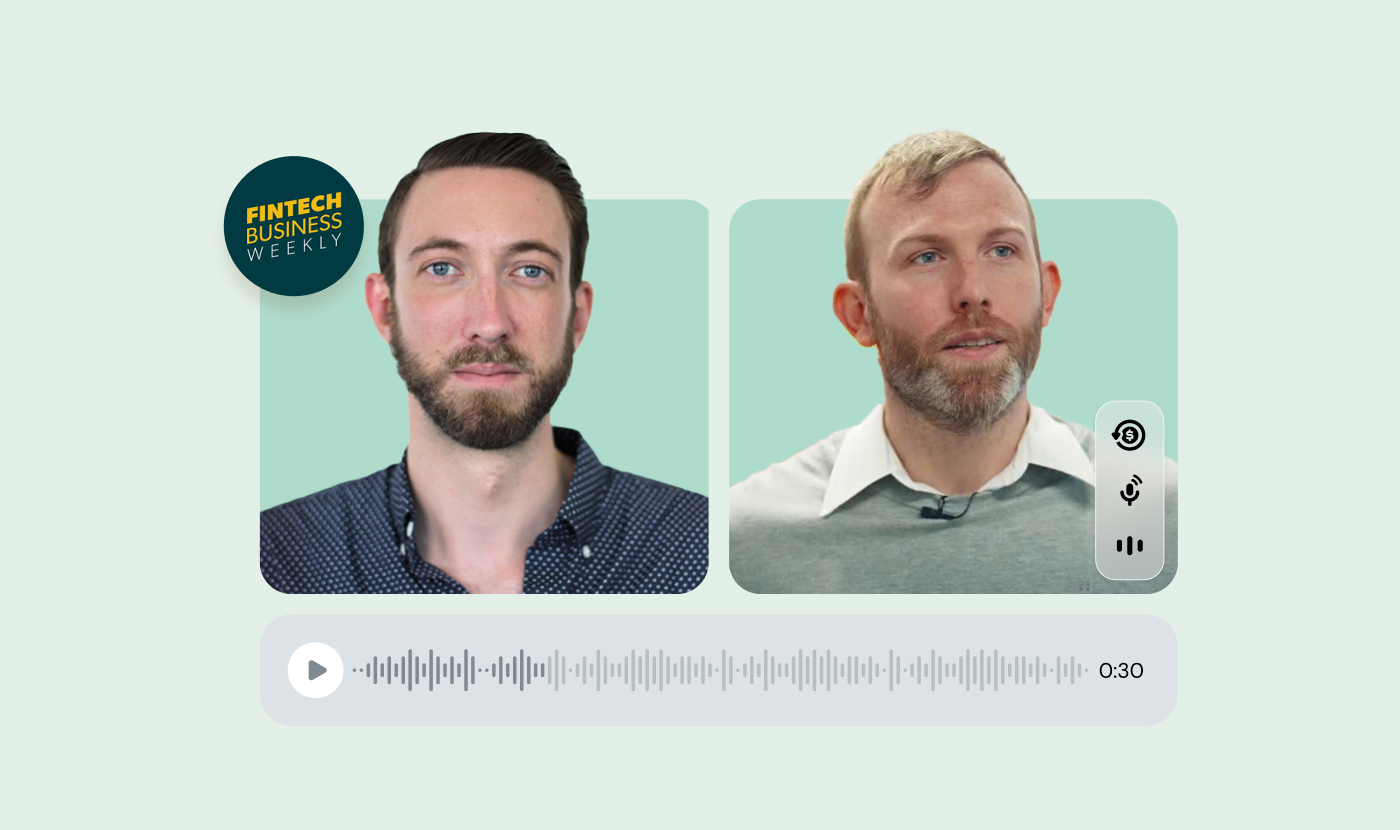

Seamless and secure customer communication is essential in the world of fintech and financial services. In a recent episode of the “Fintech Business Weekly” Podcast, James Doherty, Head of Business Development for Financial Services EMEA at Sinch, shared his insights on how communication platforms drive customer engagement, streamline operations, and fortify security.

Here’s a summary of key insights from the interview, providing marketing, IT operations, and digital leaders in financial services with practical steps to boost customer engagement.

Listen to the full interview here.

Beyond onboarding: Building engagement and security

Key insight: Effective communication extends beyond customer acquisition. For long-term retention, financial institutions should leverage omnichannel strategies to keep customers informed and engaged beyond the initial point of contact.

James highlighted three core pillars of effective financial communication: engagement, information dissemination, and security. Each pillar contributes to a comprehensive and seamless customer experience:

- Engagement: Gone are the days when simple SMS reminders were enough. Two-way conversations through channels like WhatsApp or Rich Communication Services (RCS) now enable richer, more interactive customer journeys. For instance, a potential customer applying for a loan can start their application through a quick conversation on their preferred channel.

- Informing: Keeping customers updated on product launches, terms and conditions, and account activity is critical. Timely updates encourage customer loyalty. Using the right channel ensures messages are seen and understood, reinforcing trust.

- Security: With the rise of digital banking and fintech, secure communication is paramount. Fast and reliable delivery of OTPs and two-factor authentication (2FA) arrive promptly and securely is non-negotiable. Sinch’s approach to minimizing intermediaries in SMS delivery helps enhance reliability and reduce the risk of fraud while offering an API that gives financial institutions more options for seamless 2FA.

Speed and security: Strengthening customer trust

Key insight: Reliable security measures like 2FA are essential for building trust. Delays in receiving authentication codes can frustrate users and damage their confidence in a provider. SMS is the most important method to accomplish this, but there are others such as data verification and voice verification that can complement SMS.

Security goes beyond being a basic requirement – it’s the foundation of customer trust. Long waits for authentication codes can turn minor annoyances into major pain points, undermining confidence and loyalty. Prompt and secure two-factor authentication helps financial institutions protect user data to the highest standards. By delivering 2FA quickly and reliably, they not only meet compliance requirements but also reinforce customer confidence and satisfaction.

Key insight: Privacy compliance should be part of every customer interaction. Partnering with a communications provider that understands these regulations is invaluable.

Privacy regulations like GDPR add complexity to customer communications. We stress the importance of complying with these rules while staying engaged with customers. We support financial institutions by guiding them through opt-in and opt-out protocols, ensuring communications remain compliant without compromising user experience.

Breaking down silos for a unified customer experience

Key Insight: Financial services should aim to break down silos and align communication strategies across channels and departments. Unified communications create a seamless customer experience and build brand trust.

In large institutions, siloed communication channels create fragmented experiences. Different teams may handle SMS, email, or social media independently, leading to inconsistent messaging and a fragmented customer experience. At Sinch, we encourage cross-team collaboration to align communication strategies, ensuring a unified brand voice and efficient outreach.

Embracing emerging technologies

Key insight: While it’s tempting to adopt every new tech trend, we focus on platforms that enhance customer experience without steep learning curves. RCS messaging blends the simplicity of SMS with the engagement potential of more complex apps.

Some innovations – like the metaverse – might not yet be relevant for mainstream financial communications. RCS, however, fills the gap between SMS and advanced messaging by incorporating branded elements, images, videos, and two-way interaction.

We’ve already been using RCS to help banks and fintechs offer richer, branded interactions that feel familiar to customers.

Looking ahead: The promise and caution of AI

Key insight: Financial institutions should approach AI thoughtfully, focusing on gradual improvements rather than bold, untested implementations. Trust and security shouldn’t be compromised.

AI, especially generative AI, is on everyone’s radar. The discussion highlighted its potential but advised caution, particularly in the highly regulated financial sector. We use AI to enhance conversational capabilities in customer service and onboarding, while ensuring compliance and security.

Conclusion: Listen to the full interview

James Doherty and Jason Mikula’s discussion on the Fintech Business Podcast is a must-listen for financial services professionals aiming to optimize communication strategies. Their insights offer a roadmap to enhancing customer interactions – from advanced tools like RCS to foundational elements like secure 2FA delivery. With our comprehensive, customer-first approach, financial institutions can build stronger, more secure, and engaging communication frameworks.

Sinch is already trusted by financial companies like:

- Nets, helping them prevent fraud with two-way SMS

- Nationwide, increasing industry average engagement and click-through rates four times

- HSBC, revolutionizing the personal loan experience with WhatsApp

For deeper insights, catch the full podcast episode. James and Jason offer practical advice for professionals aiming to stay ahead in the ever-evolving world of financial communications.