Products

How CreditMantri turned to marketing automation to see 5X growth

The Covid-19 pandemic catalyzed the need for digital marketing in two ways – one by causing the shutdown of physical stores and offices which forced businesses across the world to operate digitally at full-scale, and two by giving consumers more free time to spend on digital platforms. This need for digital marketing has, in turn, spiked the need for methods to increase the efficiency of campaigns, which is achieved through marketing automation. Marketing automation software enables a company to run and manage marketing processes and campaigns, across multiple channels, on autopilot.

How is marketing automation useful?

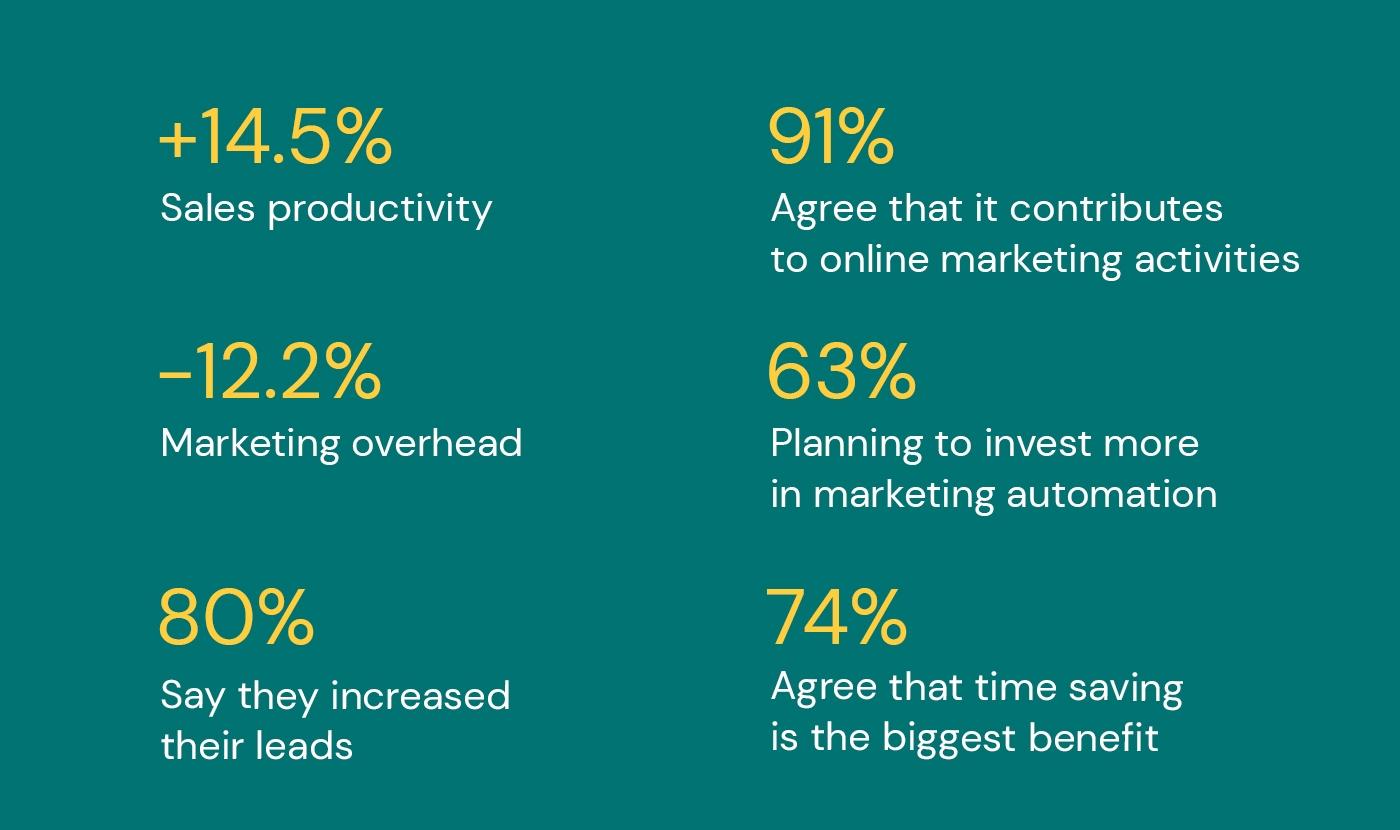

We’ll let numbers do the talking!

A recent study by Invesp revealed the following facts:

- Marketing automation, on an average drive up to 14.5% increase in sales productivity

- 80% of users using marketing automation software saw an increase in the number of leads, and 77% had an increase in conversions.

- 91% of marketing automation users agree it is ‘very important’ to the overall success of their online marketing activities.

The above numbers indicate not only the importance of marketing automation for business growth but also its impact. Industries like software and retail have been quick in adopting marketing automation. Whether you plan to use marketing automation to improve qualified lead pipeline or customer retention or lead nurturing process, marketing automation can write your brand’s success story. Take for example, CreditMantri’s case.

Case Study: CreditMantri

CreditMantri is a one-stop solution for credit needs and intends to change the way credit is delivered in India by harnessing the power of technology and digital platforms. It works with various lenders, including India’s top banks and NBFCs to offer credit seekers the best financial products and services. The company has already served over 12 million customers across India.

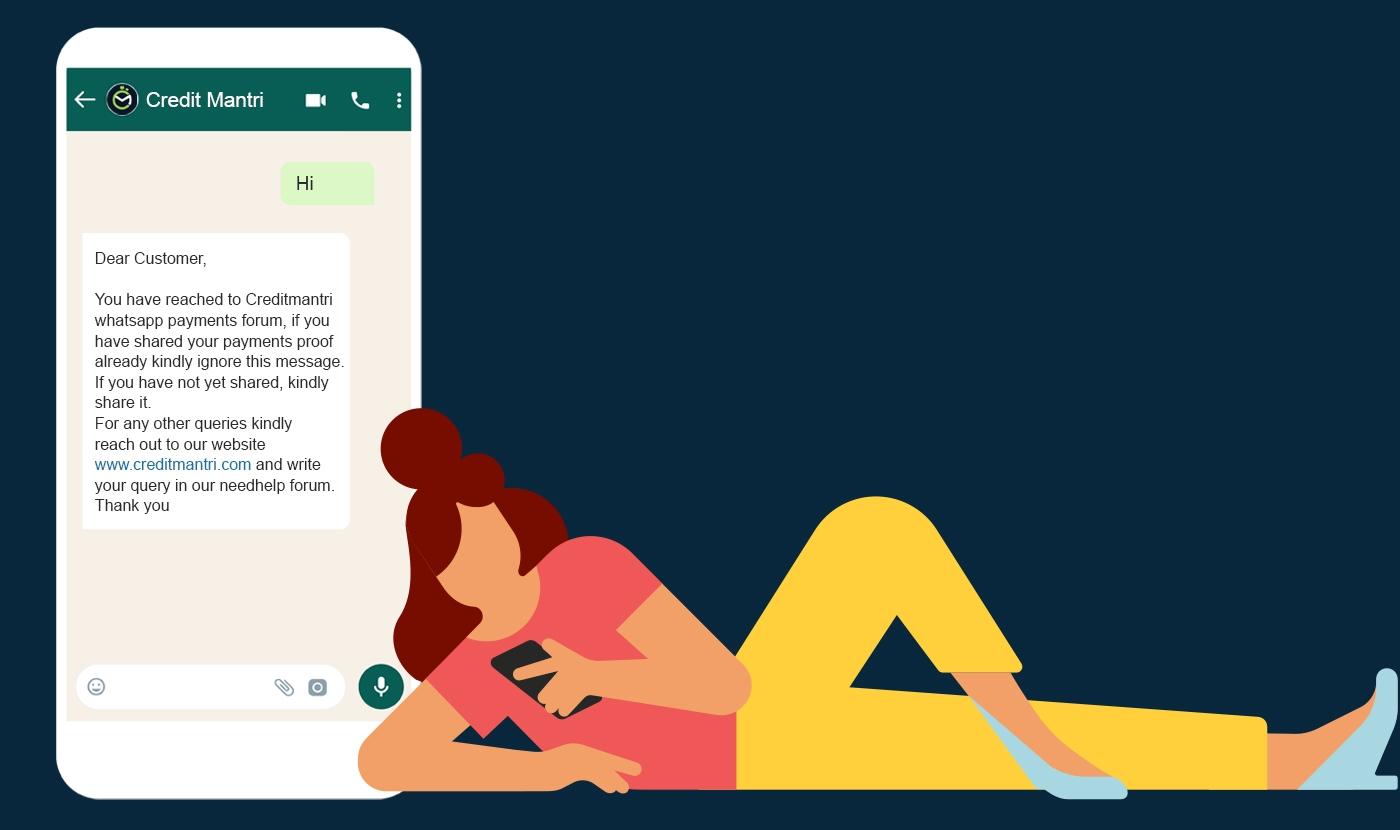

CreditMantri had been relying on standalone channels to reach out to their prospects. The manual process of alternating between channels meant excessive dependency on human resources and time lags. With Credence, marketing automation solution from Sinch, CreditMantri is able to deliver a superior customer experience. The seamless process helps the brand meet their prospects and customers across all familiar channels like SMS, Email, WhatsApp, App Push Notification (APN), Browser Push Notification (BPN) & Outbound Dialer (OBD).

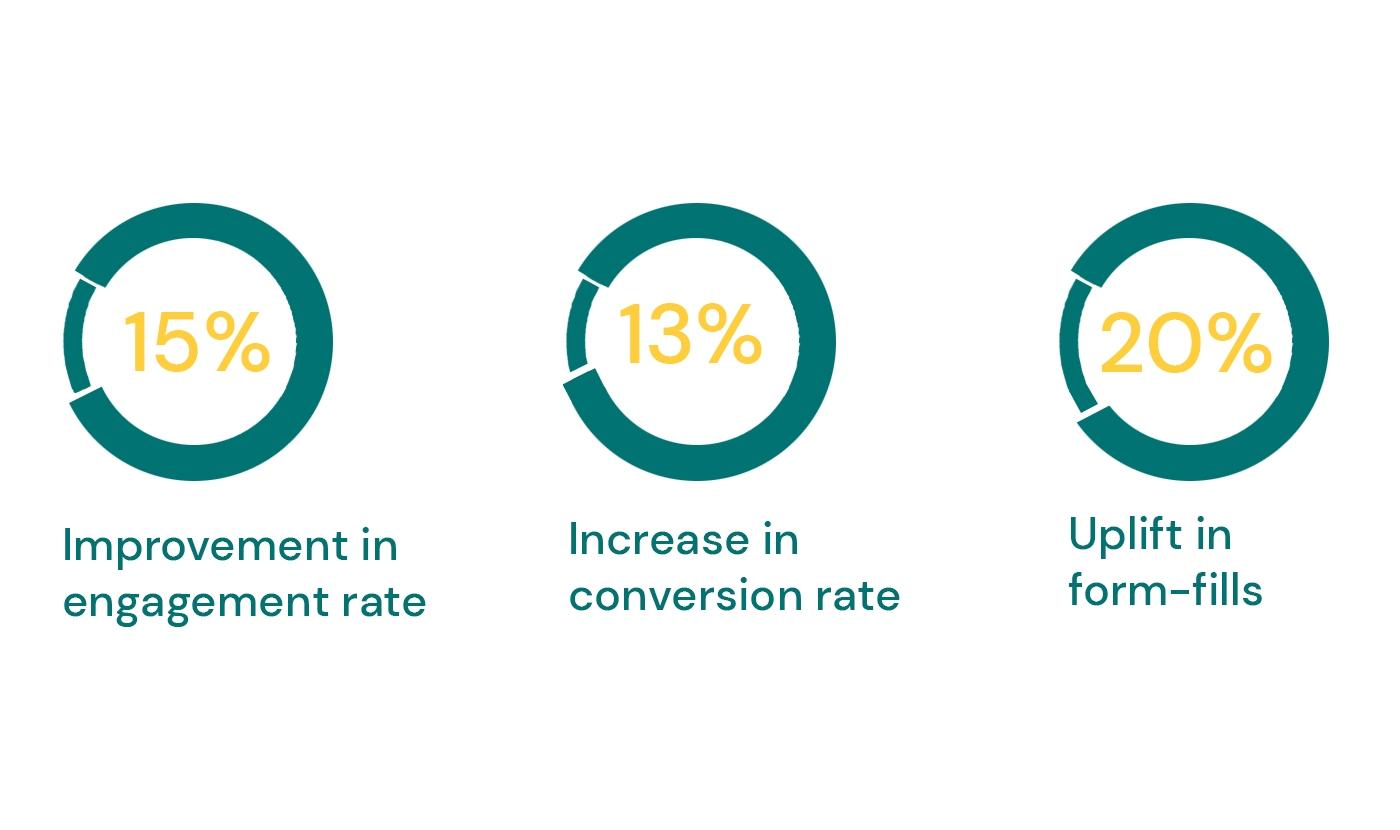

Today, CreditMantri is supremely positioned to service customers across the country for credit requirements and the results are impressive!

Here’s what CreditMantri achieved within a short span of time

“It has been three years since our association with Sinch and I must say that it’s been a truly collaborative and fruitful relationship. Sinch helped us render a seamless omnichannel experience to our customers. With their WhatsApp solution, we were able to deliver quality conversations, at scale and optimize costs to see 5x growth within a short period. We’ve been interacting with 3x customers than we did in the past” says Nandini Raman, Marketing Head at CreditMantri.

Marketing automation and its adoption

Some industries, like BFSI, have digitized their services but not their marketing processes. This is either because they don’t see a potential for ROI or because of a lack of know-how. In this article, we aim to tackle both these issues by exploring the importance of marketing automation in BFSI, challenges faced with modern customers, the benefits of automation, and important aspects of implementation.

What makes Marketing automation important for BFSI?

Take a look at what makes marketing automation really important for the Banking, Finance, and Insurance Services (BFSI) sector.

Customer expectations have changed

The modern customer is tech-savvy and spends a large part of their day online on a computer or a mobile device. People tend to divide their time among multiple online channels – social sites, email, web-apps, video conferencing tools, websites, OTT platforms, etc., with this consumption increasing since the pandemic. Most industries have leaned into this diversity by creating multi-channel communication lines between them and their customers. They reach out to customers via different platforms – social media, email, search engines, etc., and customers can reach them via multiple channels. This, in turn, has normalized multi-channel communication and customers expect it from all their service providers, even BFSI.

Customer journey has changed too

Given that purchasing services and/or products is extremely easy today (it can literally be done in a few clicks), customers take time in making decisions. They compare services across providers, take feedback over social channels, and sometimes delay decisions for a later time (since it is easy to just continue from where they left off now that the service is digital).

This means a customer looking for a service is moving across multiple online channels and being able to identify their online journey helps brands position their services for better recall and ultimately, conversion.

Despite the evidence, very few financial institutions are utilizing the potential of user data.

A Capgemini report on Big Data Alchemy: How can Banks Maximize the Value of their Customer Data, revealed the following:

- Only 37% of banking customers feel their financial institution knows their needs.

- Only 44% of customers experience consistent multi-channel communication.

- Only 43% of customers are satisfied with their bank’s product-channel fit.

- Only 43% of customers feel the relationship with their bank is satisfactory.

To incorporate these aspects, marketing automation is required. To recall, a marketing automation tool such as Credence, at its core, collects and analyses public user data (hence identifying the customer’s journey) and then pushes marketing messages on the platform they are using (creating multi-channel conversations across web, social, email, and text). The technology has the capability to modify its messaging and strategy mid-campaign for better results, which allows businesses to run entire campaigns on autopilot.

Benefits of Marketing Automation

Ability to collect rich user data

Customers create a digital footprint with every single click, and this data is very important, especially for marketing. It gives insights into what channels a customer frequents, at what times, what content they are likely to interact with, what content they ignore, etc. Marketing automation platforms have tracking and analytics systems in order to collect this user data which is used to derive the best results from campaigns. Since users have a larger online presence today because of the pandemic, it’s an ideal time to harvest rich user data that can be used for nice marketing and sales campaigns.

Create personalized conversations

A personal message will always have a better chance of conversion than a generic one. For example, sending out an email with information on a new line of credit cards to users who have been researching credit cards online will yield a higher ROI than sending an email blast to all user in a campaign list. Since email platforms charge based on recipients, the business in this example also saves costs on marketing by only targeting interested users.

Multi-channel marketing capability

A major challenge faced by businesses today stems from the fact that the number of channels to reach users on is massive. Targeting all platforms is just not an option – The costs will be huge, and the ROI will be low. Marketing automation makes reaching out to customers on all these channels, both a viable and affordable option by using user data to target the right channels at the right time.

More effective campaigns

All of the above lead to highly effective marketing and sales campaigns. A business does not need to invest money on creating open campaigns on all platforms for fear of missing out on a potential customer or sale, because the marketing automation tool is capable of forecasting a user’s online journey through data analytics and targeting the right platform for better costs per conversion.

Checklist: What to keep in mind when implementing marketing automation

Data security

Data security is especially critical for BFSI companies because the data involved is sensitive. When implementing a marketing automation system, users must be made aware of the data being collected through privacy policies, and this data must be stored in a secure location.

Integrating existing systems and processes

The automation tool selected must be able to incorporate legacy systems (or be able to import data from legacy systems) and existing business processes. The alternative is to redefine system architecture and processes which are time and cost consuming.

Defining the right measurement

While marketing analytics systems are capable of harvesting all public user data, not all of it will be relevant for all companies. Defining what metrics are useful and what are not, will help the automation tool derive best results. For example, impressions. When a business is running a limited-time sale, it makes sense to show the same message to the same customer multiple times (therefore, higher impressions per user). For long-term and regular messaging, setting lower impressions makes more sense.

Implementing the right solution

There are a lot of options that BFSI companies can explore to implement marketing automation. However, considering the fact that the expertise of BFSI companies is towards finance and not technology, implementing a solution that can take care of all the aspects mentioned in this article makes the most sense.

Our marketing automation platform, Credence completes automates data aggregation, audience targeting, and campaigns along with real-time analytics and monitoring. The powerful platform empowers businesses to optimise engagement across all touch points in a customer’s journey.

With Credence, you can orchestrate marketing campaigns at scale- optimized for devices and conversions. The platform has so far supported leading banks and financial institutions of the country in achieving higher ROI with fewer resources spent on planning, scheduling, and optimizing campaigns.

Why are large enterprises using Credence?

Several functionalities in Credence help enterprises succeed at marketing automation.

Preferred content through preferred channel

Platform users have the option to target their subscriber through Email, SMS, WhatsApp, and Voice channel but also has the option to reach their customer through the channel on which the customer engagement is high.

Send time optimization

The business can target their subscribers through email at the time they are most active and engaged. Such calculation is based on historical engagement data. You even have the option of handling fallback time and blackout window as also handle communication if the send time has already passed.

Engagement analytics

You can analyze your workflows over multiple KPIs for engagement channels.

Personalized IVR

Suppose that the platform user wants to send an OBD call to their bank account holders regarding the loan outstanding amount and last day of payment, they have the option to select number of personalized fields, play numbers, amount, name and date as personalized field, option to re-order the sequence simply by drag and drop and the option to upload clips in wav and mp3 format.

Multi-level IVR

It can be used when the platform user wants to send an OBD call to their bank account holders with language selection option and post language selection the bank wants their account holder to select from different options like Personal loan, Home Loan or Credit Score and as per selection bank wants to send communication.

Token criteria for conditional journeys

This can be used when the platform user wants to target those customers who were born after a certain year and the bank has the date of birth of their customers.

Arithmetic operations on transactional data

Suppose that the platform user wants to target those customers who have already spent 90% of the total credit card limit. In this case, the bank needs to provide each transaction event to Credence and the desired action can be taken.

File-based triggers

Platform users have a file-based system in which the bank gets loan details daily. Bank wants to upload the base on certain frequency and wants to send communication to those users who are either new in the base file or the loan_paid status changes from yes to No. This can be facilitated through Credence.

Dynamic emails

With Credence, send weekly mailers to their subscribers without manual intervention. You can also use Pinch which is the in-house email platform to support business continuity or integrate your existing vendor on the platform to avoid disruption of ongoing campaigns.

Facebook integration

You have the option to integrate a Facebook Business Manager account with Credence UI. That’s not all! Credence equips your business with advanced browser push, drag and drop builder, conversion tracking metrics, funnel creation option and much more!

Looking for the best marketing automation software? Visit the link to schedule a demo.